Dar es Salaam. Tanzania will specifically tackle five issues as it embarks on the implementation of its new trade policy, the Deputy Prime Minister said yesterday.

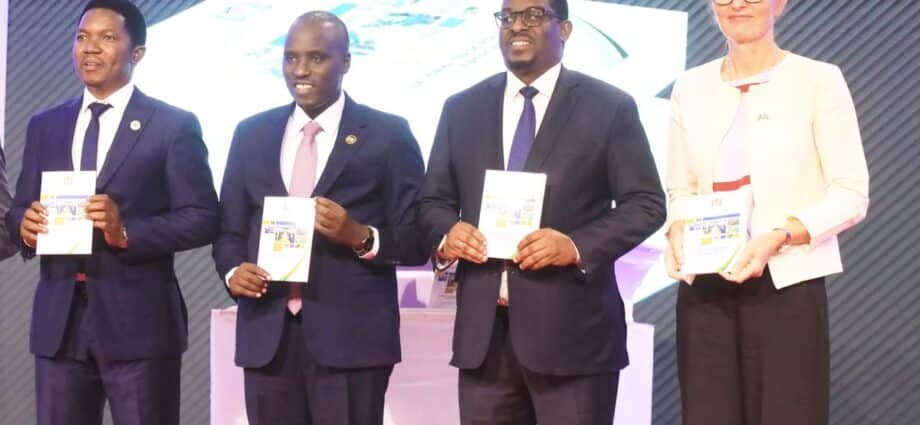

Gracing the launch of the new Trade Policy, Dr Doto Biteko named some of the issues that the country will have to tackle, such as raising value addition to local products and enhancing the competitiveness of Tanzania’s exports.

He said Tanzania has had a 2003 policy that had been overtaken by events, and the new one, among other things, is expected to increase the competitiveness of Tanzania’s products.

“It will promote value addition in our industries to increase employment,” he said.

The policy, said Dr Biteko, will also enable trade facilitation to strengthen regional relationships and sustainable, inclusive trade.

He emphasised the importance of using the policy to eliminate trade barriers and establish a legal framework aimed at strengthening and promoting trade, urging government officials to abandon practices that hinder progress.

“A government official must recognise that their respect in the office is to ensure they facilitate business and enable people to profit, not to frustrate them. There are people whose only aim is to obstruct and frustrate others,” he said.

He noted that the contribution of the trade sector to Tanzania’s economy was still small, thus highlighting the importance of using the policy to simplify business processes and increase its contribution to the national income.

“People complain a lot that our policy is outdated. Now that we have made changes, it’s time to show the world that we have reformed and are keeping up with global pace,” he said, adding, “A policy is just a document, and if it exists without people of good intention to implement it, it will remain just a storybook. Therefore, we must change our mindset and our thoughts.”

He urged all businesspeople in the country to understand that the government was theirs and that it wants to see them benefit from the businesses they do.

However, he warned those with the habit of evading taxes to stop because it denies the country its rightful revenues.

In his remarks, the minister for Industry and Trade, Dr Selemani Jafo, said the policy was made possible with the help of various stakeholders, including diplomats from different countries and TradeMark Africa.

“Many stakeholders have been involved, and our goal was to ensure we get a policy that reflects the current reality. Through this policy, we expect to significantly increase exports, including to African markets,” he said.

Speaking during the event, the Norway Ambassador to Tanzania, Tone Tinnes, said the private sector has shown its capability to drive modernization through creativity, innovation, and the skills and technology necessary to propel Tanzania forward.

She said in recent years, Tanzania has witnessed a new dynamic.

The government’s push to enhance trade, attract investment, and improve the business climate is commendable.

She said recent trade data shows that Tanzania is now increasing its exports again, with regional trade opportunities significantly contributing to this growth. Foreign Direct Investment (FDI) is also increasing.

She said regional trade and investment opportunities are expanding. While trade barriers have been reducing, intra-regional trade is still lower than optimal, and there is a huge potential to increase.

“Studies show that Tanzania has had a revealed comparative advantage in manufacturing (mainly agriculture-related), both within East Africa and in some areas also across the broader African continent. Today, Tanzania is getting an up-to-date trade policy aimed at enhancing its competitiveness regionally and globally,” she said.

She said a thriving business community needs consistent, transparent, and fair regulatory frameworks, simplified procedures, including taxation, and structured, high-quality consultations between the private and public sectors to prevent, discuss, and resolve issues.

“A skilled labour force, which, if complemented with deliberate measures to make trade more inclusive, will also enhance efforts on reducing poverty in Tanzania. We are seeing impressive growth both in domestic and foreign investment pledges,”

“Tanzania Investment Centre reports an increase to $6.5 billion for the last financial year. And we look forward to seeing the realisation of your ambitions to reach 1,000 projects registered and $8.5 billion in investment pledges for the next year,” she said.