In its latest Annual Debt Management Report (2021/2022 fiscal year) that the loss-making national carrier secured the loan with a security from the national government but failed to repay.

Of the 841.6 million, the government guaranteed $525 million.

“Kenya Airways defaulted on both the guaranteed portion of the loan amount as well as the non-guaranteed portion,” the National Treasury says.

“The National Government is in the process of novating the debt to be finalised during 2022/2023 fiscal year.”

Original contract extinguished

Novation is the process by which an original contract is extinguished and replaced with another, under which a third party takes up rights and obligations duplicating those of one of the parties to the original contract. This means that the original party transfers both the benefits and burdens under the contract.

KQ’s loan from the Exim Bank of USA was meant to purchase seven aircraft and one engine.

“The Covid-19 pandemic containment measures adversely affected the airline business globally including KQ. Government intervention included, among other financial support, the settlement of the guaranteed debt extended to KQ,” National Treasury’s director in charge of debt management, Dr Haron Sirma told The EastAfrican.

KQ chief executive Allan Kilavuka however disputed the Treasury figure when reached by The EastAfrican.

“The value you quote for the US Exim facility is not correct; $485 million is what relates to the US Exim guaranteed debt. I don’t have the context… maybe they have included other guarantees, not just the US Exim facility,” he said.

Negotiated moratoria

He said that due to Covid-19, when it reduced operations, KQ negotiated moratoria.

“The airline is yet to get back to full operations and has requested GOK (Government of Kenya) to support on the guaranteed loan to avert the possibility of the loan going into default.”

Treasury says it will closely monitor contingent liabilities arising from state-owned enterprises, as they pose major fiscal risks to the economy.

KQ is 48.9 per cent owned by the government and a group of 10 local banks which own 38.1 per cent of the shares.

Other shareholders include KLM Royal Dutch Airline (7.8 percent), employees (2.4 percent) and other shareholders at 2.8 per cent.

Push for restructuring

The government has been pushing for the restructuring of the airline on the back of state bailout plan.

Under the plan the airline is required to reduce its network, operate a smaller fleet and possibly reduce its workforce further.

As a result the airline has focused on restructuring its fleet including selling planes and sub-leasing to other airlines in an attempt to return to profitability.

Data from the airline shows that the national carrier’s fleet size narrowed in the last nine months to 41 aircraft from 43 in December 31 2021 after two leased aircraft (Embraer 190) were returned to the lessor following the expiry of their leases.

Of the 41 aircraft, 18 are owned/financed by the airline itself while 23 are on lease arrangement.

Its fleet size dropped to 39 in the year 2017 from a high of 52 in 2015, before rising to 43 in 2021.

Renegotiating lease contracts

The airline is renegotiating aircraft lease contracts with the lessors as part of a string of austerity measures to reduce operating costs.

Other measures rescue measures include engagement with principal shareholders (government) for financial support, engagement with key suppliers and financiers for moratoria, freeze on non-critical spending and implementation of temporary salary cuts for staff.

KQ has also increased focus on cargo business and has already converted two passenger aircraft to cargo freighters.

Share this news

This Year’s Most Read News Stories

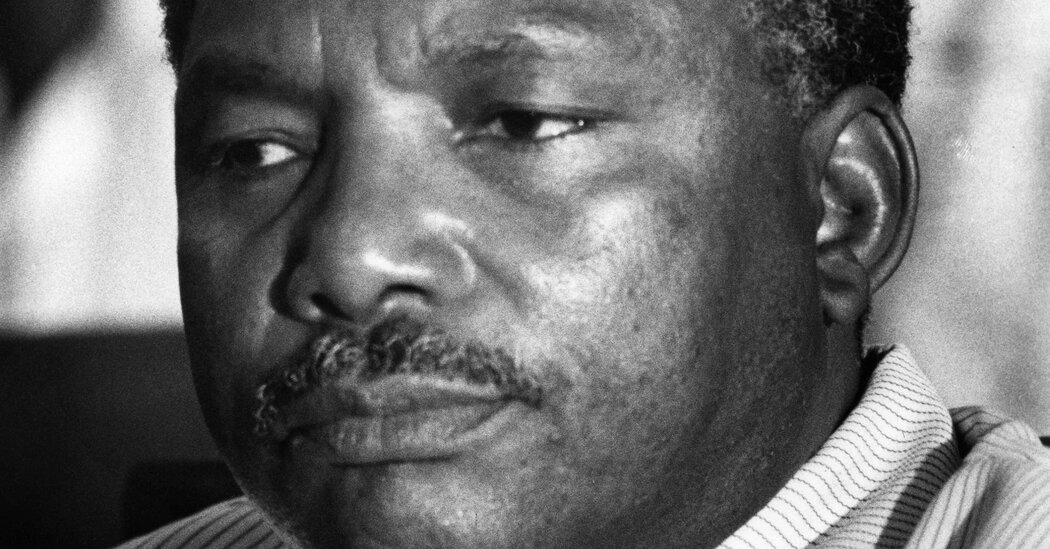

Ali Hassan Mwinyi, Former President of Tanzania, Dies at 98

Ali Hassan Mwinyi, a schoolteacher turned politician who led Tanzania as its second post-independence president and helped dismantle the doctrinaire socialism of his predecessor, Julius K. Nyerere, died on Thursday in Dar es Salaam, the country’s former capital. He was 98.Continue Reading

Air Tanzania Banned From EU Airspace Due to Safety Concerns

Several airports have since locked Air Tanzania, dealing a severe blow to the Tanzanian national carrier that must now work overtime to regain its certification or go the wet lease way

The European Commission has announced the inclusion of Air Tanzania on the EU Air Safety List, effectively banning the airline from operating in European airspace.

The decision, made public on December 16, 2024, is based on safety concerns identified by the European Union Aviation Safety Agency (EASA), which also led to the denial of Air Tanzania’s application for a Third Country Operator (TCO) authorisation.

The Commission did not go into the specifics of the safety infringement but industry experts suggest it is possible that the airline could have flown its Airbus A220 well past its scheduled major checks, thus violating the airworthiness directives.

“The decision to include Air Tanzania in the EU Air Safety List underscores our unwavering commitment to ensuring the highest safety standards for passengers in Europe and worldwide,” said Apostolos Tzitzikostas, EU Commissioner for Sustainable Transport and Tourism.

“We strongly urge Air Tanzania to take swift and decisive action to address these safety issues. I have offered the Commission’s assistance to the Tanzanian authorities in enhancing Air Tanzania’s safety performance and achieving full compliance with international aviation standards.”

Air Tanzania has a mixed fleet of modern aircraft types including Boeing 787s, 737 Max jets, and Airbus A220s.

It has been flying the B787 Dreamliner to European destinations like Frankfurt in Germany and Athens in Greece and was looking to add London to its growing list with the A220.

But the ban not only scuppers the London dream but also has seen immediate ripple effect, with several airports – including regional like Kigali and continental – locking out Air Tanzania.

Tanzania operates KLM alongside the national carrier.

The European Commission said Air Tanzania may be permitted to exercise traffic rights by using wet-leased aircraft of an air carrier which is not subject to an operating ban, provided that the relevant safety standards are complied with.

A wet lease is where an airline pays to use an aircraft with a crew, fuel, and insurance all provided by the leasing company at a fee.

Two more to the list

The EU Air Safety List, maintained to ensure passenger safety, is updated periodically based on recommendations from the EU Air Safety Committee.

The latest revision, which followed a meeting of aviation safety experts in Brussels from November 19 to 21, 2024, now includes 129 airlines.

Of these, 100 are certified in 15 states where aviation oversight is deemed insufficient, and 29 are individual airlines with significant safety deficiencies.

Alongside Air Tanzania, other banned carriers include Air Zimbabwe (Zimbabwe), Avior Airlines (Venezuela), and Iran Aseman Airlines (Iran).

Commenting on the broader implications of the list, Tzitzikostas stated, “Our priority remains the safety of every traveler who relies on air transport. We urge all affected airlines to take these bans seriously and work collaboratively with international bodies to resolve the identified issues.”

In a positive development, Pakistan International Airlines (PIA) has been cleared to resume operations in the EU following a four-year suspension. The ban, which began in 2020, was lifted after substantial improvements in safety performance and oversight by PIA and the Pakistan Civil Aviation Authority (PCAA).

“Since the TCO Authorisation was suspended, PIA and PCAA have made remarkable progress in enhancing safety standards,” noted Tzitzikostas. “This demonstrates that safety issues can be resolved through determination and cooperation.”

Another Pakistani airline, Airblue Limited, has also received EASA’s TCO authorisation.

Decisions to include or exclude airlines from the EU Air Safety List are based on rigorous evaluations of international safety standards, particularly those established by the International Civil Aviation Organization (ICAO).

Sign up for free AllAfrica Newsletters

Get the latest in African news delivered straight to your inbox

The process involves thorough review and consultation among EU Member State aviation safety experts, with oversight from the European Commission and support from EASA.

“Where an airline currently on the list believes it complies with the required safety standards, it can request a reassessment,” explained Tzitzikostas. “Our goal is not to penalize but to ensure safety compliance globally.”

Airlines listed on the EU Air Safety List face significant challenges to their international operations, as the bans highlight shortcomings in safety oversight by their home regulatory authorities.

For Air Tanzania, this inclusion signals an urgent need for reform within Tanzania’s aviation sector to address these deficiencies and align with global standards.

The path forward will require immediate and sustained efforts to rectify safety concerns and regain access to one of the world’s most critical aviation markets.

Source: allafrica.com

Insecurity prompts Zanzibar to review its lucrative island leasing

The Tanzanian central government is planning to boost its security presence in the Zanzibar archipelago. A commission tasked with auditing the country’s security forces was appointed in July by President Samia Suluhu Hassan. It says it is concerned about the situation in the country’s Indian Ocean islands that are under the control of the semi-autonomous Zanzibar local government.Continue Reading