Credit Bank Plc has opened talks with a foreign private equity (PE) firm to sell an additional 25 percent stake ahead of its listing on the Nairobi Securities Exchange.

Reliable sources from the bank disclosed that discussions are ongoing to bring in another deep-pocketed investor as part of a major turnaround plan seeking to propel the bank into a medium-sized lender by next year (2025).

Last year, the Tier 3 lender sold its 20 percent shareholding to a Mauritius-based private equity fund, Shorecap III, after they struck a deal in April following approvals from the Competition Authority of Kenya and the Central Bank of Kenya.

“We are speaking to a potential investor who is willing to take up a further 25 percent stake in the bank. There are prospects that another investor will come into the bank. It is a foreign private equity firm,” said the source.

The source further disclosed that new shares would be created to accommodate the new investor as the existing shareholders are now ready to dispose of their shares.

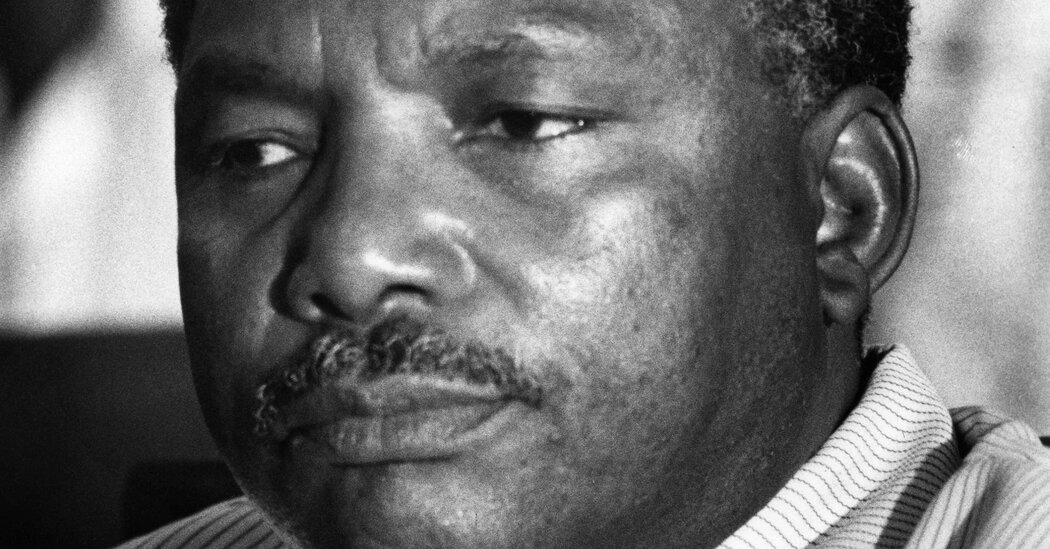

If the deal is successful the bank, which is majority owned by the family of the late politician Simeon Nyachae, will be 45 percent jointly owned by two foreign PE firms.

The foreign investor interest in Credit Bank is crucial in laying the groundwork for the proposed listing as it serves as an indicator of investor confidence in the lender’s growth prospects.

“Company growth remains a key focus for the board, and we were pleased that the efforts to attract investment have succeeded, boosting our strategic ability to grow our balance sheet sustainably,” said the bank’s chairman, Mr Moses Mwendwa, in the 2022 annual report.

“As we embark on a new journey of growth, be rest assured that the lessons and resilience built into Credit Bank over the last year will help us navigate business risks to deliver on our promise of sustainable returns.”

Credit Bank is seeking more funding to implement its aggressive five-year (2021-2025) growth plan with hopes of achieving an asset base of Sh49 billion and Tier II status by 2025.

The proposed share sale could also boost the lender’s capital and liquidity ratios, which are under pressure.

Its core capital to total risk-weighted assets increased to 11.8 percent in 2023 from 7.4 percent in 2022, compared to the statutory minimum ratio of 10.5 percent, resulting in the capital buffer (excess capital) turning to 1.3 percent from negative 3.1 percent, according to the lender’s audited financial statements.

The total capital to total risk-weighted assets improved to 16.3 percent from 14.9 percent against the minimum statutory ratio of 14.5 percent, resulting in the capital buffer increasing to 1.8 percent from 0.4 percent.

On the other hand, the lender’s liquidity ratio declined to 20.01 percent from 20.5 percent during the period under review against the minimum statutory ratio of 20 percent translating to excess liquidity declining to 0.01 percent from 0.5 percent.

As at 31 December 2022, the Banks authorised share capital was 75,000,000 ordinary shares of Sh 100 each of which 29,159,714 shares are issued and fully paid.

Credit bank began operations in 1986 as a non-bank financial institution before securing a commercial banking licence in 1995.

Between 1995 and 2010, the lender served a niche market, mainly large businesses, before the strategy review in 2010 which positioned it as retail-facing bank.

The lender announced in August last year that it plans to raise at least Sh1 billion from the Nairobi Securities Exchange (NSE) through an initial public offering (IPO).