The National Assembly’s Finance Committee has rejected the Treasury’s proposal to allow the Kenya Revenue Authority (KRA) to spy on Kenyans’ M-Pesa transactions and bank account details.

Treasury Cabinet Secretary Njuguna Ndung’u had proposed to amend the Data Protection Act to exempt the KRA from the requirement of seeking court orders before accessing sensitive personal information held by data controllers and processors, including banks, telecom operators, utilities, schools, land registries, and the National Transport and Safety Authority.

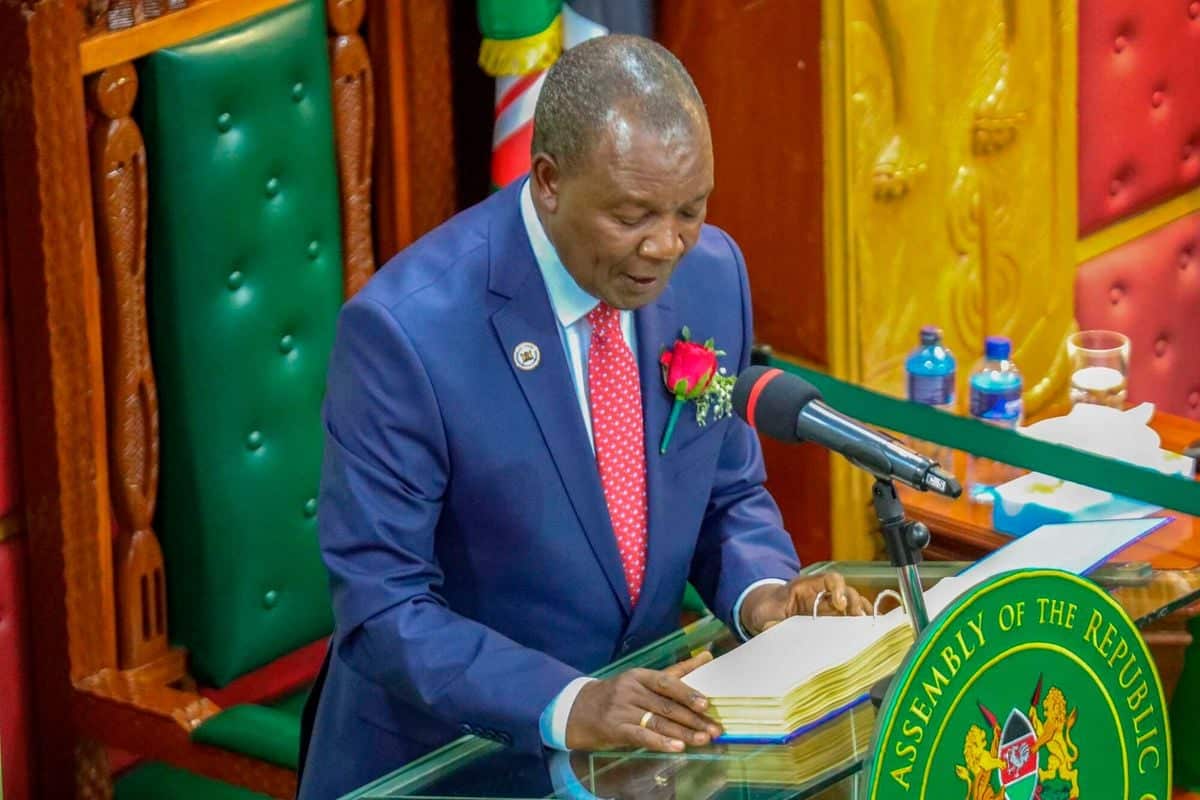

However, Molo MP Kuria Kimani-chaired the Finance Committee rejected the proposal for changes to the Finance Bill that seek additional taxes of Sh302 billion, which excludes customs revenues.

“The committee notes that the proposal to allow the KRA access to personal data as proposed may not meet the threshold under articles 31(c) and (d) of the Constitution of Kenya,” he said.

“Additionally, the committee observed that Section 51 of the Data Protection Act outlines the circumstances under which exemptions might apply. Further, Section 60 of the TPA [Tax Procedures Act] empowers the commissioner or an authorised officer with a warrant to have full access to any data for the purposes of administering a tax law.”

Section 51 (2) of the Data Protection Act 2019 allows data controllers and processors to share personal data with a third party if it relates to the individual himself purely for personal or household activity and when it is necessary for national security or public interest. Section 51(2) also allows for exemption if the disclosure is required by or under any written law or by an order of the court.

Legal practitioners wondered why the State wanted to allow the taxman to have absolute access to personal data through the Data Protection Act rather than amending Section 60 of the Tax Procedures Act, which requires the taxman to first obtain a court order before going after private information.

Section 60 of TPA, which had once been declared unconstitutional by the High Court, requires the KRA to first get a court order before accessing personal data.

Some organizations, including the Law Society of Kenya (LSK) and Amnesty International Kenya, an NGO, had called for this provision to be expunged from the Finance Bill 2024 terming it ‘unconstitutional.’

The KRA wants to leverage on increased use of data and linkages between its systems with third parties such as banks and mobile money platforms like M-Pesa to spy on taxpayer’s activities, use of Internet-enabled cameras at excisable goods processing plants and full rollout of digital electronic tax registers to grow revenue.

The KRA’s enforcement units have been using various databases to pursue suspected tax cheats, including bank statements, import records, motor vehicle registration details, Kenya Power records, water bills and data from the Kenya Civil Aviation Authority (KCCA), which reveals individuals who own assets such as aircraft.

Car registration details are also being used to smoke out individuals who are driving high-end vehicles but have little show in terms of taxes remitted.