Unguja. A section of traders in Zanzibar have complained over the decision by the Zanzibar Revenue Board (ZRB) to charge taxes by estimates instead of using the Virtual Fiscal Management System.

According to the businessmen some are turned away by the taxman over claims that the amount they want to pay is less yet the calculations are based on sales records using machines.

However, in a quick rejoinder ZRB’s acting Taxpayer Education manager Makame Mohammed Hamis said they are empowered by the law to conduct audits at any time they deem necessary.

According to him what usually leads to estimated tax for some traders if there is suspicion over the payments that are to be made, especially when they are below the level compared to the previous payments.

“The inspection that takes place is usually done in accordance with the law so that the Board is satisfied with the information of the taxpayer and the business that takes place,” he said.

“We went there to make payments but ZRB officials refused to receive the payments saying the amount was too low yet this is what was recorded in the fiscal devices,” said Ali Said, a businessman in Mlandege.

On his part, the businessman Juma Mohammed said that tax estimation is against the government’s goals of establishing a revenue collection system using electronic machines and according to him the procedure was introduced to close the gaps that allowed tax evasion.

“If that was the case then there was no reason to sell us these machines at a cost of Sh400,000 as tax collection continues to take place in the old ways, but it also has serious consequences for the development of the business sector.” said Juma.

Share this news

This Year’s Most Read News Stories

For years, a UK mining giant was untouchable in Zambia for pollution until a former miner’s son took them on

For years, the people in the villages around Chingola in Zambia endured frequent health challenges and dead fish floating around in their water source, but that was just the beginning of their nightmare.Continue Reading

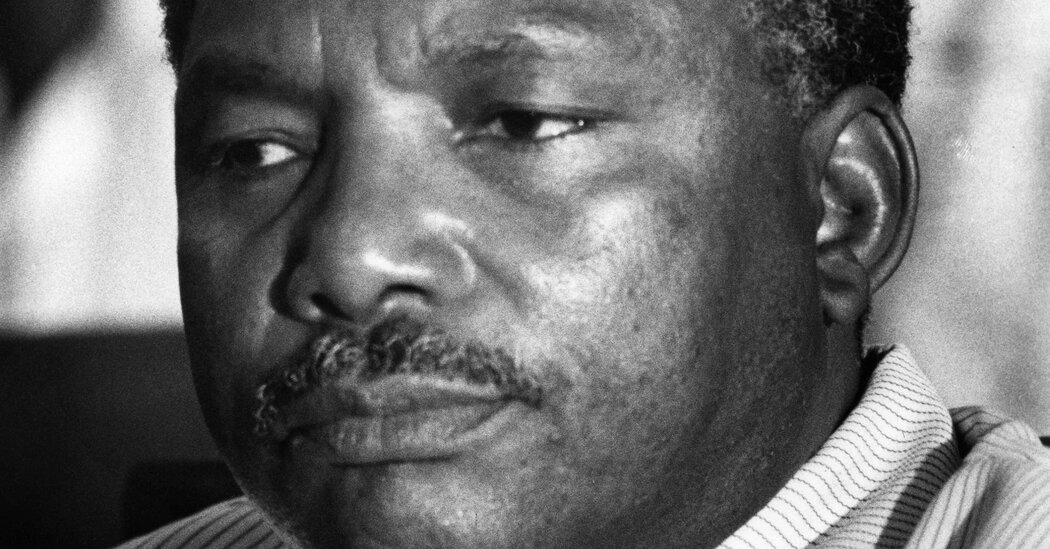

Ali Hassan Mwinyi, Former President of Tanzania, Dies at 98

Ali Hassan Mwinyi, a schoolteacher turned politician who led Tanzania as its second post-independence president and helped dismantle the doctrinaire socialism of his predecessor, Julius K. Nyerere, died on Thursday in Dar es Salaam, the country’s former capital. He was 98.Continue Reading

European Union Bans Air Tanzania Over Safety Concerns

Kampala — The European Commission added Air Tanzania to the EU Air Safety List, banning the airline from operating within European Union airspace. This decision follows the denial of Air Tanzania’s Third Country Operator (TCO) authorization by the European Union Aviation Safety Agency (EASA), citing significant safety deficiencies.

The EU Air Safety List includes airlines that fail to meet international safety standards. Commissioner Tzitzikostas emphasized the importance of passenger safety, stating: “The decision to include Air Tanzania in the EU Air Safety List underscores our unwavering commitment to ensuring the highest safety standards. We strongly urge Air Tanzania to take swift action to address these safety issues. The Commission has offered its assistance to Tanzanian authorities to enhance safety performance and achieve compliance with international aviation standards.”

Air Tanzania joins several African airlines banned from EU airspace, including carriers from Angola, the Democratic Republic of Congo, Sudan, and Kenya. Notable names include Congo Airways, Sudan Airways, and Kenyan carriers Silverstone Air Services and Skyward Express. The ban reflects the EU’s strict approach to aviation safety worldwide.

Source: allafrica.com