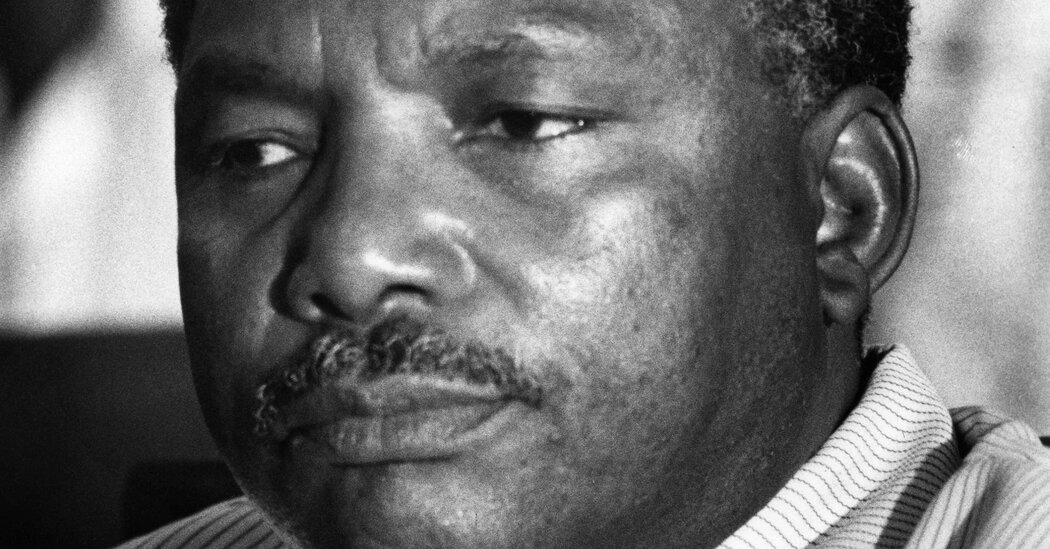

DODOMA — President Samia Suluhu Hassan has approved three bills into law, Prime Minister Kassim Majaliwa disclosed to lawmakers in Dodoma on Friday.

Adjoining the 12th Parliamentary meeting in the capital city, the Premier said the Head of State approved the Financial Bill No. 6 of 2024 and the Appropriation Bill No. 5 of 2024 into law.

“In this Parliament, members had the opportunity to discuss various bills brought before the Parliament and read them a second and third time,” the Premier noted.

Additionally, the Premier stated that in the recently concluded Parliament meeting, the law-making body received two bills which were read for the first time.

He mentioned these bills as the Tanzania Broadcasting Corporation (TBC) Bill of 2024 and the Written Laws Miscellaneous Amendments No. 3 Bill of 2024.

However, Mr Majaliwa also mentioned eight other bills that were discussed and passed by the lawmakers:

· The Law School of Tanzania Amendment Bill 2024

· The Airports Law Bill of 2024

· The Social Security Amendment Bill of 2024

· The Child Protection Laws and Civilian Amendments Bill of 2024

· The Prevention and Combating of Corruption Amendment Bill of 2024

· The Fair Competition Amendment Bill of 2024

· The Written Laws Miscellaneous Amendment Bill of 2024

· The Written Laws Miscellaneous Amendments No. 2 Bill of 2024.

“The Parliament has done a great job debating these bills and facilitating the enactment of laws that have passed through all procedures.

During the debates, we witnessed lawmakers giving opinions, offering advice, and making amendments to the proposed laws in the submitted bills,” the Prime Minister noted after outlining the bills.

Source: allafrica.com