Unguja.Zanzibar. People’s Bank of Zanzibar (PBZ) has launched a bancassurance service as part of its efforts to increase the inclusion of more communities in the formal financial system.

The government targets in its Financial Strategy to ensure that 80 percent of Tanzanians have sufficient understanding of insurance services, with 50 percent actually using insurance services by 2030.

Deputy insurance commissioner, Ms Khadija Said, praised the bank for the step, stating that the service will help accelerating the delivery of insurance services in the isles as well as nationwide.

“This initiative is very important to the government as it supports the implementation of the ten-year financial strategy (2020-2030), which aims to deepen the insurance penetration,” she said, urging the bank to continue providing more education to citizens about the importance of insurance services.

Ms Said called on financial institutions in the country to continue collaborating with various insurance companies to collectively facilitate the accessibility of the service.

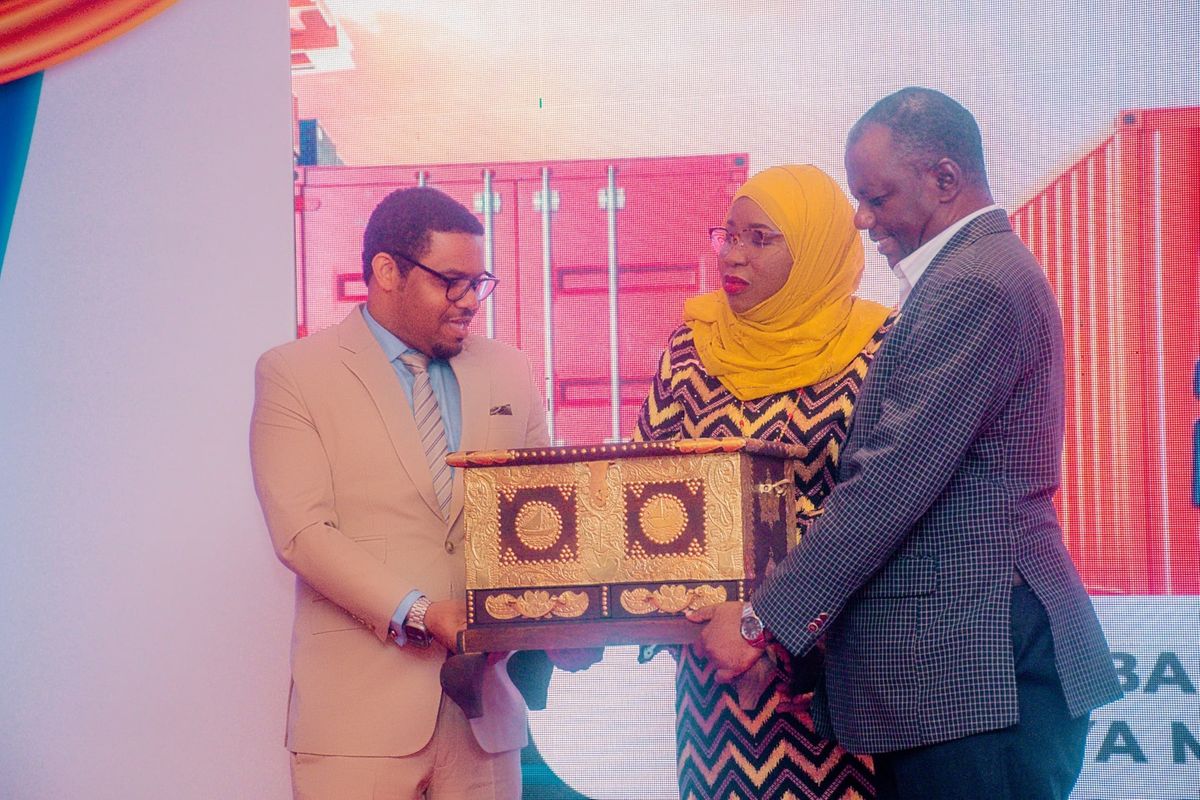

PBZ managing director Arafat Haji said the introduction of the service which has all approvals from the Tanzania Insurance Regulatory Authority (Tira) and the Bank of Tanzania (BoT), is part of the bank’s strategy to continuously improve its services, with the intention of creating a one-stop shop.

“This product will be provided through all PBZ branches in the country, in collaboration with various insurance companies, as authorized by Tira. PBZ customers can now access insurance services and other financial services, such as obtaining loans for insurance premium financing, at a competitive level,” he said.

The bank’s director of business, Mr Eddie Mhina, listed the insurance companies involved in this programme as Zanzibar Insurance Corporation (ZIC), National Insurance Corporation (NIC), Alliance Life, Jubilee Insurance, Strategis Insurance, and Metro Life Assurance.

“The launch of this program comes at a time when PBZ is continuously excelling in our digital services, and thus being recognized as one of the financial institutions effectively implementing the vision of BoT in achieving an inclusive digital economy and transitioning towards a less cash-dependent economy,” added Mhina.

According to Mhina, the bank’s goal is to eliminate inconvenience for customers by adding several value additions to the insurance service, including easy access to reporting claims, convenience in registering new insurance policies where customers will receive digital notifications for the expiry of their policies, and receiving close support in renewing insurance policies.