The Lobito Corridor project, which connects four African countries, is ready for implementation after the US awarded a technical assistance grant for an environmental assessment study.

A feasibility study and the signing of the concession agreement is also complete for the 780km greenfield railway connecting the Lobito rail line in Luacano, Angola, to the existing railway line in Chingola, Zambia.

The African Finance Corporation (AFC), the lead developer of the Zambia-Lobito railway, signed a concession agreement with the governments of Zambia and Angola to develop and operate the rail on the sidelines of the UN General Assembly in New York City.

During the ceremony attended by the US Secretary of State Antony Blinken, the US Trade and Development Agency awarded a technical assistance grant of $2 million to the AFC for an environmental and social impact assessment.

Blinken also announced the official joining of Tanzania in the project.

Read: US taps Tanzania in battle with China for minerals

“The Lobito Corridor – connecting Angola, Zambia, and the Democratic Republic of Congo – is one of our biggest projects. The ultimate goal is infrastructure connecting the Atlantic to the Indian Ocean,” Mr Blinken said.

“Today, Tanzania is also joining conversations about the Lobito Corridor for the first time – something we very much welcome.”

The expansion of the Lobito Corridor to include Tanzania is meant to allow the project to run all the way to the Indian Ocean to facilitate transportation of nickel and other minerals.

Blinken said that so far, the United States and its partners have committed over $4 billion to Lobito Corridor projects.

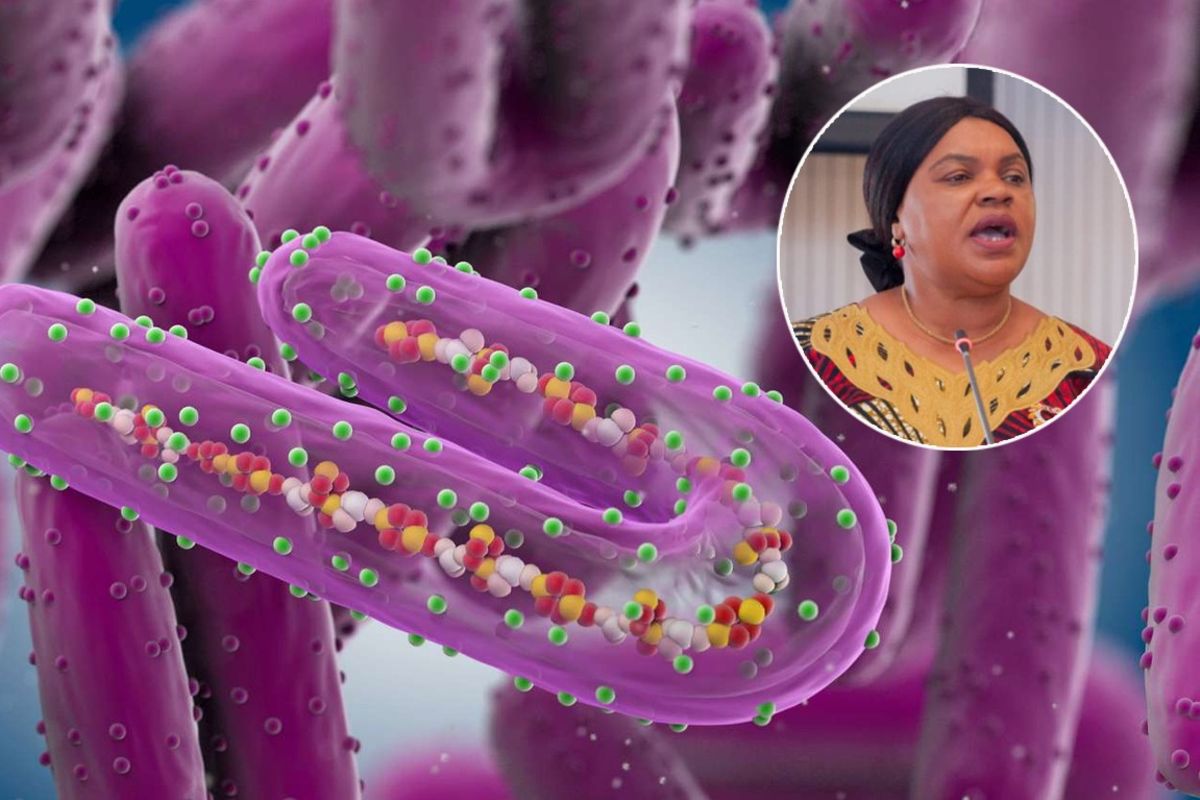

USTDA Director Enoh T. Ebong said the project would facilitate economic activity, trade and critical minerals development between the Port of Lobito in Angola and Zambia’s Copperbelt.

Read: US commits $360m to Lobito Corridor project

US priority

“This project will help reshape the economic landscape of Angola, Zambia, and the Democratic Republic of the Congo, and it will foster trade while uplifting the people whose livelihoods will be tied to economic activity along the corridor,” Dr Ebong said.

“Support for the rail line will contribute to the development of the Lobito Corridor, a US government priority under the Partnership for Global Infrastructure and Investment (PGI) that seeks to provide a private sector-driven, sustainable and transparent option for emerging markets seeking infrastructure investment to accelerate inclusive economic development.”

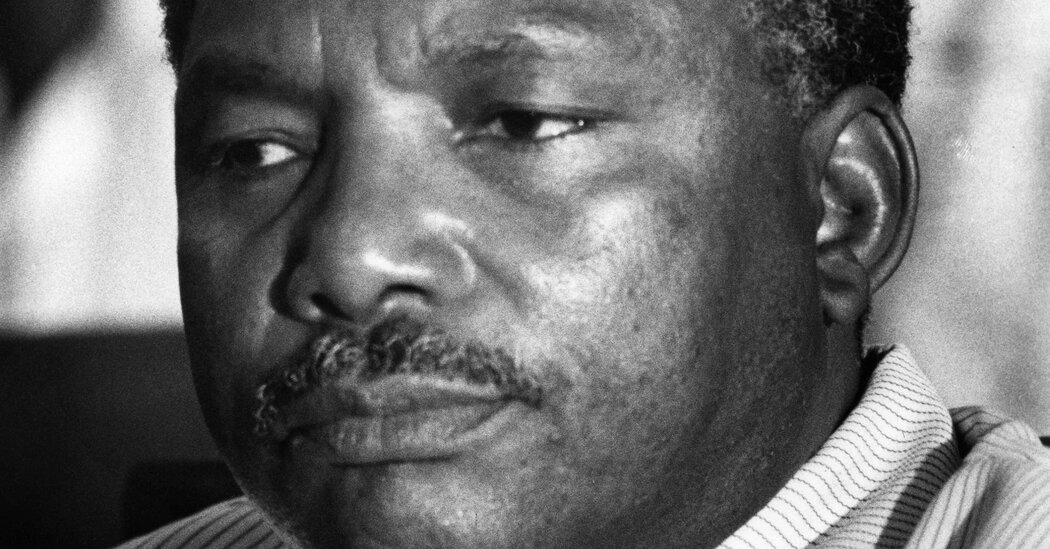

Samaila Zubairu, President and CEO of AFC, said that once completed, the Zambia-Lobito Rail Corridor will create a trans-continental trade corridor that will facilitate trade and investment across Africa and in various sectors, including mining, agriculture, energy and tourism.

“We are therefore pleased to receive this project preparation grant from USTDA to advance the ESIA for the project, underscoring the significance of investing in enabling infrastructure in Africa to secure trade routes and enable critical minerals supply for the global energy transition.”

The high-level discussion advanced PGI’s flagship Lobito Corridor, which aims to develop trans-continental link from the Atlantic to the Indian Ocean.

Foreign ministers of Angola, DRC, Tanzania and Zambia attended the event, alongside the European Partnerships Commissioner, Italian Vice Foreign Minister, the AFC CEO and Senior Vice President for Agriculture and Human Development of the African Development Bank.