Unguja. The Zanzibar government has reiterated its commitment to adopting digital technology, citing its role in enhancing security and driving economic growth.

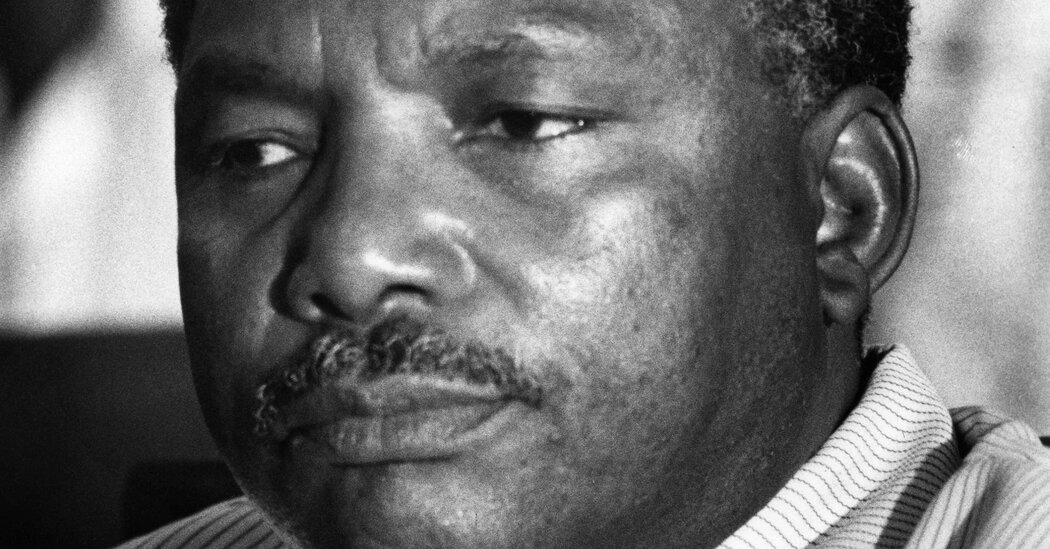

Speaking during the launch of a mobile payment service for fuel purchases via Mixx by Yas in Unguja on March 2, 2025, Second Vice President Hemed Suleiman Abdulla commended Zanzibar Petroleum Ltd for introducing the service, saying it reflects the country’s progress in digital transactions.

“Zanzibar is making great strides in technology. This initiative is proof of the ongoing digital transformation, aligning with global advancements,” said Mr Hemed.

He said that mobile fuel payments will enhance transaction security, reduce reliance on cash, and enable citizens to purchase fuel quickly and efficiently via mobile phones.

He further directed the company to ensure that all security measures are in place at fuel stations to protect users of the service. He also urged other fuel retailers in Zanzibar to embrace electronic payment systems to support the government’s financial inclusion goals.

“I encourage citizens to take full advantage of this service, as it will simplify payments, enhance transparency, and secure their funds,” he added.

Mixx by Yas Zanzibar regional director, Azizi Said Ali, reaffirmed the company’s commitment to working with the government and other institutions to expand digital payment solutions across various sectors.

“We are ready to collaborate in enhancing digital transactions for service provision, ensuring trust and security for both providers and consumers,” he said.

He added that the company is open to partnerships aimed at improving essential services such as electricity, water, and fuel through digital payment solutions.

Zanzibar Petroleum’s Tanzania regional manager, Altaf Jiwan, assured customers of the company’s commitment to delivering efficient, fast, and high-quality services. He noted that the mobile payment service was designed to offer convenience, safety, and round-the-clock accessibility.