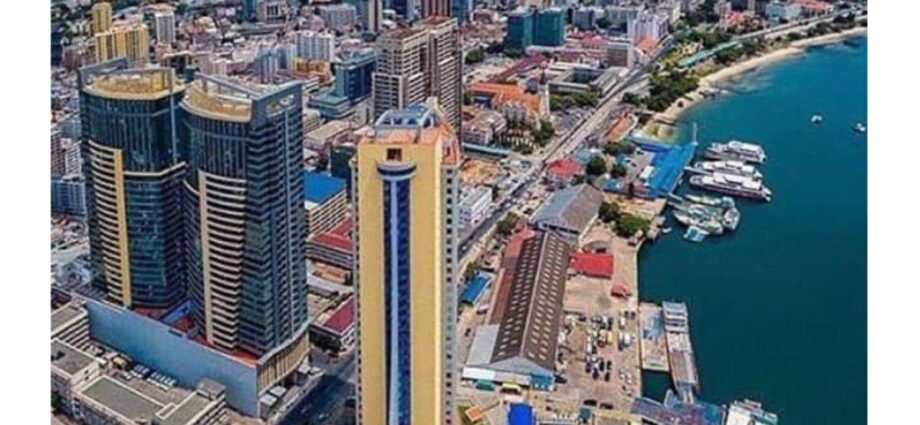

Dar es Salaam has been ranked as the 85th wealthiest city in the world and 12th in Africa, boosted by growth in the number of high net worth individuals (HNWI) by 20 percent in the last decade.

The World’s Wealthiest Cities 2023 report by consultancy New World Wealth and Henley Partners placed Tanzania’s commercial capital city among the top cities globally with the fastest-growing numbers of dollar millionaires.

The latest report, which tracks private wealth migration trends worldwide, shows Dar es Salaam has 1,400 highly wealthy individuals with at least $1 million in net worth, and 4 centi-millionaires (people with a net worth of over $100 million) and one individual who is a dollar billionaire.

The report which features exclusive data highlighting 97 of the world’s wealthiest and fastest growing cities with the most millionaires, centi-millionaires, and billionaires, and accompanied by global and real estate insights from leading academic and industry experts.

In Africa, Dar es Salaam fell out of the top 10 and is ranked 12th behind other cities such as Luanda, Accra, Pretoria(SA), Cape Town (SA), Casablanca (Morocco), Nairobi (Kenya), Cairo (Egypt), Johannesburg (SA), Durban(SA), Cape Winelands (SA), and Garden Route (SA)

South Africa and Egypt had the most cities in Africa in the ranking, led by Johannesburg which has 14,600 dollar millionaires – the most in Africa.

However, this was a decline from the 15,200 millionaires reported in the 2022 report.

The second spot was taken by Egypt’s capital Cairo, which has 7,800 HNWIs, but which also recorded a decline from 7,400 in the previous report.

South Africa’s second-largest city Cape Town emerged third in the continent with 7,200 millionaires, followed by Nigeria’s most populous city, Lagos, which has 5,400 HNWI in the review period.

The number of dollar millionaires in Africa has been impacted by the global recession, a shortage of foreign currency and galloping inflation in most of the economies in the region.

These economic challenges highlight the difficulties facing investors amid a tough business environment driven by inflation.

The report also shows that Kigali, Rwanda’s economic center and a burgeoning tech and financial hub was Africa’s fastest growing market over the past decade, both in terms of millionaire growth and overall wealth growth.