Dar es Salaam.

Tanzania has ranked second in East Africa and ninth among the top ten countries in Africa with the best scientists who made a significant contribution to the world of science, according to the list provided by the international journal of science (AD Scientific Index 2023).

In the world, Tanzania is among the top 100 countries with the best scientists, so it has ranked 96 due to the good work of 10 scientists from the Ifakara Institute of Health (Ihi). The institution has ranked first among the 55 universities/institutions in the country that were evaluated.

The 10 scientists include the Institute’s Executive Director, Dr. Honorati Masanja, whose 103 publications attracted 6,691 citations. Others whose publications and citations are in parentheses are Dr. Sarah Moore (96 publications, 5,997 citations).

Dr Fredros Okumu (95 publications, 5,240 citations), Dr Nicodem Govella (38 publications, 2,890 citations), Dr Ally Olotu (36 publications, 3,366 citations) and Dr Eveline Geubbels (46 publications, 2,051 citations).

Other scientists are Dr Dickson Wilson (27 publications, 1,599 citations), Dr Samson Kiware (30 publications, 1,160 citations), Halfan Ngowo (29 publications, 944 citations) and Dr Dominic Mosha (22 publications, 885 citations).

According to the magazine, the ranking system was based on the number of expert scientists and that various criteria were used to rank the countries. The first was based on the number of scientists in the top two percent list while the second criterion was determined by the number of scientists in the top 10 percent, top 20 percent, top 40 percent, top 60 percent and top 80 percent list.

When the final criteria used were determined by the number of scientists listed in the international scientific journal AD and in terms of equality after using all three criteria, the world level of the most talented scientist of the respective country, was used.

Practically, the organizers of the magazine analyzed academic studies from 216 countries, and 19,525 universities/institutions, and 1,223,175 scientists using many criteria to present the results that will be used to evaluate productivity and efficiency for individuals and institutions.

The report has identified the top 10 academic and research institutions in Tanzania based on the scientific qualifications of affiliated scientists.

The list which is dominated by public institutions includes Ihi, Muhas, Sua, Nimr, NM-AIST, CUHAS Bugando, University of Dar es Salaam (Udsm), KCMUCo, University of Mzumbe (Mu) and Chuo University of Dodoma (Udom).

Regarding the top 10 scientists in the country who are productive in publishing valuable scientific works, the magazine mentioned Professor Rudovick Kazwala (Sua), followed by Professor Sayoki Mfinanga (Nimr).

Others are Dr Honorati Masanja (Ihi), Professor Stephen Mshana (CUHAS Bugando), Dr Sarah Moore (Ihi) and Professor Patrick Ndakidemi (NM-AIST). Other scientists according to the research are Professor Karim Manji (Muhas), Dr. Fredros Okumu (Ihi), Dr. Bruno Sunguya (Muhas) and Professor Rachel Manongi (KCMUCo).

Share this news

This Year’s Most Read News Stories

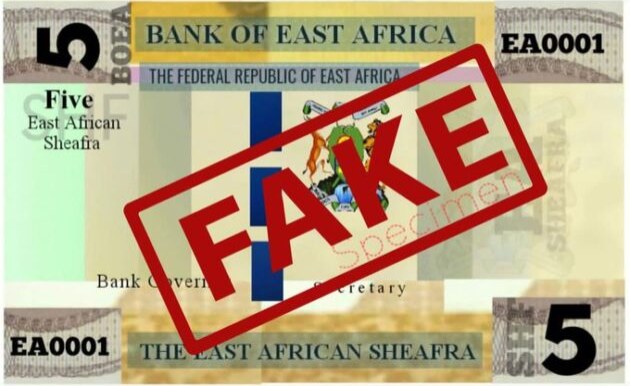

East African Community Bloc Dismisses Fake Common Currency

The secretariat of the East African Community (EAC) regional bloc has dismissed a post on X, formerly Twitter, which claimed that the bloc’s member countries have launched a common regional currency.Continue Reading

Tanzania PS Wants Greater Public Awareness in Health Insurance

Dodoma — PERMANENT Secretary (PS) for Health Ministry, Prof Abel Makubi, said accomplishing universal health insurance requires greater awareness to members of the public before the programme kicks off on July 1, 2023.Continue Reading

Zanzibar Airports Authority enforces Dnata monopoly

. Airlines that have not joined the Zanzibar Airports Authority’s (ZAA) preferred ground handler, Dnata, at the Abeid Amani Karume International Airport (AAKIA) face eviction from the Terminal Three building Dnata is the sole ground handler authorised to provide services for flights that operate at Terminal 3.Continue Reading