Dar es Salaam. A new report from the insurance market shows that the market remained stable, with key indicators such as policyholders and beneficiaries increasing by 32.0 percent, alongside growth in claims and expanded employment opportunities.

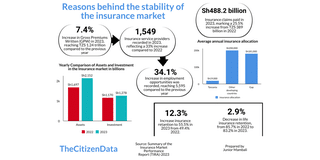

The overall market grew by 7.4 percent, achieving Gross Premiums Written (GPW) of Sh1.24 trillion compared to previous years, the Tanzania Insurance Regulatory Authority (Tira) report for 2023 revealed.

The report indicated that the industry paid claims totalling Sh488.2 billion last year, accounting for 25.5 percent of premiums, up from Sh389 billion in earlier years.

It also showed that policyholders and beneficiaries represented 37.2 percent of the total population in the country covered by insurance services.

Read: Tanzania’s insurance industry grows by 26.7 percent

“The global insurance market’s growth is measured by parameters like claims payments, which reflect company stability, and employment, which indicates individual economic growth and contributions to national income. We will continue collaborating with stakeholders to educate the public and increase product usage,” said the Commissioner of Insurance, Dr Baghayo Saqware.

Dr Saqware made the remarks on Friday, November 22, 2024, during the official launch of the 2023 performance report, which highlighted that employment opportunities in the sector rose to 5,595 from 4,173 in previous years.

Additionally, the number of service providers grew to 1,549 from 1,165, representing a 33 percent increase.

Insurance retention also rose to 55.5 percent last year from 49.4 percent, meaning more money remained within the country to support economic development.

However, Dr Saqware noted that despite this positive growth, the amount Tanzanians allocate for insurance remains low, averaging Sh19,000 per year, compared to Sh200,000 in other developing countries.

He emphasised that more effort is needed to address this gap.

“To achieve the government’s goals, the market needs to grow at an average of 15 percent annually. Therefore, I urge stakeholders to continue collaborating and increasing investments that will enable the market to expand,” he stressed.

Launching the report, the Deputy Minister for Finance, Mr Hamad Hassan Chande, said the report is good news as it shows the right direction of the market, explaining that insurance is a part of the financial sector which contributes to the transfer of income to the government and helps in development activities.

He said the report gives a clear picture that the government, through Tira, is creating an environment for good business relations for stakeholders in the sector, this is from implementing insurance issues through the 2030 plan which wants consumers to reach 50 percent.

Mr Chande added that the growth of insurance is a big step, so there is a need to continue more efforts to get more revenue.

“The insurance industry plays a crual role in building the economy and protecting the health and safety of people, so growth must continue,” he said.

For her part, Assemble Insurance Tanzania Ltd, Managing Director Tabia Masoud said that for the insurance market to continue, they need to be given information on the development of the market and the presence of new challenges.

She said information on means of increasing their strength should also be communicated for the insurance industry to continue growing.

“For the insurance sector to continue to grow, innovations must be used to meet the needs of Tanzanians and all stakeholders in this sector,” she suggested.