Dar es Salaam. The oversubscription of CRDB Bank’s Samia Infrastructure Bond, which raised Sh323 billion, has drawn mixed reaction over investor appetite and trust in Tanzania’s capital markets.

The bond targeted to raise Sh150 billion but investors oversubscribed it by 115 percent, according to a statement issued by the bank yesterday.

Named Samia Infrastructure Bond, the bond is a financial initiative designed to enhance rural infrastructure projects managed by the Tanzania Rural and Urban Roads Agency (Tarura).

The money raised through the bond by CRDB Bank PLC, will go towards financing contractors executing projects under Tarura’s upcoming tenders.

The Minister of State, President’s Office for Regional Administration and Local Government (RALG), Mr Mohamed Mchengerwa, emphasised that the bond’s success marks a significant step in addressing Tanzania’s infrastructure challenges.

“The Sh323 billion raised will accelerate road construction and other critical projects, directly improving the lives of citizens. It also demonstrates the strength of Tanzania’s financial system in supporting large-scale national development initiatives,” he said.

Financial analysts believe the bond’s oversubscription reflects investor confidence and a stable liquidity in the local capital markets.

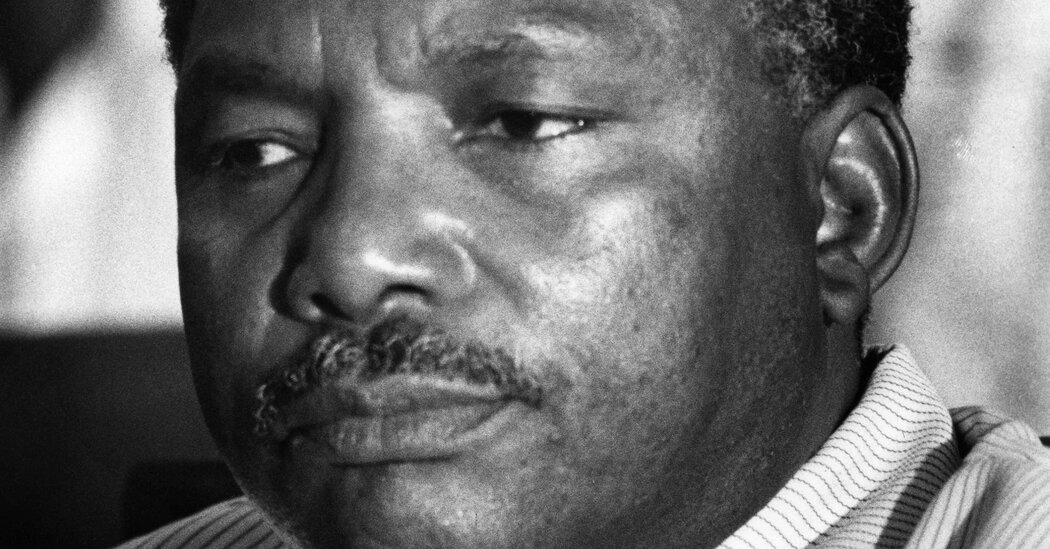

“That means there is enough liquidity locally and the government can tap that potential to borrow domestically and reduce foreign commercial loans which are actually expensive,” said Prof Abel Kinyondo of the University of Dar es Salaam.

However, Prof Kinyondo warned that the performance may sometimes have negative interpretation about the domestic business and investment environment.

“Sometimes, staying with idle money like that tells something about the possible risks associated with the local business environment. The government needs to ask itself why these people are staying with idle cash instead of putting them in productive activities like building some manufacturing plants?” he said, adding that something must be done to stimulate other investment opportunities.

Independent financial market analyst, Mr Christopher Makombe, said the oversubscription signifies strong investor demand and investor confidence on CRDB financial health.

He said the funding will mean faster completion of projects as CRDB supports contractors as well as government by ensuring timely payments.

“Another reason which might have made the bond attractive is the coupon payment plan which is four times a year, unlike other government bonds which pay coupon twice a year,” he said.

“To the overall Tanzania market, the news is positive and indicates a possibility of drop in yields going forward as demand for bonds increases and liquidity seems to be available for that. The bond success is setting ripe ground for other corporate issuance in the future,” he added.

CRDB Bank chief executive officer, Mr Abdulmajid Nsekela, reinforced that the bank’s ability to secure more than double the targeted amount signifies trust in the financial institution’s stability.

This achievement demonstrates the strong investment potential within our market. Investors showed great enthusiasm, knowing that their funds are secure with a well-structured project. We take immense pride in earning the trust of Tanzanians,” said Mr Nsekela.

The Samia Infrastructure Bond, the second phase of CRDB Bank’s Five-Year Medium-Term Note Programme, follows the success of the Kijani Bond, which raised Sh171.82 billion—over four times its initial target of Sh40 billion.

Capital Markets and Securities Authority (CMSA), Mr Nicodemus Mkama, highlighted that the listing of the bond on the Dar es Salaam Stock Exchange (DSE) has increased corporate and institutional bond investments by 38.9 percent, now valued at Sh1.16 trillion.

“The bond is a clear reflection of the strength of our capital markets, positioning the DSE as an integral player in facilitating investment in Tanzania’s national infrastructure projects,” said Mr Mkama.

DSE chief executive officer, Mr Peter Nalitolela echoed similar sentiments, stating that the strong investor response enhances liquidity in financial markets.

“We are pleased to see initiatives like the Samia Infrastructure Bond bringing prosperity to investors and the country,” he said.

Tarura chief executive officer, Mr Victor Seff, emphasised that the timely availability of funds will accelerate road construction and other infrastructure projects.

“We have many ongoing projects nationwide, but financing has always been a challenge. Now, contractors will receive timely payments, ensuring projects are completed as planned,” he said.

The bond offers a 12 percent annual return paid quarterly.