Unguja. The Revolutionary Government of Zanzibar (RGZ) has collected more than $20 million (Sh53.27 billion) through its mandatory travel insurance scheme for international visitors since its launch in October 2024.

Of the amount collected, only $1.59 million (Sh4.13 billion) was spent on emergency services for tourists during the scheme’s first six months of implementation.

Introduced by the President’s Office – Finance and Planning, the initiative requires all foreign visitors to pay a $44 (about Sh116,880) insurance fee as part of their entry requirements into Zanzibar.

The policy covers a wide range of risks, including medical emergencies, death, loss of documents, and other unforeseen incidents during a visitor’s stay on the islands.

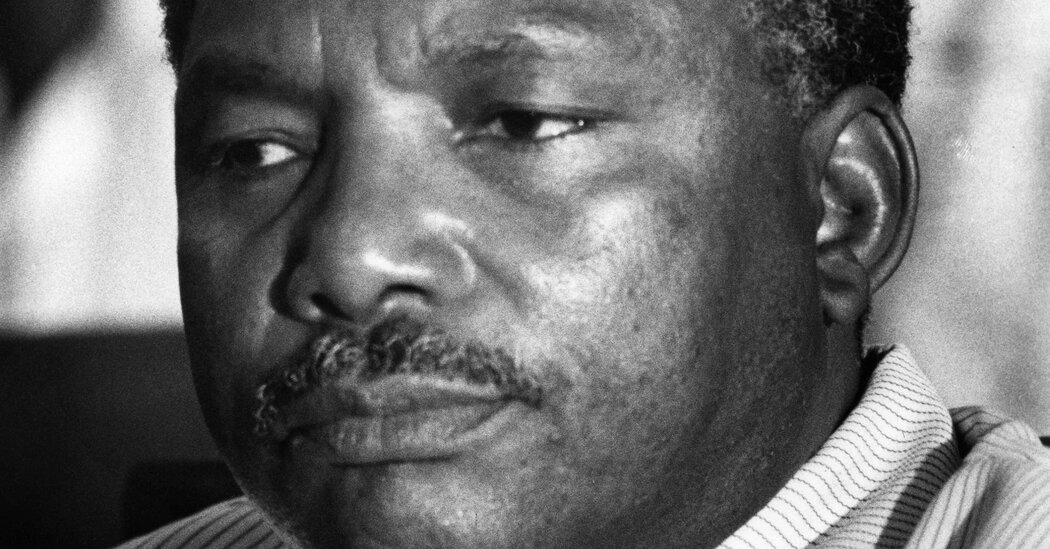

According to the Deputy Minister of Finance and Planning, Mr Juma Makungu Juma, funds collected between October 1, 2024, and March 31, 2025, were used to provide emergency medical services, evacuations, and repatriations for affected tourists.

“The goal of this insurance is to ensure that tourists who face emergencies while in Zanzibar can access immediate support without delay. The amount spent so far has gone into medical treatment, air evacuations, and returning bodies or patients to their home countries,” he said.

Among the notable cases was that of two Hungarian tourists who sustained leg fractures en route to the airport.

After initial treatment at Lumumba Hospital, they were flown home aboard an air ambulance chartered by the Zanzibar Insurance Corporation to Morocco.

Other cases involved the repatriation of bodies of tourists from France, Germany, and Kenya who died while visiting the islands.

The scheme was discussed in the House of Representatives on May 22, 2025, when Kiembesamaki legislator Suleiman Haroub Suleiman sought clarification on the revenue generated and how the funds had been utilised.

At the time, it had been reported that $6 million (Sh16 billion) had been collected, but a subsequent official response confirmed that the figure had reached $20 million (Sh53.27 billion).

In response to public feedback and to promote regional integration and ease movement within the bloc, the RGZ has since reduced the insurance fee for citizens of East African Community (EAC) member states to $22 (about Sh58,440).

While the majority of the funds remain unspent, authorities say the insurance pool is designed to ensure that sufficient resources are available when needed, particularly in emergencies requiring urgent medical or logistical interventions.