Dar es Salaam. In alignment with its Foreign Exchange Intervention Policy of 2023, the Bank of Tanzania has recently intervened in the Interbank Foreign Exchange Market (IFEM) to support the country’s monetary policy objectives and ensure the stability of the Tanzanian Shilling.

This move underscores the bank’s active role in maintaining equilibrium in the foreign exchange market, addressing the needs of the economy while achieving broader monetary policy goals.

The auction saw substantial participation, reflecting the market’s demand for US dollar liquidity and the bank’s successful efforts in managing this demand. According to a statement, the Bank of Tanzania sold $25 million through the auction, with a weighted average exchange rate of Sh2,663.16 per US dollar.

The main objective of the auction was to stabilise the foreign exchange market and facilitate the effective implementation of the country’s monetary policy. The results of the auction included a total amount tendered of $75.2 million, out of which the successful amount was $25 million.

This was at a weighted average exchange rate of Sh2,663.16 per US dollar. The highest bid rate was Sh2,670.00 per US dollar, while the lowest bid rate was Sh2,640.00 per US dollar. The BoT accepted the highest bid rate accepted: Sh2,670.00 per US dollar and the lowest bid rate of Sh2,658.20 per US dollar.

A total of 25 banks participated in the auction. While the intervention demonstrates the Bank’s active role in managing currency stability, experts have also weighed in on the long-term effectiveness of such measures.

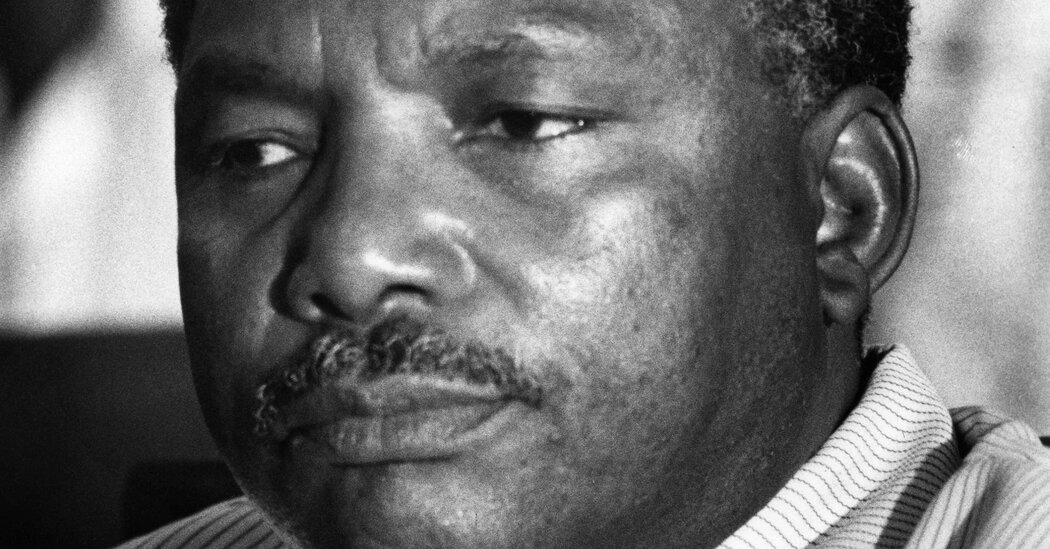

An economist from the Dar es Salaam University College of Education (DUCE), Prof Abel Kinyondo, said that while the initiative is beneficial, the stability of a country’s currency should ultimately be tied to its production capacity.

“A country’s currency is essentially backed by the value of what it produces. When production increases, particularly of goods and services needed domestically, it reduces the reliance on foreign currencies, like the US dollar, to import essential goods,” Prof Kinyondo explained.

He said that demand for foreign goods drives the need for US dollars, as individuals and businesses exchange local currency to acquire these products.

However, by boosting local production, the need for foreign exchange diminishes, thus stabilising the local currency.

Additionally, Prof Kinyondo pointed out that achieving a surplus of locally produced goods allows for exports, increasing demand for the local currency.

Foreign buyers would need to exchange their dollars for Tanzanian shillings to pay for these exports, which could help strengthen the value of the shilling against the US dollar.

“By focusing on enhancing local production, the country can reduce its dependency on foreign currencies, thus strengthening its currency in the global market,” he concluded.