Dar es Salaam. The Tanzania Private Sector Foundation (TPSF) has reaffirmed its commitment to inclusivity, prioritising technology, youth, and women within its development agenda. This initiative seeks to tackle the challenges faced by its members—predominantly businesspeople—and to bolster their involvement in shaping national economic policies.

The commitment was underscored during a meeting held in Dar es Salaam on 20th November 2024, where proposed amendments to TPSF’s constitution were discussed. These amendments form part of a broader reform strategy aimed at modernising the organisation and strengthening its representation across Tanzania’s diverse economic sectors.

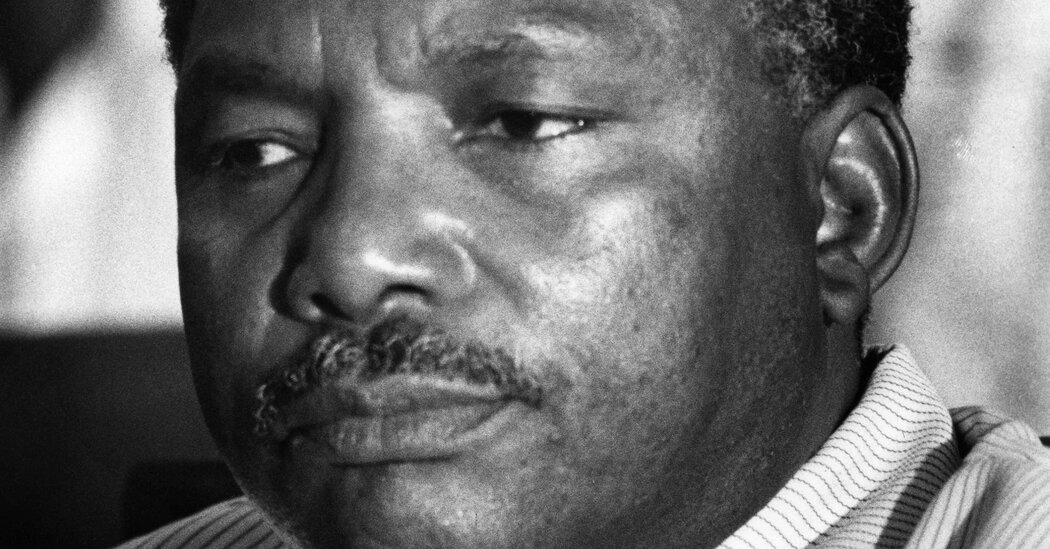

Speaking to the press, TPSF’s Executive Director, Mr Raphael Maganga, highlighted the centrality of inclusivity in the reforms.

“Today, we are reforming to make the organisation more inclusive for youth, women, and technology. We are also increasing the number of sector clusters from 14 to 25, ensuring all economic sectors have a voice in major national decisions,” said Mr Maganga.

He observed that the previous structure had left many members inadequately represented. By expanding sector clusters, TPSF aims to provide members with a more direct platform to present their challenges and proposals to the government.

Mr Gaston Kikuwi, Chairperson of the Small and Medium Enterprises (SME) and Small Business Associations of Tanzania (Vibindo), emphasised the importance of integrating smaller businesses into TPSF’s framework.

“TPSF has often been viewed as an organisation for large businesses. We are working to ensure that small, medium, and large enterprises are equally represented,” Mr Kikuwi explained.

He stressed the significant role of small businesses, which comprise 96 percent of industries and 66 percent of employment in Tanzania.

“Including small businesses will enable them to address issues such as policy barriers, access to land, and social services, leading to substantial benefits for the sector and the nation as a whole,” he added.

As part of its reforms, TPSF is contemplating a name change to reflect its evolution from being perceived as an aid-based organisation to a federation representing a diverse range of sectors.

Mr Mustafa Hassanali, Chairperson of the Tanzania Designers Association, voiced his support for the proposed changes, particularly the creation of a dedicated platform for designers.

“TPSF’s inclusivity will streamline the presentation of challenges, proposals, and tax matters to the government. This aligns with Tanzania’s national vision for 2050,” Mr Hassanali noted.

On her part, Ms Mwajuma Hamza, Executive Director of the Tanzania Women Chamber of Commerce (TWCC), highlighted the need for increased representation of businesswomen within TPSF.

“This will connect women entrepreneurs with the government, providing a platform to share ideas and drive growth and innovation,” said Ms Hamza.

TPSF member, Mr Otieno Igogo, expressed optimism about the reforms, believing that greater inclusion will stimulate economic growth for private sector businesses by fostering stronger connections with the government.

The proposed reforms signal TPSF’s resolve to transform itself into a more inclusive and effective organisation, empowering Tanzanian entrepreneurs of all scales to actively contribute to the nation’s economic development.