Dar es Salaam. Following the successful issuance of Tanzania’s first green bond for water infrastructure by the Tanga Urban Water Supply and Sanitation Authority (Tanga Uwasa), the government is now promoting the use of green bonds for other public institutions.

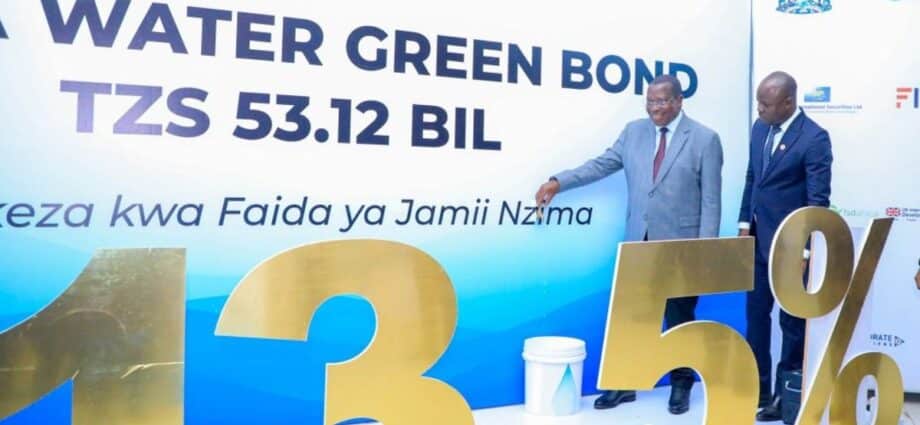

The Tanga Uwasa bond, valued at Sh53.12 billion, was oversubscribed by three percent, raising a total of Sh54.72 billion.

This success story is being used by the ministry of Finance, in collaboration with stakeholders, to educate other government institutions on securing independent funding through green bonds.

“Green bonds are a new concept for public institutions in Tanzania,” said Mr Ben Mwaipaja, the head of communications at the Ministry of Finance. “But Tanga Uwasa proves it’s possible. This approach can significantly accelerate development.”

He said other government institutions are expected to follow the suit in two months.

Green bonds are fixed-income securities that raise capital for projects that support the combating of climate change and investment in sustainable development such as renewable energy, energy efficiency, green transport, and waste-water treatment.

Mr Mwaipaja said that projects such as health, roads, and water are largely financed by the Treasury, although there are opportunities for citizen involvement, both domestic and international, to accelerate development.

He said that although no other institutions have shown interest, there is hope for such development due to the global trend of funding through green bonds.

Commenting on the issue yesterday, a finance and tax expert from Mzumbe University, Prof Haruni Mapesa, said for investors to show up for green bonds, they need to understand the history of the relevant institution, its leadership, and the type of projects it wants to implement.

“In a few years to come, we will witness our country doing well in the financial and capital markets as citizens have started to be motivated and invest their money in the area,” he said.

Prof Mapesa added that private individuals, especially pensionable retirees, are starting to abandon investing in agriculture, land, and housing and instead have increased their confidence in the financial and capital markets.

In January this year, the commissioner for financial sector development in the Ministry of Finance, Dr Charles Mwamwaja, told The Citizen that other government institutions would soon start to raise funds for crucial development projects.

He said the government was in the advanced stages of drafting documents that comply with capital market standards so that it could issue green bonds and speed up various development projects.

“Many investors have an appetite for investment in things that concern them. Green bonds are currently the trend around the world. The government institutions, along with continuing to create an enabling environment, will soon start entering the markets,” he said.

Last year, Tanzania’s two largest commercial lenders, CRDB Bank and NMB Bank, issued multicurrency green bonds, but both were oversubscribed.