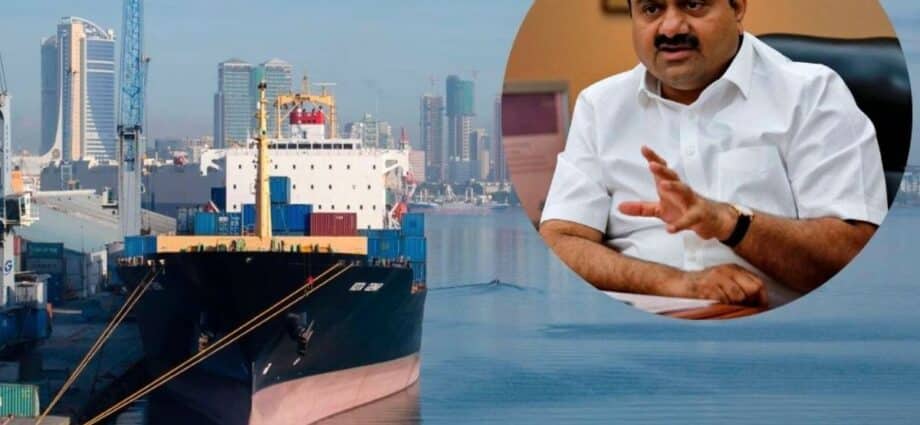

Tanzania plans to honour its contracts with an Adani Group unit despite a US indictment of its billionaire chairman Gautam Adani on accusations of bribery and fraud, a senior official at the ports authority said.

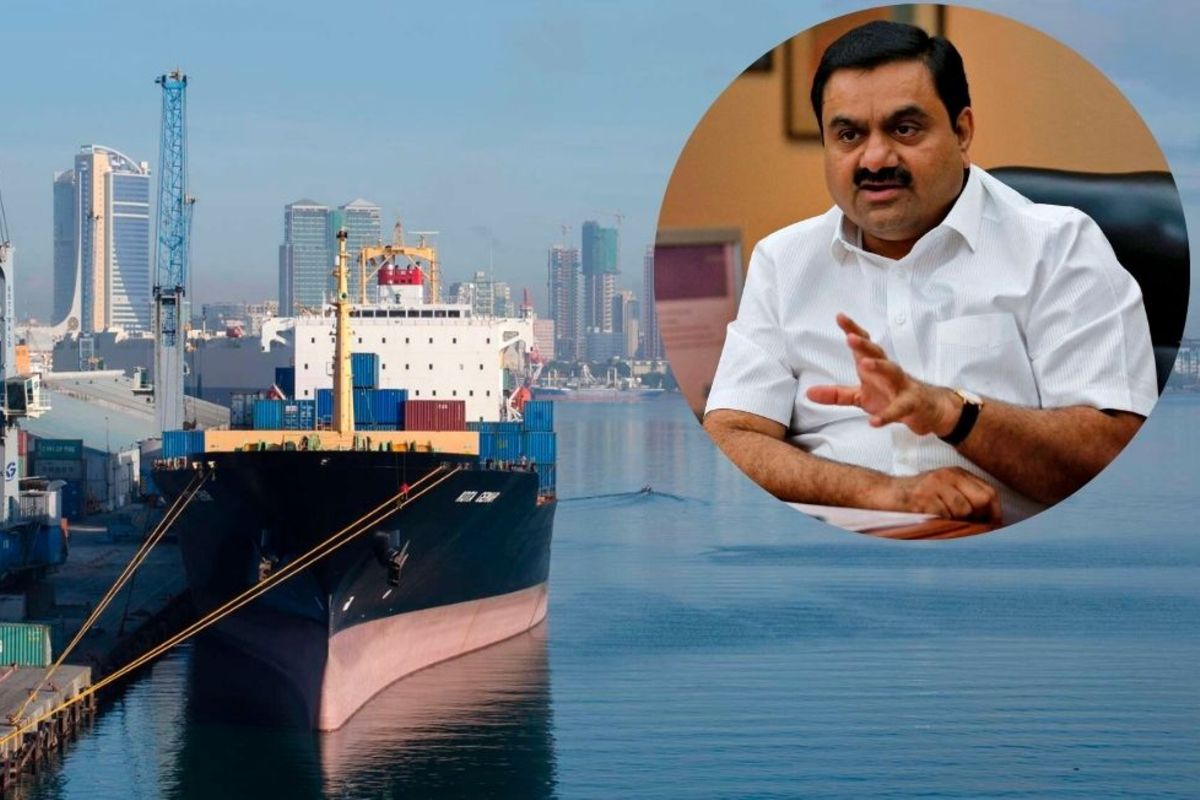

Adani was indicted for fraud last week and arrest warrants were issued for him and his nephew for their alleged roles in a $265 million scheme to bribe Indian officials to secure power-supply deals. Adani Group has denied the accusations.

In May, Tanzania entered into a 30-year concession agreement with Adani Ports, a unit of Adani Group, to operate a container terminal in its Dar es Salaam port, known as Container Terminal 2.

Adani Ports also struck a share purchase agreement for a 95 percent stake in state-owned Tanzania International Container Terminal Services for $95 million.

“We don’t have any problems with anyone. Everything we are doing is according to our laws and agreements,” Tanzania Ports Authority Director General Plasduce Mbossa told Reuters late on Tuesday when asked about the contracts’ status.

“For contracts we have, we don’t have such claims (of wrongdoing). If there are other people who are taking actions, then they are doing so according to their reasons.”

Last week in neighbouring Kenya, President William Ruto scrapped a deal signed with a unit of Adani to build power transmission lines.

He also cancelled a proposal to add a second runway at the Jomo Kenyatta international airport and upgrade the passenger terminal in exchange for a 30-year lease.