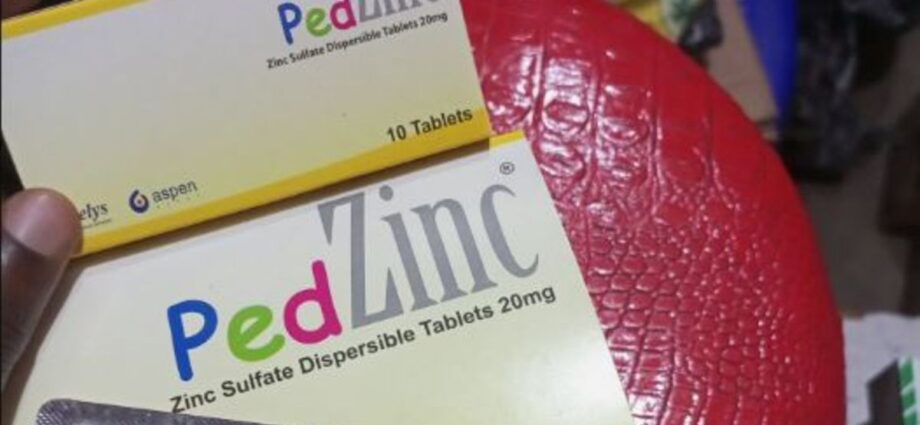

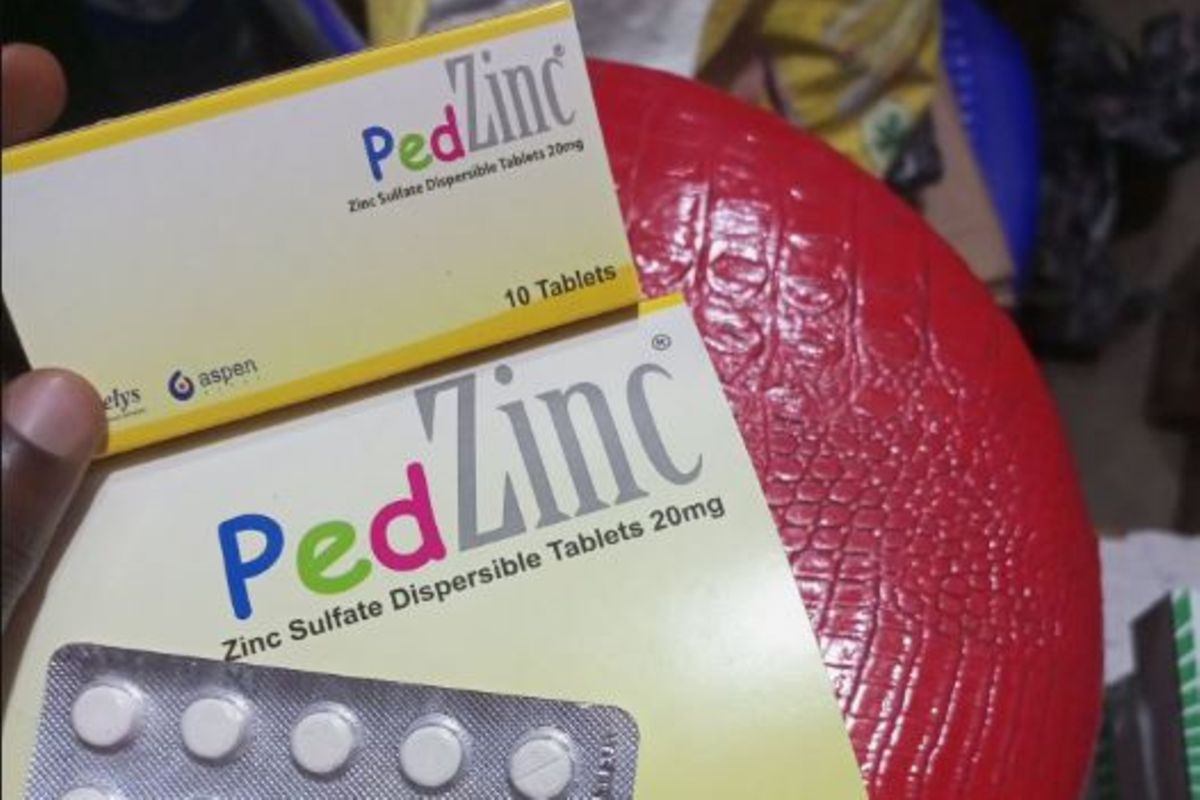

Zanzibar. The Zanzibar Food, Drugs and Cosmetics Agency (ZFDA) has withdrawn a batch of PED Zinc (Zinc Sulphate Dispersible Tablet) from the market due to quality concerns.

The affected batch, numbered 2203002, was manufactured by Beta Healthcare International Ltd, based in Nairobi, Kenya.

A statement issued yesterday and signed by ZFDA’s Executive Director, Dr Burhan Othman Simai, confirmed that health centres had raised complaints about the tablets producing a cloudy residue.

According to the statement, the affected batch was produced on 1 March, 2022, with the expiry date of 28 February, 2025.

“Following the complaints, ZFDA conducted an investigation, including laboratory analysis of samples. The results confirmed that the batch failed quality tests, rendering it unsuitable for human consumption,” Dr Simai stated.

He urged the public to identify and avoid using the recalled medication. Those already in possession of the affected batch are advised to return it to their respective health centres or the pharmacies where they obtained it.

Additionally, health professionals have been instructed to discontinue dispensing the affected tablets, separate them from their inventory, and return them to their suppliers.

ZFDA has also ordered importers, distributors, and both wholesalers and retailers to halt the distribution and sale of the recalled batch. Instead, they are required to isolate the stock and hand it over to ZFDA for proper disposal.

“ZFDA urges healthcare professionals and the public to continue reporting any pharmaceutical products suspected of poor quality or adverse effects. This will enable timely interventions to safeguard public health,” the statement added.

In May 2024, ZFDA also withdrew over 1,000 tins of Infacare infant formula from the market and imposed a ban on its importation, sale, and distribution. The decision was made after it was discovered that the product contained labels indicating it was ‘not for sale in Tanzania.’

However, the agency revealed that some traders had engaged in fraudulent practices by removing the original labels, covering them with stickers, or replacing the original lids to bypass the restriction. ZFDA warned that such acts are illegal.

The recall was enforced because the product did not meet the regulatory requirements for food safety, registration, and quality assurance. During inspections, ZFDA confiscated over 1,000 tins of the formula that were found with the prohibited markings.

ZFDA continues to monitor the market to ensure compliance with safety standards and urges the public to remain vigilant when purchasing pharmaceutical and food products.