When I joined The Citizen as a retained correspondent in January 2005, I could not fathom the impact this role would have on my journalistic career.

At that time, Tanzania’s media landscape was undergoing an important transformation, fueled by the Nation Media Group’s (NMG) strategic investment in Mwananchi Communications Limited (MCL).

The Citizen was still in its infancy, having been in operation for only three months.

As a 23-year-old trainee writer, starting at the Business Desk under the guidance of Bakari Machumu was a combination of exciting and scary experiences.

With little interest in the area of business journalism, my first assignment was a disaster.

When the then EuroAfrican Bank – which was later acquired and renamed Bank of Africa (BoA) Tanzania – loaned Sh200 million to a leasing company, I mistakenly reported the loan amount to be only Sh20 million by omitting a zero.

Since English Grammar has never been one of my serious challenges, the error went unnoticed.

However, early the next morning, the bank’s managing director lodged a complaint with the Managing Editor of The Citizen at the time, Mr Joachim Buwembo, who then informed Mr Machumu about the mistake.

What I learnt from that incident was that in business journalism, precision with numbers is crucial.

A single gaffe can change the meaning of the whole story and your own reputation as someone who gets his/her daily bread through news writing.

I thus had to refine my attention to detail, especially regarding numerical accuracy.

Working alongside skilled business writers such as Constantine Sebastian, Finnigan Wasimbeye, Imani Lwinga, Hassan Mghenyi (May his Soul Rest in Eternal Peace), Tawanda Tahwa, Damas Kanyabwoya, Dickson Amos, Mnaku Mbani and Mwanamkasi Jumbe among others, facilitated my growth in the business, finance and economic field of journalism.

In fact, the Business Desk was blessed to also be enjoying the services of such talented individuals, including the then Mwanza Bureau Chief Richard Mgamba and Arusha Bureau Chief Zephania Ubwani (May his Soul Rest in Eternal Peace).

Their presence provided a rich learning environment for those of us who were trying to make ourselves known in the market.

At the News Desk, the pioneering team led by News Editor Usia Nkhoma included outstanding writers like Zuhura Yunus (who later became the Director of Presidential Communications and now the Deputy Permanent Secretary in the Prime Minister’s Office [Labour, Youth, Employment and Persons with Disability], Mkama Mwijarubi, Maurice Chirimi, Mercy Randa, Rodgers Luhwago, Levina Kato, Benard Missoke and Rose Athumani (May her Soul Rest in Eternal Peace).

Those who joined the team a few days later included Tom Mosoba, Peter Nyanje and Mkinga Mkinga (May his Soul Rest in Eternal Peace) among others.

Mosoba, Mgamba and Sebastian later served as Managing Editors on different times while Nyanje and Kanyabwoya took on News Editor roles at different periods.

The Features Desk, under the leadership of Loy Nabeta, was equally impressive.

With writers like Stella Barozi, Eric Kabendera, Fausta Musokwa, Amana Mbise, Nyanda Shuli, Eric Kalunga, Morris Mwavizo, Kanky Mwaigomole, Langa Sarakikya, Delfina Ntangeki, Salome Gregory and Christine Chacha, the desk revolutionized feature journalism in Tanzania.

The team transformed feature articles from being lengthy but boring political and business content promos into engaging and captivating reads that would compel you to read again and again.

In sports journalism, the desk boasted talents like Atilio Tagalile (May his Soul Rest in Eternal Peace), Emmanuel Muga (now an advocate of the High Court), Hassan Muhiddin (the current chief sub-editor), Kamata Njelekela, Mohamed Ugasa, Miguel Suleyman, Suleiman Jongo and Majuto Omary.

All the desks were being complemented by the work of photographers such as Mpoki Bukuku (May his Soul Rest in Eternal Peace), Athuman Hamisi (May his Soul Rest in Eternal Peace), Edwin Mjwahuzi, Salhim Shao and Emmanuel Herman, who captured compelling images that brought stories to life.

For The Citizen on Sunday, it was interesting to learn from Sakina Datoo, Nyaronyo Kicheere and several other key writers.

The subbing and graphics desks, packed with some of the finest editorial minds and designers in the industry, provided a nurturing environment for learning and growth.

Each desk, from Business to News to Features and Sports, played a pivotal role in shaping my journalistic skills and professional development.

Reflecting on my journey, I am grateful for the opportunity to work alongside such distinguished colleagues and mentors.

The lessons learned during those formative years have been just priceless.

From the late days of President Benjamin Mkapa’s administration to the present day of Samia Suluhu Hassan, The Citizen has played a pivotal role in Tanzania’s journalism and governance. It has been instrumental in shaping public discourse and influencing government action.

During the Mkapa era, The Citizen was active in bringing national attention to Tanzania’s debt relief negotiations.

This was a period marked by significant financial and political challenges, and the paper’s investigative journalism helped drive critical discussions about economic management and international aid.

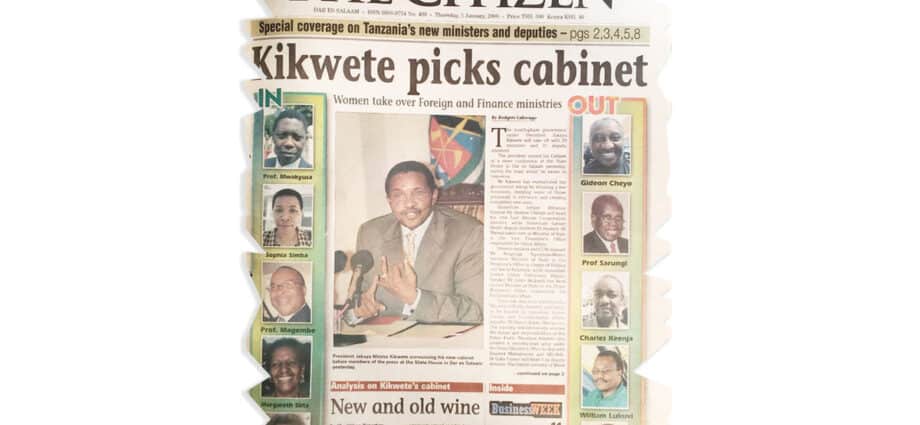

In the early years of Jakaya Kikwete’s presidency, The Citizen played a key role in its coverage of the Richmond electricity generation scandal.

The newspaper was among the first to question Richmond’s ability to deliver the promised 100 megawatts.

It repeatedly questioned the company’s financial and technical capabilities.

The public outcry over frequent power outages and Richmond’s failure to meet its commitments led to a parliamentary probe, which ultimately resulted in the resignation of the Prime Minister and several key cabinet ministers.

The paper’s commitment to exposing corruption did not stop there. When Florence Mugarula, who was a colleague at The Citizen at that time, began reporting on the DECI (Development for Community Initiative) pyramid scheme, which was gaining prominence at Mabibo, few had actually fathomed that those behind the scheme were committing a serious blunder.

The comprehensive coverage by The Citizen brought the fraudulent scheme to the attention of authorities, including the Bank of Tanzania (BoT), leading to broader scrutiny and investigation.

Similarly, The Citizen played a significant role in unveiling the siphoning of approximately Sh133 billion from the BoT’s External Payment Account (EPA).

The newspaper’s persistent reporting on the scandal kept the issue in the public eye and eventually led to former President Kikwete dismissing former BoT governor Daudi Balali rather than accepting his resignation.

One of the most prominent examples of The Citizen’s impact was its coverage of the Escrow Account scandal, during which Richard Mgamba was the Managing Editor.

The newspaper’s thorough reporting ensured that the scandal became a household topic, leading to parliamentary inquiries and decisive actions.

Throughout its history, The Citizen has consistently challenged assumptions about its role as a mere extension of its sister paper, Mwananchi. It has managed to get a niche in business journalism, thereby contributing to the improvement of Tanzania’s business climate and advocating for better governance.

By focusing on issues such as investment, health, education, water, regional integration and international relations among others, The Citizen has empowered Tanzanians to make informed decisions and engage with global issues on a local level.

As Bakari Machumu aptly put it, The Citizen’s role has been to empower the nation to think globally and act locally.

Indeed, in the world of journalism, it’s the content that counts, and The Citizen has proven time and again that its reporting makes a meaningful difference in Tanzanian society.

The learning process continues and this time, as rightly put by the Managing Editor, Mpoki Thomson, the focus now shifts to monetizing the digital content.

——————————————————————————————————–