Tanzania yapewa miezi sita kufuta adhabu ya kifo

Sima mara ya kwanza kutolewa hukumu ya kutaka marekebisho ya sheria kuhusu adhabu ya kifo.Continue Reading

Sima mara ya kwanza kutolewa hukumu ya kutaka marekebisho ya sheria kuhusu adhabu ya kifo.Continue Reading

Having initiated democratic change, Tanzania’s president appears to be fighting a rearguard action by Magufulist hardliners.

After she succeeded the late John Magufuli as President of Tanzania in March 2021, Samia Suluhu Hassan began mitigating the authoritarianism of her predecessor. She restored basic civil rights, unbanning public rallies and loosening media controls, started consulting with opposition parties on necessary reforms, and proposed an inclusive ‘committee of experts’ to guide the long-delayed constitutional review process.

Samia also sacked Magufuli loyalists, including chief secretary Bashiru Ally, foreign affairs minister Palamagamba Kabudi, and spy chief Diwani Athumani Msuya, who had overseen the previous president’s crackdown on civil liberties. And she returned to the Cabinet people who had been sidelined by Magufuli, including January Makamba and Nape Nnauye.

But late last year her reforms appeared to stall, and Magufuli’s hardline supporters seemed to be making a comeback. She appointed some of them to key positions – such as Doto Biteko as Deputy Prime Minister – and reversed some reform moves. A key one was the long-expected review of the country’s constitution, which she postponed until after next year’s national elections.

Perhaps the appointment that bothered democratic reformists most was that in October 2023 of Paul Makonda – widely disliked by the opposition – to the role of ideology and publicity head in the ruling Chama Cha Mapinduzi (CCM) party. This year started more encouragingly with Makonda’s transfer from that more important post to the governorship of Arusha.

It is now becoming harder to read where the president is going. Some analysts say the hardliners are out again. Yet democratic reforms don’t seem to be going as far or as fast as they should before the local government elections in October this year and the national ones next year.

This week, for instance, two new political parties – the Independent People’s Party and Action for Human Justice (AHJ Wajamaa) – complained that the Office of the Registrar of Political Parties was stalling approval of their registration applications. These are small parties and perhaps inconsequential. But ISS Today was told the apparent stalling might be because the two parties’ leaders were CCM ‘Magufulist’ hardliners looking for an alternative route to power, having been frustrated by Samia within the CCM.

One insider said, perhaps hyperbolically, that the ruling party feared the new opposition parties ‘would do a Zuma on the CCM.’ This refers to the way former South African president Jacob Zuma formed a new party, uMkhonto weSizwe (MK). MK astonishingly played the decisive role in knocking the ruling African National Congress down from 57% to just 40% of last month’s national vote.

In early February this year, Tanzania’s Parliament made what were supposed to be sweeping electoral reforms by passing three bills: the National Election Commission Act, Presidential, Parliamentary and Local Government Elections Act, and Political Parties Affairs Laws (Amendment) Act. The bills were intended to make the National Electoral Commission independent rather than a branch of the executive.

Electoral reform is critical as the 2020 elections were widely deemed to have been manipulated. The reforms include changing the selection of electoral commissioners, who are now solely appointed by the president. An independent panel chaired by judges would in future manage selection.

The laws also open up the position of director of elections to all competent citizens. The selection panel would present a shortlist of three candidates to the president, who would select the director. The same process would apply to the chair and vice-chair of the National Electoral Commission.

The laws similarly open up the process for selecting electoral officials at lower levels, removing requirements that they are appointed from district governors, i.e. from the executive, which in effect largely means they are CCM deployees.

Tanzania’s Governance and Economic Policy Centre (GEPC) hailed Samia as ‘a democrat par excellence‘ for initiating these reforms. However, it cautioned that important gaps remained. These could only be bridged by reviving the stillborn full constitution review, as the electoral reform bills were not underpinned by the current constitution. One of the most important gaps is that election results are not subject to judicial review.

GEPC proposed other democratic reforms such as equal access of political parties to state media and restrictions on using the national security apparatus ‘to support a given political party or its candidates during elections’ (i.e. the CCM).

The country’s main opposition parties complained that despite the appearance of granting the National Electoral Commission independence, the new legislation still reserved the final decision over appointment of commissioners and the director of elections to the country’s president.

Get the latest in African news delivered straight to your inbox

Nevertheless, says Zitto Kabwe, outgoing leader of the second largest opposition party, ACT-Wazalendo, through negotiations by his party and others, several improvements had been made to the bills – mainly to enhance the National Electoral Commission’s independence.

Kabwe told ISS Today he had recently explained to his party’s national executive committee that change is a process, not a one-day event. ‘Therefore, we must encourage ourselves that these changes are a very important step in our journey to demand free and fair elections and leave a lasting mark in our country through our party.’

ISS Researcher Nicodemus Minde suggests that Samia’s apparent inconsistencies were necessary strategic political manoeuvres to protect her from the Magufulists. Writing in The Conversation, he said they had won her support in her party and among the broader public. ‘Nonetheless, she could still face resistance from hardline factions within her party who may seek to undermine her in the 2025 general elections.’

Even so, appeasing the hardliners can all too often be a cover for shoring up one’s own power.

Peter Fabricius, Consultant, ISS Pretoria

Source: allafrica.com

President Dr Samia Suluhu Hassan on Thursday evening realigned government executives including bringing new faces to the list.

According to the statement issued by Chief Secretary, Dr Moses Kusiluka, the Head of state has appointed Maswa East CCM legislator, Stanslaus Nyongo to become deputy Minister of State in the President Office (Planning and Inveatment).

President Samia also appointed Felister Mdemu to the post of deputy permanent secretary in the Ministry of Community Develeopment, Gender, Women and Special Groups in charge of gender issues and women.

Before her appointment, Ms Mdemu was asistant to the President (Community Development).

Also in the list include Amon Mpanju,who has been appointed to the post of deputy permanent secretary in the Ministry of Community Development, Gender, Women and Special Groups in charge of Community Development and Special Groups.

The Head of State has also appointed the Director of Presidential Communication, Zuhura Yunus as deputy permanent secretary in the Prime Minister’s Office (Labour, Youth, Employment and People with Disabilities).

The realignment also involves appointment and transfer of District commissioners. Mr Petro Itozya has been appointed to become Kisarawe District commissioner while Fatuma Nyangasa has been transfered from Kisarawe to Kondoa District.

Dr Hamis Mkanachi has been transfered from Kondoa District to Urambo District, replacing Elibarik Bajuta who will be asigned other duties. President Samia has also transfered Reuben Chongolo who was serving as Songwe District Administrative Secretary to Mufindi District.

Get the latest in African news delivered straight to your inbox

Also Mr Frank Sichwale has been moved from Mufindi District to Songwe. The Head of State has also appointed and transfered District Executive Directors whereby she has appointed Musa Kitungi to become DED for Mafia District.

Kaleka Kasanga has been appointed DED for Shinyanga District.

Also Shaban Mpendu has been been appointed DED for Babati Town Council while Sigilinda Mdemu has been appointed DED for Mlele District Council.

President Samia also has transfered Upendo Mangali from Babati Town Council to become DED for Sumbawanga District Council.

Kisena Maguba has been transfered from Shinyanga District Council to become DED for Kigoma Municipal Council, replacing Mwantum Mgonja whose appointment has been revoked.

Moreover, the Head of State has transfered Teresia Irafay from Mlele District Council to Hanang’ DC.

The President has also appointed three High Court Judges. The appointed judges are Nehemia Mandia, Projestus Kahyoza and Marium Omary.

Source: allafrica.com

President Samia Suluhu Hassan has concluded a sixday official and working visit to the Republic of Korea, leaving the government optimistic about future prospects.

The visit, described as a significant milestone in Tanzania-Korea relations, yielded valuable insights and agreements expected to enhance bilateral cooperation and bring tangible benefits to both nations.

According to government officials who accompanied President Samia, the visit marked the signing of a Framework Agreement with the Republic Korea, which will enable Tanzania to obtain soft loan worth 2.5bn US dollars (equivalent to 6.5tril/-) from the Economic Development Cooperation Fund (EDCF) over the next five years.

Speaking to journalists at the State House in Dar es Salaam, Permanent Secretary in the Ministry of Finance, Dr Natu Mwamba outlined the next steps following the agreement.

“We are now tasked with identifying projects for implementation,” she said. “Tanzania has traditionally received assistance from Republic of Korea in various sectors such as energy, transport, infrastructure, education, health, agriculture and water. The new projects could fall under these or other areas,” She noted.

Dr Mwamba explained that a systematic approach is being followed, involving the Planning Commission, which is responsible for initiating project proposals.

“These proposals are reviewed and refined, with contributions from Zanzibar through the Zanzibar Planning Commission, before being submitted to the Ministry of Finance for further evaluation and prioritisation.

Once finalised, the projects will be discussed with the Republic of Korea through a policy dialogue process, paving the way for mutually agreed-upon implementations,” she explained.

She added, “The selected projects will align with Tanzania’s priorities and development goals, focusing on areas such as skills and technology acquisition,” Sharing insights gained from the visit, Professor Kitila Mkumbo, Minister of State in the President’s Office (Planning and Investment), highlighted the Republic of Korea’s remarkable progress achieved through self-reliance and significant foreign investments.

He noted the growing presence of the Republic of Korean companies in overseas markets, particularly in Asia, and drew inspiration from their success.

“There is great potential to attract Korean investors to Tanzania, given the abundance of opportunities in the country,” he said.

Prof Mkumbo identified several key areas for collaboration, including agriculture, where Tanzania seeks to enhance productivity through mechanisation and agro-processing, leveraging Republic of Korea’s expertise.

He also mentioned the strategic focus on mineral resources, with Tanzania prioritising in-country mineral processing to add value before export.

“Trade promotion is another crucial area,” he added, “as Tanzania aims to expand trade with Republic of Korea by adding value to its agricultural, livestock, forestry and mineral products.” Several initiatives are underway to attract Republic of Korean investment to Tanzania.

The Tanzania Investment Centre (TIC) has signed an agreement with Generating Company Limited, a Republic of Korean firm, to provide information and develop programmes to attract Republic of Korean investment companies.

This is expected to boost Korean investment in Tanzania in the near future. Minister for Information, Communication and Information Technology, Nape Nnauye, highlighted the collaboration on startups.

The Tanzania Startups Association (TSA) accompanied the delegation and visited Pangyo Techno Valley (PTV), a hub for information technology, biotechnology, cultural technology, and fusion technology.

Mr Nnauye also mentioned ongoing discussions about establishing an ICT centre in Dodoma, similar to PTV, with Republic of Korea showing willingness to provide a loan for the project’s construction.

“Tanzania has selected Dar es Salaam, Dodoma, Arusha, Mwanza, and Mbeya as smart cities,” Nnauye noted.

“The delegation studied Korea’s smart city initiatives to gain insights for improving Tanzania’s own smart city efforts.” Industry and Trade Minister Dr Ashatu Kijaji explained that Tanzania and the Republic of Korea have signed an Economic Partnership Agreement (EPA) aimed at establishing a mutually beneficial trade network with partner nations.

This agreement covers a smaller scope compared to a traditional free trade agreement but emphasises the importance of product quality, continuity and rules of origin.

Dr Kijaji highlighted the Generalised System of Preferences (GSP), a World Trade Organisation initiative that promotes economic development by eliminating duties on 10,998 products when imported from designated beneficiary countries. Out of these, 1,126 are agricultural products.

Get the latest in African news delivered straight to your inbox

However, Tanzania’s utilisation of this preferential scheme has been limited.

“We need to emphasise areas such as product quality, continuity and the rule of origin in our discussions to benefit fully from these opportunities,” she stressed.

“We desire that as we begin discussions in all sectors of the economy and production, we emphasise areas such as product quality, continuity and the rule of origin.” Dr Kijaji added. Dr Kijaji further said Tanzania contributes a little because of the product quality, and in the discussions that the government will initiate, they wish Republic of Korea to teach Tanzanians about standards so that they can produce products that meet global market criteria. Another issue, she said Tanzanians are grappling with is that many products lack a rule of origin.

“We have resources here, but what is preventing us from using them up to 80 per cent to produce our products?” she queried. “Another area is continuity, where we want to invite major investors so that when we start production, we can meet market demands,” she noted.

Source: allafrica.com

The African Development Bank Group (AfDB), through its Affirmative Finance Action for Women in Africa (AFAWA) initiative has collaborated with the Graca Machel Trust (GMT) and Women Creating Wealth (WCW) to facilitate financing for women in Tanzania.

The AfDB Country Manager, Dr Patricia Laverly, said the bank is committed to supporting access to finance for businesses that are owned, managed, and led by women across Africa.

“Today, we celebrate approximately 34 women-owned businesses in Tanzania that have benefited from the training provided through our programme,” she said during a graduation ceremony.

She said that through the lender, the women who manage businesses in the country will meet the requirements to access loans from banks across the country and grow their enterprises.

She added that AfDB is sending a clear signal to all women in Tanzania that the bank is ready to stand by them, helping to develop, grow, expand, and make their businesses profitable.

The Ambassador and Director of International Trade and Economic Diplomacy in the Ministry of Foreign Affairs and East African Cooperation, John Ulanga said that women contribute a lot to employment opportunities in the country through entrepreneurship and small businesses that they manage in the country.

“Through Small and Medium Enterprise (SME) women have helped the country in innovation and productivity, poverty reduction, community development, contributing to financial inclusion and becoming role models to the young generation,” said Mr Ulanga.

Get the latest in African news delivered straight to your inbox

He emphasised that women should not limit themselves in doing business as long as there is a chance for them to build up their market, they should take a chance and do their businesses across nations.

Furthermore, the GMT Senior Entrepreneurship Manager Ms Korkor Cudjoe, said that the programme was started to inspire more women to think big about growing their businesses.

“AfDB which is affirmative finance action for women, invested 250,000 US dollars (equivalent to 655m/-) and in this programme, we have managed to raise 2.2 US million dollars as direct investment into the women’s businesses.” She said the lender has helped them to help women learn and prepare their financial books, prepare their businesses and also get the right technical assistance for them to be able to access finance.

She said, “Women need to prepare to raise their finances, without proper preparation, discipline of record keeping in business in a way that business will fail to have investors and that is why we teach them both sides.”

Source: allafrica.com

Rais wa Tanzania, Samia Suluhu Hassan amefanya uteuzi wa viongozi mbalimbali, huku akiigusa ofisi yake kwa kuteua watendaji wanne katika nafasi mbalimbali za uongozi.Continue Reading

By BOB KARASHANI

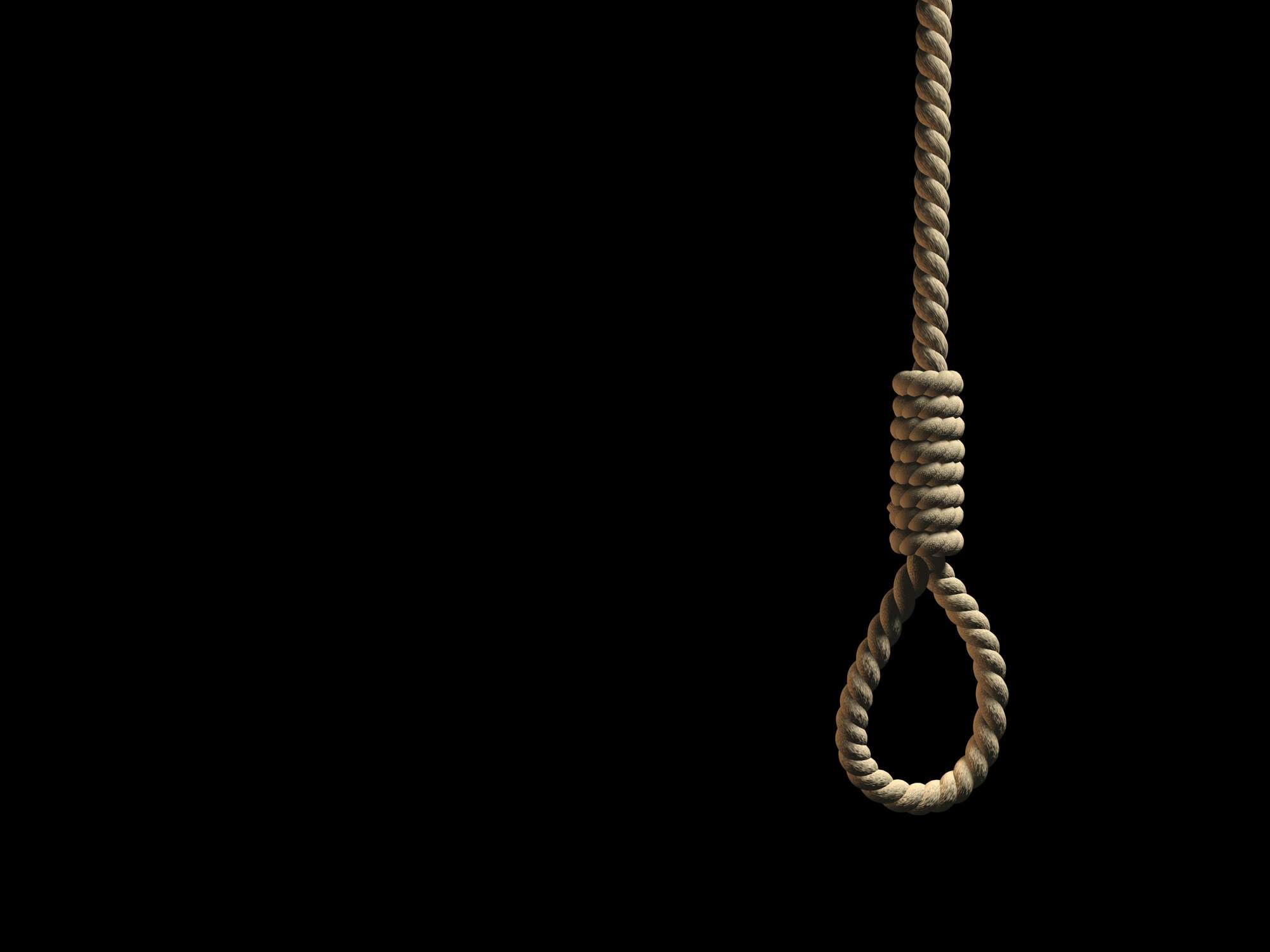

The African Court on Human and Peoples’ Rights has reiterated its longstanding order to Tanzania to revoke the death penalty in line with the continental charter on the right to life.

Delivering judgment on two separate cases, the court sitting in Arusha emphasised again that mandatory capital punishment was a violation of the African Charter and gave the country six months to remove it from its legal statutes.

Nzigiyimana Zabron, a Burundi national, and Tanzanian Dominick Damian are convicted murderers who have been languishing on death row at Mwanza’s Butimba Central Prison for the last 12 years awaiting execution.

While the continental court has issued several similar orders for Tanzania to scrap the death penalty in recent years, the punishment has remained enshrined in the country’s Penal Code despite growing opposition against it as a colonial era legacy.

Read: African court criticises states for ignoring verdicts

This puts it among several African countries that continue to retain it despite a 1999 resolution by the African Commission for Human and People’s Rights calling on African Union member states to observe a moratorium on capital punishment.

Only eight countries have abolished it in law and practice in the past 10 years, since 2014. Others are eyeing formal abolition while continuing to mete out the sentence for major offences.

Many, including Tanzania and Kenya, have not carried out any executions for years. Tanzania’s last execution was in 1995 and Kenya, which also still sentences people to death, in 1987.

In a July 2023 report, a Tanzanian government commission overseeing judicial reforms proposed that death sentences should be commuted to life imprisonment as a more “humane” option.

The commission, which was chaired by the former chief justice Mohamed Chande Othman, said public opinion in the country was sharply divided on the merits and demerits of capital punishment as the best way to deal with serious crimes.

Two offences carry the death penalty in Tanzania — murder and treason.

The report recommended that the Penal Code be amended to allow alternative punishments for murder in line with the circumstances behind each case and the sentence be converted to life imprisonment in cases where execution is delayed for at least three years.

Read: Tanzania rules to keep death penalty

Official statistics show that by May 2023, there were 691 prisoners in Tanzanian prisons awaiting execution of their death sentences meted out by domestic courts.

In the cases of Zabron and Damian, the African court rejected their appeals for their convictions to be quashed outright, saying their guilt had been established beyond reasonable doubt in the respective trial proceedings with no evidence of “miscarriage of justice.”

But it ruled that their sentences to die by hanging should be revoked immediately and resentencing hearings be held within a year “through a procedure that does not allow the mandatory imposition of the death sentence and upholds the discretion of the judicial officer (judge).”

It said the imposition of the mandatory death sentence under Section 197 of Tanzania’s Penal Code “constitutes an arbitrary deprivation of the right to life” and breached Article 4 of the African Charter by depriving the judicial officer of the “discretion to hand out any other penalty once the offence of murder is established.”

The court also deplored hanging as a method of implementing the death penalty, stating that it was “a form of torture and cruel, inhuman and degrading treatment which is in violation of Article 5 of the Charter.”

It said the violations against the right to life established by both applicants “extended beyond their cases” and required the respondent State to publish the two judgments on the websites of its judiciary and legal affairs ministry within three months and then continuously for one full year.

Tanzania Deputy Prime Minister and Minister of Energy, Dr. Doto Biteko, has called upon stakeholders in Africa’s fisheries sector to intensify their efforts in protecting fisheries resources in a bid to improve the sector’s contribution to the economy.

Daily News recently published an in-depth detailing how the sector was threatening fishermen and business people into bankruptcy.

Addressing the First Africa Small-Scale Fishers Meeting in Dar es Salaam that coincided with the 10th anniversary celebration of achievements in the fisheries sector, Dr. Biteko urged stakeholders to prioritize small-scale fishers to boost the sector. In Tanzania, he said the group accounts to approximately 95 percent for all fishing activities.

Official figures show Tanzania produces an average of 475,579 tons of fish that includes about 429,168 tons of fish coming from natural waters, contributing about 3.4 tril/-. This is nearly 1.9 percent of the annual contribution of the sector to the gross domestic product – GDP.

READ: PM demands report on illegal fishing activities

“Despite efforts in Tanzania and across Africa, the fisheries sector faces several challenges, including the impacts of climate change, limited stakeholder involvement in fisheries management, particularly women and youth, and post-harvest losses,” he said.

Minister of Livestock and Fisheries, Abdallah Ulega, expressed honor in Tanzania hosting the first Africa Small-Scale Fisheries Conference, originating from the International Year of Artisanal Fisheries and Aquaculture (IYAFA) celebrated in Rome, Italy, in March 2023.

“The aim of this conference is to give small-scale fishers a platform to voice their needs and improve the sector, ensuring their involvement in policy-making, legal frameworks, and strategic planning,” added Minister Ulega.

The conference themed, “A Decade of Progress: Envisioning the Future of Sustainable Small-Scale Fisheries,” celebrates ten years of implementing the Voluntary Guidelines for Securing Sustainable Small-Scale Fisheries.

The conference is expected to review the implementation of these guidelines and related policy and strategic frameworks for fisheries and aquaculture development in Africa.

Source: allafrica.com

Arusha. Ushindani katika usafiri wa anga katika Bara la Afrika unatajwa kuwa mdogo kutokana na mashirika ya ndege kuwa machache na kuwa yakiongezeka yatasaidia kuongeza ushindani,nauli kushuka pamoja na ubora wa huduma kuongezeka.

Aidha, bara hilo linatajwa kuwa na upungufu wa rasilimali watu wakiwemo marubani na wahandisi katika sekta hiyo muhimu ambayo inazidi kukua kwa kasi.

Kutokana na sababu hizo, wakurugenzi wakuu na wakuu wa Mamlaka ya Usafiri wa Anga Afrika ( AFCAC), wanakutana jijini Arusha kwa siku mbili kujadili namna ya kuboresha sekta hiyo.

Akizungumza katika mkutano huo leo Jumatano Juni 5, 2024, Mkurugenzi Mkuu wa Mamlaka ya Usafiri wa anga nchini (TCAA), Hamza Johari, amesema malengo makubwa ni kuweka mikakati ya pamoja katika bara hilo kuhakikisha usafiri wa anga unakuwa salama.

“Tunataka tuangalie masuala ya kiushindani katika usafiri wa anga,tumeona kwamba ushindani si mkubwa sana kwani mashirika ya ndege ni machache,yanapokuwa machache nauli nazo zinakuwa juu tunataka yawe mengi,yanavyokuwa mengi yakashindana vizuri basi nauli na zenyewe zitarekebika.

” Tunataka tuangalie masuala ya rasilimali watu kwa maana ya kwamba tuna upungufu wa idadi ya marubani wanaohitajika katika sekta upungufu wa wahandisi wanaohitajika pia,”amesema Johari.

Kwa mujibu wa takwimu zilizotolewa Oktoba 5, 2023 mkurugenzi huyo, amesema kuanzia mwaka 2003 hadi 2023, idadi ya ndege zilizokuwa zinatoa huduma katika anga la Tanzania zimeongezeka kutoka 101 hadi 206,marubani wakitoka 234 hadi 603 huku waongoza ndege wakiongezeka kutoka 70 hadi kufikia 154.

Amesema kulikuwa na ongezeko la wakaguzi wa usalama kutoka 28 hadi 44, wahandisi wa mitambo ya viwanja wakiongezeka kutoka 20 hadi 44 na wataalam wa anga wakiongezeka kutoka 50 hadi kufika 83.

Kuhusu marubani amesema Tanzania inahitaji marubani 780 hivyo kuna upungufu mkubwa kuendana na kasi ya ukuaji ambapo hadi wakati huo walifadhili marubani 22 waliokuwa wakisoma nje ya nchi ila kwa sasa NIT itafundisha kwa Dola 48,000 ambazo ni sawa na Sh120.3 milioni badala ya Dola 120,000 zilizokiwa sawa na Sh300.9 milioni.

Hatua nyingine ni kuhakikisha usafiri wa anga Afrika unazidi kuwa salama na endelevu na kuwa wataangalia eneo la ulinzi kwani kumekuwa na tabia ya watu wenye nia ovu ikiwemo magaidi,kuteka ndege, kulipua viwanja na kutega mabomu japo matukio hayo hayatokei kwa wingi katika bara la Afrika lakini lazima wachukue tahadhari.

“Sasa hivi dunia imekua katika teknolojia kila kitu kinakwenda kidijitali na tunavyokwenda kwenye ulimwengu huo kunaweza kutokea mashambulio ya mifumo na mifumo ikiharibika tutashindwa kufanya shughuli zetu,tutaangalia zaidi uhalifu huo wa mitandaoni ili tusije kushambuliwa na tutengeneze sauti moja kama Afrika,”ameongeza Johari.

Akifungua mkutano huo, Waziri wa Uchukuzi, Profesa Makame Mbarawa, amesema wakuu hao watajadiliana na kutoka na maazimio ya pamoja katika kuboresha usafiri huo pamoja na miundombinu huku suala la usalama likipewa kipaumbele kwani bila usalama hakuna usafiri wa anga wa uhakika.

Kuhusu suala la uchafuzi wa mazingira,Waziri Mbarawa amesema wakuu hao na wataalamu wa sekta ya anga watajadiliana jinsi wanaweza kuhakikisha anga linakuwa safi na salama na kuongeza maendeleo katika nchi hizo.

“Tanzania tumefanya kazi kubwa kwenye sekta ya usafiri wa anga na tuna miradi mbalimbali inaendelea na lengo la Serikali ni kuendelea kufungua usafiri wa anga na kuifanya anga zetu ziwe salama.

“Tunaendelea na ujenzi mkubwa wa viwanja vya ndege katika mikoa mbalimbali ikiwemo kiwanja cha Msalato Dodoma ambacho kitagharimu zaidi ya Sh365 bilioni,”amesema.

Waziri huyo amesema lengo la Serikali ni kuhakikisha mikoa yote inakuwa na viwanja vya ndege vya kisasa na kuwataka Watanzania waendelee kutumia usafiri huo ambao ni usalama zaidi ukilinganisha na usafiri mwingine.Continue Reading

Tanzanian authorities have urged maize farmers to seek markets in neighbouring countries for their surplus.

According to the Ministry of Agriculture, the country expects a bumper harvest, and the surplus will exceed the preliminary demand assessment of maize, more than 1,2 million tonnes estimated for export markets in neighbouring countries.

The National Food Reserve Agency is set to purchase cereals from farmers earlier in July due to expected bumper maize harvests from key growing areas in the southern region.

National Food Reserve Agency (NFRA) executive director Dr Andrew Komba said the agency was set to start buying maize, rice and other food crops from farmers for storage and selling to local and foreign food markets beginning July.

NFRA strategy was to manage food reserves to ensure sustainable supply that would meet both domestic and export needs, the food agency officials said.

The agency had opened 14 crop purchasing centres in leading maize producing areas in the southern highlands. Ministry of Agriculture had allocated Tsh300 billion (US$115 million) for buying some 300 000 tonnes of food crops during the harvesting season between June and July.

Minister for Agriculture Hussein Bashe said Tanzania expects to produce 31,5 million tonnes of food crops compared with 20.4 million tonnes harvested last year. He zsaid the country expects to harvest over 10 million tonnes of maize during the 2024 season that runs between mid-June and July. –

Source: allafrica.com

Zanzibar Investment News Tanzania Investors Ltd © 2025