DAR ES SALAAM: THE bilateral trade between Tanzania and Brazil has reached 74.8 million US dollars (203.2bn/-) in a decade, reflecting a steady growth of economic ties between the two countries.

The increased trade volume is equivalent to 13 per cent increase in 12 years compared to the previous record of 66 million US dollars set in 2011.

The Ambassador of Brazil to Tanzania, Mr Gustavo Nogueira, said last Friday during the Brazil-Tanzania business seminar that despite the current figures, there is potential for further expansion of the bilateral trade.

“I’m confident that this trade mission will significantly contribute to furthering our countries’ shared goal of increasing bilateral trade and investment and ensuring mutual prosperity for our businesses and citizens.

“We believe that these countries have the opportunities to share with each other, to grow with each other, to learn from each other in a partnership among equals,” he said.

The main exports from Brazil to Tanzania are poultry meat, heavy construction vehicles and raw sugar while Tanzania exports vinyl polymers and also raw tobacco.

He said due to the Tanzania’s population of 65 million people, Brazil realises how crucial it will be for locals to promote its industrial base, to promote its manufacturing base, to create wealth in order to provide jobs and opportunities for its growing population.

He added that the country’s government efforts to improve the regional transport infrastructure of ports, roads and railways to further benefit from this geographic dividend, is vital for investment.

“These important infrastructure projects will expand trade opportunities not just to East Africa and Southern Africa, but also to Asia, the Arab world and beyond,” Amb Gustavo added.

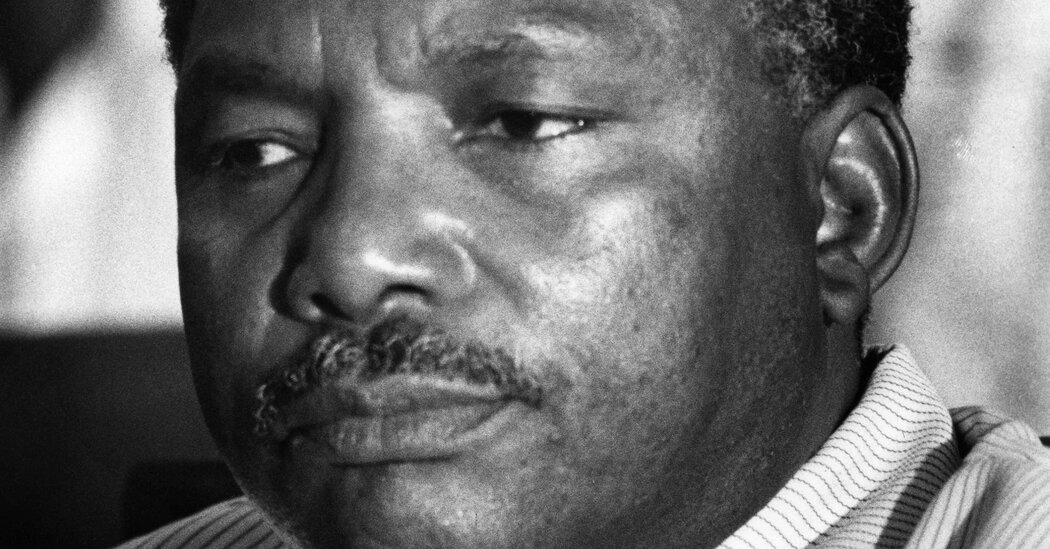

Minister for Industry and Trade Dr Selemani Jafo said the trade between the two countries remains relatively good, but need some improvement as the trade volume among the two countries remain low.

Last year, Tanzania export to Brazil was valued at 0.1 million US dollars while Brazil’s exports to the country were valued at 64.6 million US dollars.

“These statistics indicate that there is great work to be done to explore the existing potential to increase trade volume among us,” he said.

He underscored the government’s commitment to fostering business growth and enhancing investment opportunities.

ALSO READ: How can EAC enhance intra-trade, investments

Various initiatives to improve the country’s business environment have been conducted by the government including the recent launch of the Electronic Investment Window, a new Trade Policy for 2023 and the formation of the Presidential Commission on Tax Reforms to review and advise on tax issues.

“These initiatives are designed to promote business and improve the investment climate in the country, positioning the private sector as a central player in our economic activities,” he said.

The minister added that there should be a need to expand production beyond traditional ways to the value-added products with higher profit margins and to strengthen the country’s supply chain to ensure consistent product quality and timely delivery.

Source: allafrica.com