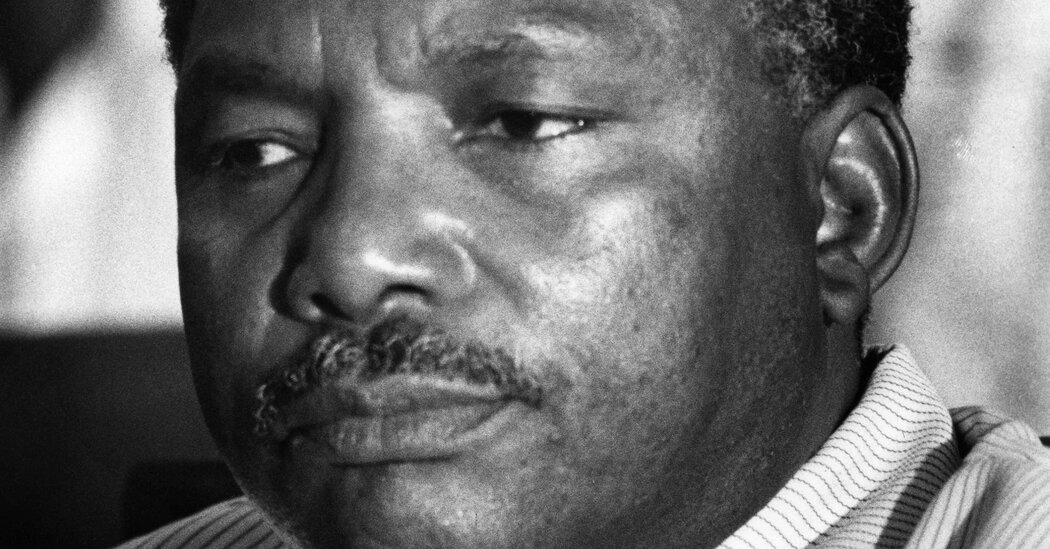

Unguja. Zanzibar’s First Vice President Othman Masoud Othman, on Monday met with a high-level delegation from the Presidential Commission on Tax Reforms, led by its Chairman, Ambassador Ombeni Sefue.

The meeting, held at the Vice President’s office in Migombani, Unguja, was part of an ongoing effort to address the pressing challenges facing the nation’s taxation system and explore ways to improve collaboration between national authorities.

In his address, Mr Othman expressed concern over the complex and burdensome tax system that businesses in Zanzibar currently face. He pointed out that the coexistence of multiple tax regimes – one from the Union government and another from Zanzibar – has created confusion and hindered the growth of local businesses.

“Business owners in Zanzibar are caught in a web of tax demands from various authorities, which not only strains businesses but also causes significant operational difficulties,” Othman stated.

He further explained that the current system is stifling business development, particularly in sectors such as agriculture, which is crucial for Zanzibar’s economic growth.

The Vice President called for a streamlined taxation approach, urging authorities to consolidate and simplify the tax process. He suggested that a unified approach would reduce redundancy, making it easier for businesses and investors to navigate the system and, ultimately, boost the country’s economy.

“There are untapped opportunities in agriculture, but the complex tax system is driving investors away from this important sector, which is vital for national development,” he remarked.

The VP also recommended that TRA focus on educating businesses and investors about the tax process, stressing the importance of fostering stronger relationships with stakeholders.

He believes this approach will create a more conducive business environment and ease the tax burden on entrepreneurs.

The discussions also touched on the wider goals behind Ambassador Sefue’s appointment, following an initiative launched by President Samia Suluhu Hassan on October 4, 2024.

The President had identified significant challenges within the tax system and tasked the commission with reviewing the system and gathering actionable proposals aimed at enhancing the business environment and increasing national revenue.

The delegation included prominent leaders such as Prof Mussa Assad, former Controller and Auditor General of Mainland Tanzania, who contributed valuable insights into the discussions on tax reform.

The Vice President’s office expressed confidence that the discussions would pave the way for reforms that will not only strengthen Zanzibar’s economy but also attract both local and international investors.