Taarifa ya awali ripoti ya ajali ya ndege Ziwa Victoria: ‘Vikosi vya uokoaji vingefika haraka, watu wengi wangetoka hai’’

Taarifa ya awali ya ripoti ya ajali ya ndege ya shirika la precision iliyotokea katika eneo la Ziwa Victoria Tanzania, imetolewa na wizara ya usafirishaji nchini Tanzania, na kuonesha kuwa vikosi vya uokoaji vilichelewa kufika katika eneo la tukio.

Ajali hiyo ilitokea majira ya saa 2 asubuhi saa za Tanzania, lakini kwa mujibu wa ripoti hiyo inaeleza kuwa boti ya kitengo cha polisi wa majini, ilifika majira ya saa saba saa za Tanzania.

‘’ Boti ilifika saa saba eneo la tukio, baada ya kufika walikua na changamoto ya kuishiwa mafuta na oksijeni, kabla hawajafika, mvuvi mmoja tayari alianza kutoka maiti zilokua ndani ya ndege’’ taarifa ya ripoti inasema

Taarifa ya ripoti hiyo pia haijatoa sababu kamili ya nini kilisababisha kutokea kwa ajali, ikisema kuwa uchunguzi bado unaendelea.

Mamlaka ya usafiri wa anga Tanzania awali ilibainisha kuwa baada ya ripoti ya awali itafuatia ripoti ya uchunguzi wa awali inayotarajiwa kuchapishwa mwezi mmoja baada ya ajali na kisha ripoti kamili baada ya mwaka mmoja.

Ndege hiyo ya shirika la precision ATR 42-500 yenye namba PW 494 ilianguka kwenye ziwa Victoria mita chache kutoka uwanja wa ndege wa Bukoba, ikijiandaa kutua ikitokea jijini Dar es Salaam kupitia Mwanza. Ajali hiyo imeua watu 19 kati ya 43 waliokuwemo akiwemo rubani na msaidizi wake.

Share this news

This Year’s Most Read News Stories

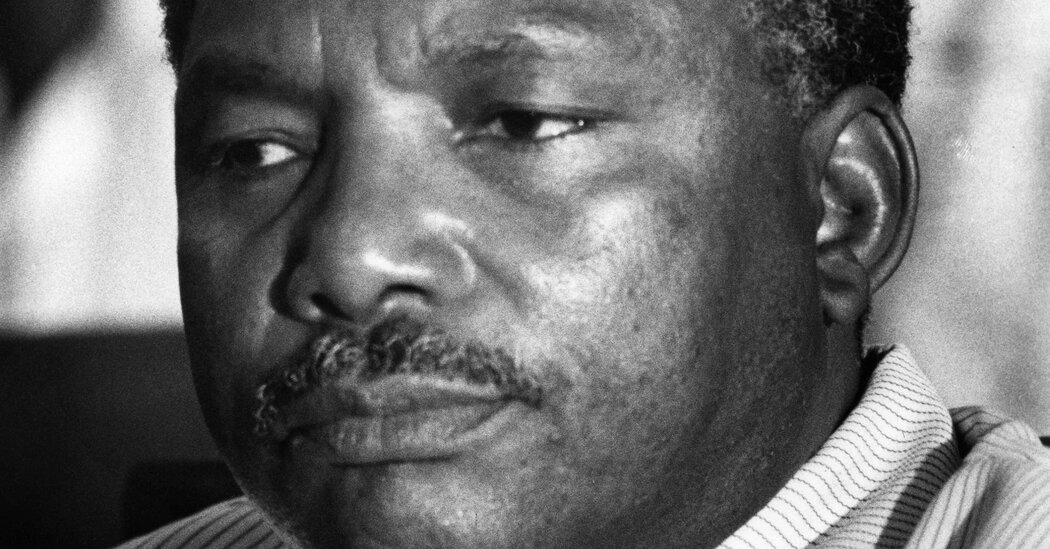

Ali Hassan Mwinyi, Former President of Tanzania, Dies at 98

Ali Hassan Mwinyi, a schoolteacher turned politician who led Tanzania as its second post-independence president and helped dismantle the doctrinaire socialism of his predecessor, Julius K. Nyerere, died on Thursday in Dar es Salaam, the country’s former capital. He was 98.Continue Reading

Karume faults lease of Zanzibar Islets

Diplomat Ali Karume has faulted the decision by the revolutionary government of Zanzibar to lease the islets that surround the islands of Unguja and Pemba to private developers saying it was absolutely not in Zanzibar’s national interests.Continue Reading

Britam half-year net profit hits Sh2bn on higher investment income

Insurer and financial services provider Britam posted a 22.5 percent jump in net earnings for the half-year ended June 2024, to Sh2 billion, buoyed by increased investment income.

The rise in half-year net profit from Sh1.64 billion posted in a similar period last year came on the back of net investment income rising 2.5 times to Sh13.27 billion from Sh5.3 billion.

“We are confident in the growth and performance trend that Britam has achieved, supported by its subsidiaries in Kenya and the region. Our business is expanding its revenue base while effectively managing costs,” Britam Chief Executive Officer Tom Gitogo said.

“Our customer-centric approach is fueling growth in our customer base and product uptake, particularly through micro-insurance, partnerships, and digital channels.”

The investment income growth was fueled by interest and dividend income rising 34 percent to Sh9.1 billion, which the insurer attributed to growth in revenue and the gains from the realignment of the group’s investment portfolio.

Britam also booked a Sh3.79 billion gain on financial assets at a fair value, compared with a Sh1.8 billion loss posted in a similar period last year.

The increased investment income helped offset the 12.7 percent decline in net insurance service result to Sh2.13 billion in the wake of claims paid out rising at a faster pace than that of premiums received.

Britam said insurance revenue, which is money from written premiums, increased to Sh17.8 billion from Sh16.6 billion, primarily driven by growth in the Kenya insurance business and regional general insurance businesses, which contributed 30 percent of the revenue.

The group has a presence in seven countries in Africa namely Kenya, Uganda, Tanzania, Rwanda, South Sudan, Mozambique, and Malawi.

Britam’s insurance service expense hit Sh13.6 billion from Sh11.3 billion, while net insurance finance expenses rose 2.6 times to Sh12.3 billion during the same period.

“Net insurance finance expenses increased mainly due to growth in interest cost for the deposit administration business driven by better investment performance. This has also been impacted by a decline in the yield curve, which has led to an increase in the insurance contract liabilities. The increase has been offset by a matching increase in fair value gain on assets,” said Britam.

Britam’s growth in profit is in line with that of other Nairobi Securities Exchange-listed insurers, which have seen a rise in profits.

Jubilee Holdings net profit in the six months increased by 22.7 percent to Sh2.5 billion on increased income from insurance, helping the insurer maintain Sh2 per share interim dividend.

CIC Insurance Group posted a 0.64 percent rise in net profit to Sh709.99 million in the same period as net earnings of Liberty Kenya nearly tripled to Sh632 million from Sh213 million, while Sanlam Kenya emerged from a loss to post a Sh282.2 million net profit.