The International Finance Corporation (IFC) is set to lend Safaricom Ethiopia an additional Sh46 billion ($350 million) to support its expansion of telecommunications and mobile money services in the country.

In latest disclosures, the global private sector financier has revealed plans to top up the debt ($157.4 million) and equity investment ($100 million for a 7.25 percent stake) it already injected into the telco last year.

If approved, this will bring IFC and its partners’ total financing to Safaricom Ethiopia –which is majority owned by Kenya’s Safaricom Plc– to Sh80 billion ($607.4 million).

“IFC’s further proposed loan of up to $350 million will support STEP (Safaricom Telecommunications Ethiopia Private Limited Company) with the ongoing expansion of its telecommunication network and mobile money services and enhance the competitiveness of the local telecommunications market,” the lender said in the disclosures.

The financier says it is ready to lend between $150 million and $200 million, noting that the rest of the balance will be sourced from development finance institutions and other lenders.

IFC had last year committed a total of Sh34 billion in debt and equity investments in the Ethiopian subsidiary of Safaricom, which is owned by the Global Partnerships for Ethiopia (GPE), a consortium of international investors in which Safaricom Kenya has a majority stake of 51.7 percent.

IFC said the initial investments “have had satisfactory environmental and social (E&S) performance,” based on the assessment done by the lender’s team, paving the way for the extra investment that’s now been proposed.

The multilateral lender expects that its expanded investments in the telco will further boost its ability to increase competitiveness in the mobile connectivity industry in Ethiopia, in addition to increasing access to quality phone networks in the country.

Safaricom Ethiopia is the first private-sector-led mobile operator in the country, after entering the industry in 2021 when the Addis government liberalised the telecommunications sector.

Since starting operations in the country in late 2022, the subsidiary is yet to break even, and has been weighing down its parent company’s profits for the last two financial years due to startup losses that are estimated to have peaked in the year ended March 2024.

In the review period, the Ethiopian subsidiary made a net loss of Sh42.66 billion ($323 million), weighing down the telco’s profits even as the Kenyan arm posted a 13.7 percent increase in profits to hit Sh84.7 billion.

Besides Safaricom, other shareholders of the Ethiopian business include Japanese trading company Sumitomo Corporation (25.2 percent), British International Investments (10.1 percent), and Safaricom’s parent firm Vodacom (5.75 percent).

Safaricom Ethiopia is also eyeing a potential $150 million (Sh19.6 billion) local currency-denominated debt from the Ethiopian Stock Exchange once it goes live in the third quarter of this year, highlighting the capital-intensive nature of the business.

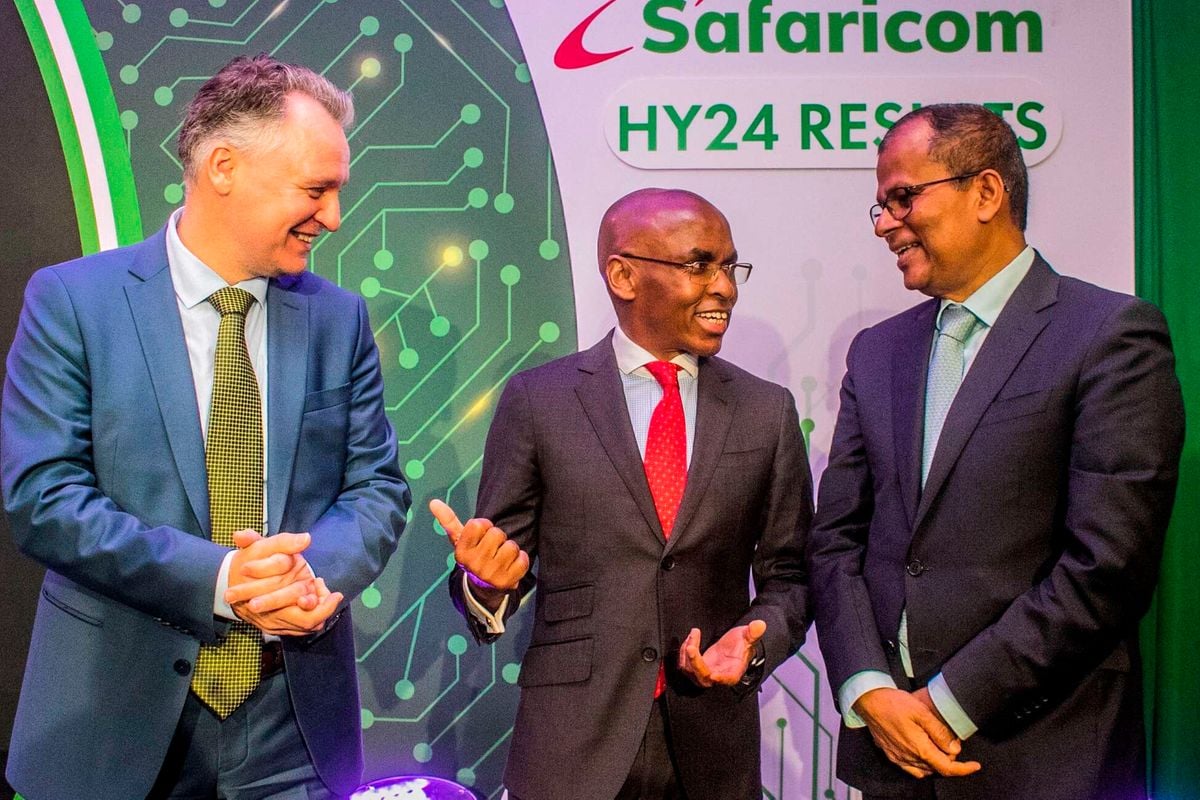

In November 2022, when Safaricom first reported results from the Ethiopian subsidiary, the chief financial officer Dilip Pal said they estimated the subsidiary could break even from 2026.

“We don’t expect significant profit in the beginning, but over time we expect the Ethiopian subsidiary to become a big driver of this company’s profits and the future of this business,” added Peter Ndegwa, Safaricom’s CEO.