Unguja. The Zanzibar Drug Control and Enforcement Authority (ZDCE) has announced the confiscation of drug trafficking suspects’ assets valued at Sh15.3 billion, declaring them government property.

The decision follows a special operation conducted in January this year which resulted in the seizure of over 100 kilograms of Methamphetamine, hashish and marijuana.

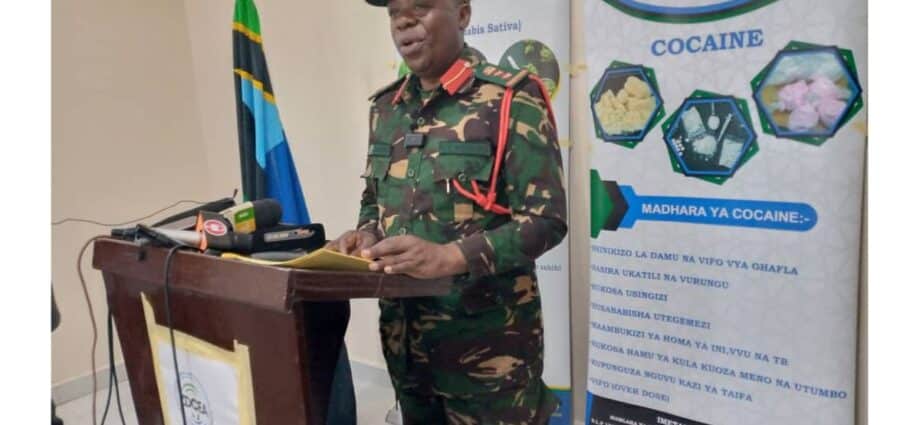

Speaking here on Monday, April 22, 2024, the ZDCE Commissioner General Colonel Burhani Zuberi Nassoro said the drugs were smuggled into the country by Salehe Khamis Basleman and Gawar Bachi Fakir, both residents of Chukwani in Mjini Magharibi Region.

The suspects are alleged to be involved in illegal drug trafficking across Zanzibar, mainland Tanzania, Africa, Asia, Europe, and the United States. However, anyone dissatisfied with this declaration can appeal to the court within 30 days from today.

“Through this trade, they have amassed a significant amount of money, which they launder by purchasing luxury cars, houses, land, and establishing dummy businesses,” he said.

He clarified that he is confiscating these assets under the authority granted to him by section 73(1) of the Zanzibar Drug Control and Enforcement Authority Act No. 8 of 2021, after considering the requirements of section 71 of the same Act.

Before reaching this decision, the authority issued various announcements in the government gazette and in the areas of the suspects, Salehe and his wife Gawar, calling for them to declare their income or the manner in which they acquired their assets. However, they failed to comply within the 30 days stipulated by law.

The assets include six cars valued at Sh399 million, three maritime transport vessels, and one engine valued at Sh29.9 million, as well as eight residential and business plots valued at Sh6.8 billion.

Additionally, there are three luxury villas worth Sh6.3 billion and eight residential and commercial properties worth Sh1.7 billion. All assets are located in various areas of Unguja Island.

He emphasized that this amount of money is significant enough to fund approximately two ministries in the Revolutionary Government of Zanzibar.

“We are raising awareness so that the people of Zanzibar understand that individuals are accumulating wealth through the illegal sale of drugs, harming our youth.

While some residents of Unguja town applaud the actions taken by the authority, they have called for the arrest of those involved to dismantle the network.

“If these people are not apprehended, they can continue their operations through other means. I believe they cannot act alone; there are collaborators,” said Ayoub Hamad.

Another resident, Raya Idd, highlighted, “We witness how drug addicts struggle on the streets to obtain money for drugs, resorting to theft, robbery, or odd jobs. Therefore, additional strategies are necessary.”

Without disclosing names or institutions, Colonel Burhan mentioned that some government officials collaborate with these criminals, some of whom have fled the country upon observing the intensifying operation, fearing identification and arrest.