Dar es Salaam. The government has extended an invitation to Pakistani investors to explore opportunities in Tanzania’s emerging sectors, including the blue economy, renewable energy, mining, and transport.

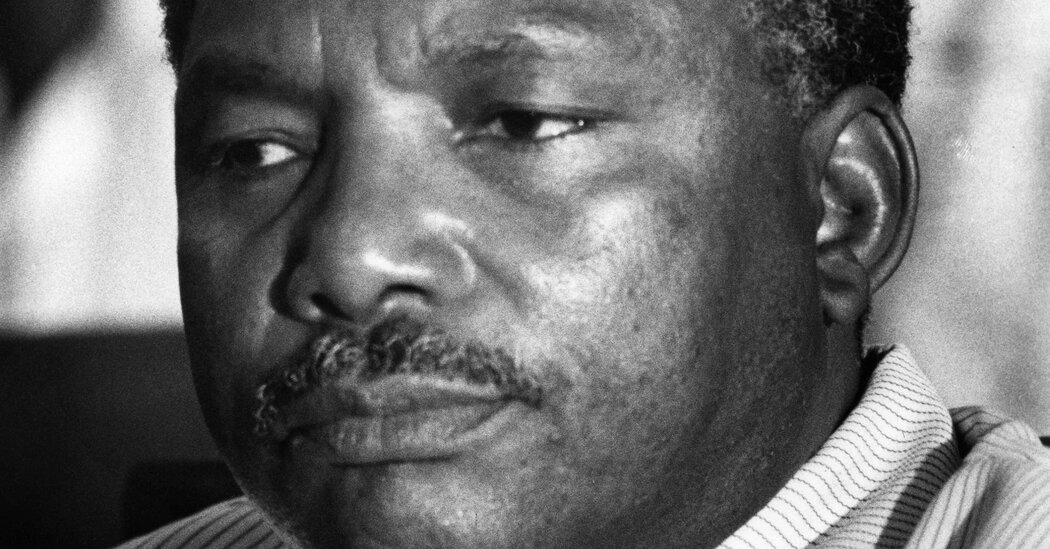

The Deputy Minister for Foreign Affairs and East African Cooperation, Mr Cosato Chumi, issued the call during celebrations to mark the 85th Pakistan Day, held on Friday, April 11, 2025.

He reaffirmed the government’s commitment to strengthening socio-economic and diplomatic ties with Pakistan, noting that bilateral trade between the two countries reached Sh423 billion last year.

Mr Chumi highlighted that Pakistan’s cumulative investment in Tanzania’s manufacturing, agriculture, transport, and services sectors has surpassed $248 million (Sh644.8 billion).

“Pakistan is a key investor in Tanzania. I am confident that both countries will continue to expand trade, investment, and cooperation, especially in emerging sectors such as the blue economy, renewable energy, mining, and transport,” he said.

He also commended the ongoing technical cooperation between the two nations, driven by a range of initiatives involving training, scholarships, capacity building, and knowledge exchange.

Mr Chumi specifically acknowledged the continued benefits many Tanzanians have received under the Technical Assistance Programme for African Countries (TAPAC), a long-standing initiative of the Pakistan government.

He further noted the strong military collaboration between the two countries, which includes joint training and regular exercise.

The Deputy Minister also praised the contributions of the Pakistan diaspora in Tanzania, numbering around 3,000 people, stating that their presence continues to support the country’s development agenda.

He underscored their active participation in various sectors—including construction, medicine, agriculture, and social welfare—as an example of their commitment to national development.

“This community serves as a lasting bridge that continues to strengthen the ties between our two countries,” he said.

Pakistan’s High Commissioner to Tanzania, Mr Siraj Ahmad Khan, reflected on the country’s progress since independence, describing it as a modern and progressive Islamic state.

He said Pakistan has built partnerships across the globe, including with African nations, guided by principles of mutual respect, shared interests, and common values.

“This year, as we commemorate Pakistan Day in Tanzania, I am reminded of the deep-rooted friendship and mutual respect that bind our two nations,” he said.

He added that since the establishment of diplomatic relations, Pakistan and Tanzania have enjoyed warm and friendly ties.

Mr Khan further elaborated on the growing collaboration across a range of fields, including trade, education, capacity building, health, and defence.

“Our shared commitment to peace, development, and regional stability continues to reinforce this bond,” he said.

He also reaffirmed Pakistan’s dedication to supporting both regional and global peace efforts, and reiterated his country’s strong support for Tanzania’s development ambitions.

The envoy went on to highlight the deepening cooperation in health and education, acknowledging the valuable contribution of Pakistani doctors and medical professionals to Tanzania’s healthcare system.

“As we look to the future, we are committed to further strengthening our partnership with Tanzania, a country that shares our vision for peace, progress, and prosperity,” said Mr Khan.

“Together, we can address global challenges—such as climate change, poverty, and inequality—and work towards building a more inclusive and sustainable world,” he added.