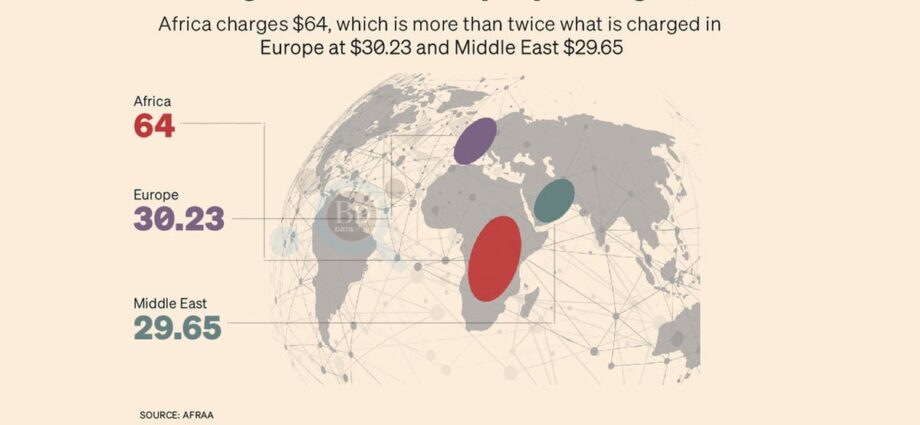

Taxes and fees charged on African air tickets are higher than what airlines in other continents charge and are inhibiting air transport on the continent.

According to the African Airlines Association (Afraa), a leading trade association of airlines based in Ghana that researches aviation, the average amount paid in taxes and fees by passengers in Africa is more than twice what air travellers in other continents pay.

Taxes and fees on African air tickets averages $64 while in Europe it averages $30 per ticket while it is even lower in Middle East at $29.65.

The high add-on fees has inhibited the growth of air travel on the continent that is grappling with high poverty rates.

Regionally, Western and Central Africa rank as the most expensive regarding international passenger charges averaging $94.59 and $93.74.

Unfriendly environment

However, passengers from Northern Africa pay the lowest in taxes and fees averaging $26.27.

The charges have been blamed on the unfriendly business environment, poor governance and less subsidies given to airlines in Africa compared to those abroad.

East African Business Council in a study on air space liberalisation in the EAC shows average departure charges account for 13 percent of the ticket prices for flights in EAC and eight percent for flights to other African countries.

Afraa notes that despite efforts by airlines to offer passengers low fares, taxes and fees cause total ticket prices to more than double of the base rate.

“The low purchasing power in Africa calls for interventions to evaluate the issue of high taxes and fees to stimulate demand and make air transport affordable to African citizens”, Afraa recommends.

Apart from passenger taxes levied directly on the ticket, airlines incur other charges connected to their operations in airports such as aircraft charge, landing, parking, passenger bus, and hangar among others.

Operational costs

In 2019 as noted by Afraa, the International Civil Aviation Organization, a United Nations agency, regulations stipulated fuel that accounted for 24.7 percent of operational costs by African airlines was not to be taxed.

However, other particular taxes and fees are applied to passengers.