This month, The Citizen marks a significant milestone, celebrating 20 years since its establishment in September 2004.

For two decades, The Citizen has been at the forefront of storytelling, shaping narratives, and impacting lives across Tanzania and beyond.

With business news at its core, The Citizen quickly established itself as Tanzania’s foremost authority on all things business-related.

This specialisation was built on rigorous research—a journalistic approach that continues to set The Citizen apart as a trusted source of information on Tanzania’s economic growth.

Despite the many changes over the years, one thing remains constant: The Citizen’s reliability as a credible news source.

This trait has been carefully cultivated and nurtured since the newspaper’s inception.

The name “The Citizen” reflects our service to our readers—addressing issues relevant to citizens and offering solutions to challenges.

This commitment to responsible journalism has been a guiding principle for 20 years, and it is a responsibility we are dedicated to carrying forward for many more decades.

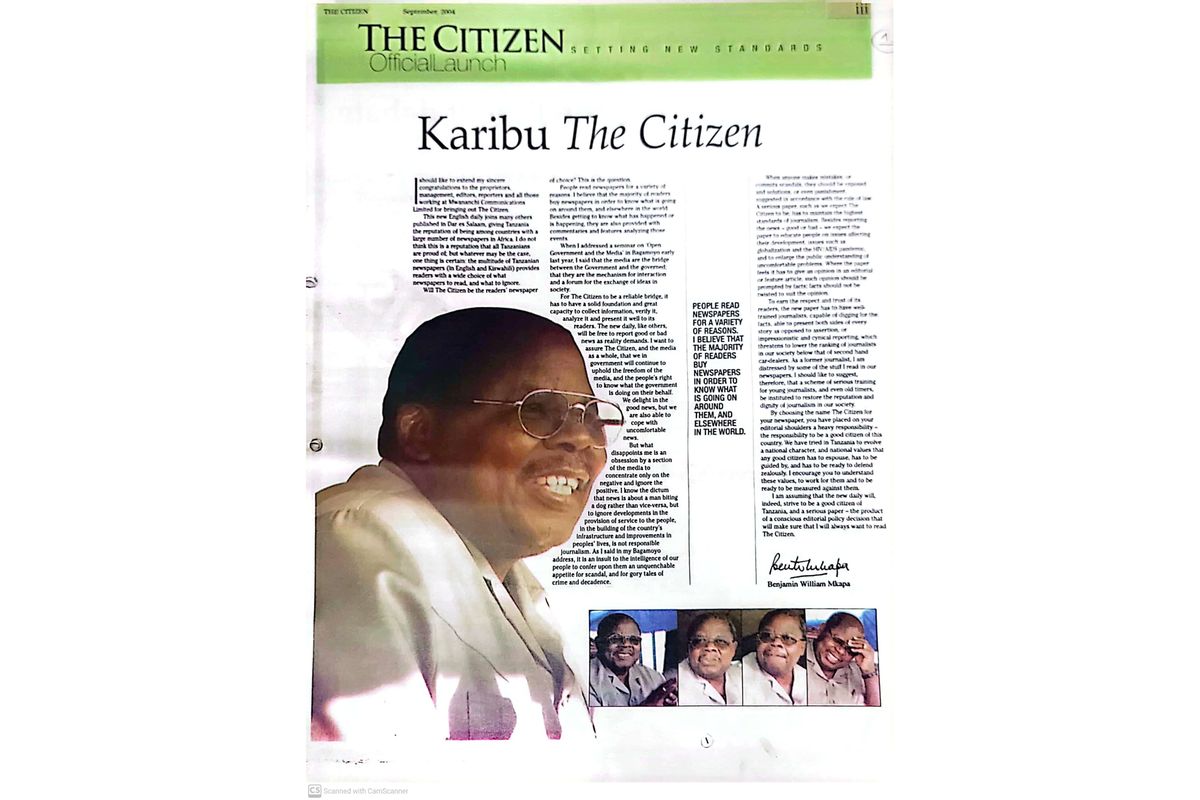

From the official launch on September 16, 2004, to the first Op-Ed written by former President and journalist Benjamin Mkapa, The Citizen has demonstrated its staying power over the years.

Mkapa, known for his astute character and thoughtfulness, penned an objective editorial that highlighted the rapid increase in news sources in Tanzania at the time, with newspapers dominating the media landscape and offering readers a wide array of both English and Swahili dailies.

What stood out in his opening remarks was the acknowledgement that The Citizen was entering a crowded market, with Tanzania being one of the African countries with extensive newspaper coverage.

The challenge for The Citizen was to carve out its own identity and create a brand that would resonate with readers.

This approach was essential for building a trusted readership base in an era where reliable information was crucial.

Through hard news, commentaries, features, and special reports, The Citizen has played its rightful role in informing, educating, and entertaining its readers.

As a watchdog, The Citizen has never wavered in its commitment to news coverage that holds the government accountable on matters of national concern and interest.

As the Fourth Estate, the media serves as a bridge between the government and the governed.

Therefore, all news platforms must diligently pursue accurate information through verification, investigation, and critical analysis of government actions.

The media’s role in shaping Tanzania’s future is vital.

Just as the late former President Mkapa assured The Citizen in 2004, when he was nearing the end of his second term in office, the government must continue to uphold media freedom and the right to information.

The media is not an enemy of the government but an ally in progress.

Using this approach, The Citizen has remained steadfast in its mission to promote business opportunities in Tanzania.

However, the newspaper has not shied away from highlighting the challenges within the business environment, some of which are statutory, while others are procedural and rooted in bureaucratic practices.

It is during coverage of these issues that The Citizen is sometimes wrongly viewed as an adversary of the State.

Mkapa once remarked that while the government may delight in good news, it must also be prepared to handle uncomfortable news.

This is the essence of responsible journalism.

Over the past 20 years, The Citizen has undergone significant transformations.

From redesigning the newspaper to augmenting its content, all these changes have been aimed at improving the reader’s experience.

We also cut back on publishing seven times a week to only five (Monday to Friday) while more efforts are directed to boosting online content.

As the future dictates, the most profound transformation has been the digital disruption that has reshaped the global media landscape.

Today, The Citizen is more than just a newspaper; it is a content platform as we continuously replenish our digital real estate.

Digital disruption forced us to adapt to the changing times and extend beyond the confines of print.

Readers can now access The Citizen from anywhere in the world through our website, thecitizen.co.tz, and all social media platforms.

Digital copies of the newspaper are also available on Mwanaclick, which can be downloaded from the PlayStore and AppStore.

While we once measured our success by counting print copy sales, today The Citizen’s audience reach has expanded exponentially, allowing us to engage millions of readers through daily digital interactions.

We recognise that consumer behaviour has evolved over the years.

We stay ahead of market trends by understanding our audience’s needs and delivering content that meets their preferences.

That is how we will continue to empower the nation.