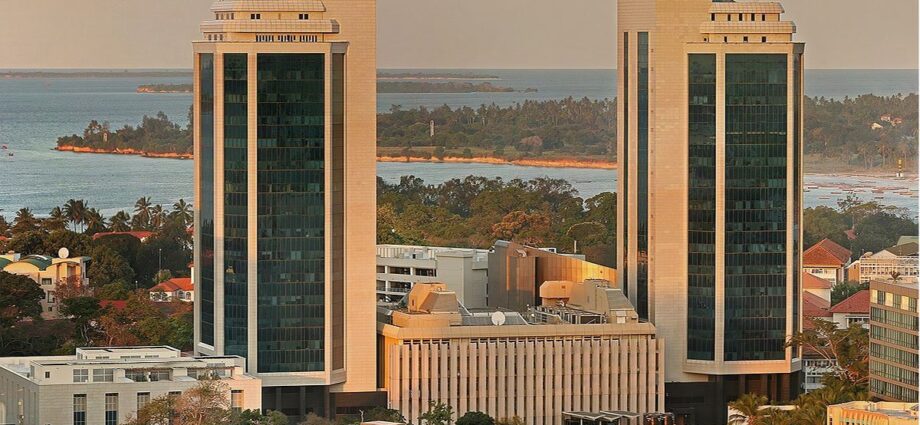

Dar es Salaam. The Bank of Tanzania (BoT) is set to release a comprehensive study on Central Bank Digital Currencies (CBDCs), examining their potential impact on the country’s financial ecosystem, payment systems, and the practicality of adoption by citizens given existing infrastructure.

According to BoT’s Director of Financial Deepening and Inclusion, Mr Kennedy Komba, the upcoming report will outline both the benefits and risks of introducing a digital shilling and guide the development of a national roadmap for CBDC implementation.

“Unlike cryptocurrencies such as Bitcoin, CBDCs are a digital representation of a country’s currency government-backed and centrally issued,” Mr Komba clarified.

He added that while cryptocurrencies are privately issued and treated as assets, CBDCs function as a digital version of fiat currency.

He did not mention the exact date but said that the study will come out soon.

BoT began exploring CBDCs in January 2023 through a phased, risk-based approach, signaling a cautious yet forward-looking stance on digital monetary policy.

However, Governor Emmanuel Tutuba was recently quoted as saying that an earlier internal study from 2021 will analyse experiences from other countries to assess real-world opportunities and obstacles.

“Money should be a medium of exchange and a store of value it must offer convenience, not disruption,” Mr Tutuba emphasized.

On the issue of cryptocurrencies, the governor reaffirmed BoT’s long-standing position that their use remains illegal in Tanzania, citing risks associated with money laundering, terrorism financing, and counterfeit funds.

“We’ve repeatedly said it’s an illegal business. The public should avoid it. Those engaging in it do so at their own risk,” he warned.

A regional report released in June last year reviewed economic trends and digital finance policies across the East African Community (EAC).

It noted significant variation in how EAC countries approach cryptocurrency regulation ranging from outright bans to tentative regulatory frameworks.

Tanzania maintains a de facto ban on cryptocurrencies, with the Tanzanian Shilling remaining the only legal tender.

The report urged EAC member states to evaluate crypto platforms, analyse market activity, and adopt clear regulations to curb fraud, tax evasion, and disruption to formal financial systems. Kenya and Tanzania reportedly lead in the region’s crypto adoption, though official data is lacking.

It also highlighted the potential for cryptocurrencies and blockchain to drive financial inclusion, job creation, and innovation in sectors such as health, education, and governance. For instance, Kenya utilized blockchain technology to improve electoral transparency in its 2022 general elections.

The report recommended that EAC countries collaborate with global institutions like the International Monetary Fund (IMF) to enhance digital finance frameworks and infrastructure.

Institutionalizing CBDC trading and establishing crypto clearing houses could bring long-term benefits.