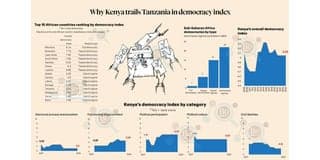

The Kenya democracy index continues to trail Tanzania for four consecutive years on poor scores on electoral process and pluralism, civil liberties and functioning of government, the report shows.

The Democracy Index 2023 report by the Economist Intelligence Unit (EIU), shows that Kenya scored an overall democracy index of 5.05 behind Tanzania’s at 5.35. This score shows no improvement from last year’s index, which has been remained the same since 2020.

Regionally, Kenya was ranked position 14 and globally 92.

EIU is the research and analysis division of The Economist Group, a leading source of international business and world affairs information.

According to EIU, “the democracy index is a thick measure of democracy that assesses each country across five categories-electoral process and pluralism, functioning of government, political participation, political culture and civil liberties.”

The electoral process and pluralism metric analyse ability to hold free and fair elections. The functioning of government involves assessing corruption, transparency and accountability by the state. Civil liberties comprise indicators related to freedom of expression and media freedoms.

Photo credit: John Waweru | Nation Media Group

Kenya scored poorly on electoral process and pluralism with 3.5 out of 10 in 2023.

Other areas that the country scored dismally are civil liberties (4.1 out of 10) and functioning of government (5.3 out of 10).

The report notes; “The failure of political incumbents to uphold democratic values and deliver good governance and economic progress has discredited electoral democracy for increasing numbers of Africans.”

Based on the 2023 National Ethics and Corruption Survey,57.3 percent of respondents perceived corruption level to be high in the country, with 24.7 percent citing high cost of living as the main reason.

Notably, the freedom of assembly though guaranteed by the Constitution has been undermined in Kenya. The police responded to Opposition protests in March 2023 with tear gas and live ammunition.

Three years after the Covid-19 pandemic, which translated to a rollback of freedoms across the world, the 2023 democracy results for Kenya indicate a continuing democratic malaise and no forward momentum.