Dar es Salaam. In a major boost to Tanzania’s Amson Group, the company’s $180 million (about Sh475 billion) bid to acquire Kenya’s Bamburi Cement has gained the backing of major shareholders.

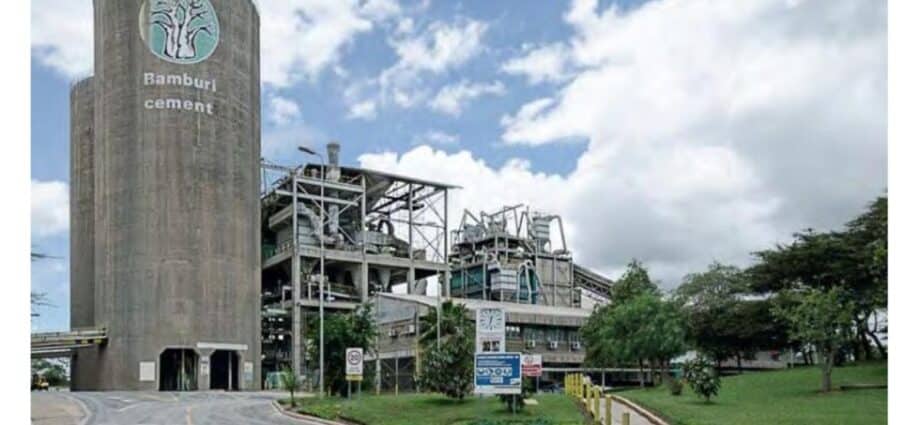

Tanzania’s Amsons Group announced its intention of acquiring Kenya’s Bamburi Cement early last month in a move that, if concluded, would become one of the biggest takeover deals in East Africa and create a giant cement producer in the region.

Amsons Group, which is a family-run business with operations in Tanzania, Zambia, Malawi, Mozambique, the Democratic Republic of Congo and Burundi, said on Wednesday that it had signed a binding offer with Bamburi Cement.

The deal will be the largest private investment by a Tanzanian firm in Kenya since the collapse of the East African Community in 1977.

The proposed deal dwarfs the $130 million investment in Kenya by Tanzania’s Taifa Gas, whose LPG facility was commissioned in the neighbouring country in February 2023.

Taifa Gas is owned by Tanzanian tycoon Rostam Aziz and its subsidiary in Kenya operates from the Special Economic Zone in Mombasa.

And, in a positive development, Amsons Group’s bid has got the backing of the major shareholders of Bamburi Cement.

Quoting a recent statement by Bamburi Cement, Kenya’s Standard Media reported recently that Holcim, the Swiss-based global building material and aggregates’ company, has agreed to sell its entire stake in the firm to Amsons.

Holcim owns 58.6 percent of Bamburi’s total issued share capital through Fincem Holding (29.3 percent) and Kencem Holding Ltd (29.3 percent).

Kenyan institutions and individuals own an estimated 32.17 per cent of Bamburi shares while another 9.23 per cent is held by other foreign investors.

“Amsons has confirmed that on July 10, 2024, it received an irrevocable undertaking from the following existing shareholders of Bamburi as part of the offer: Fincem Holding…and Kencem Holding,” said Bamburi Cement.

According to the statement, which Standard Media quoted, Bamburi Cement said it had received confirmation that Amsons had access to adequate funds to conclude the deal.

“According to the offeror’s statement, KCB Investment Bank Ltd, being the transaction advisor and sponsoring stockbroker of Amsons, has confirmed that Amsons has sufficient financial resources at its disposal to satisfy the consideration payable for all shares in Bamburi pursuant to a full acceptance of the offer,” said Bamburi.

The transaction is subject to regulatory approvals.

“Should the offer achieve 75 percent or more of the offer shares, the offeror will evaluate the continued efficacy of Bamburi remaining listed and may then, subject to approval by the Capital Markets Authority (CMA), apply for Bamburi to be delisted from NSE,” said Bamburi as quoted by Standard Media.

“In accordance with the takeover regulations, if the offer results in the offeror acquiring 90 percent of the offer shares, the offeror shall offer the remaining shareholders a consideration that is equal to the prevailing market price of the voting shares or the price offered to the other shareholders, whichever is higher, and the provisions of the Companies Act shall apply.”

Amsons Group Managing Director Edha Nahdi said last month that the proposed deal will consolidate the group’s position in the cement industry in East Africa as part of the regional economic development and market integration ideals.

“We have great plans to deepen our investment in Kenya and Bamburi,” he added.

“Our offer to acquire Bamburi is part of our corporate market expansion plan and will mark the formal entry of Amsons Group into the Kenyan market, where we also plan to invest in other industries in the coming months.”

Amsons Group has daily cement manufacturing capacity of a 6,000, including through the recently acquired Mbeya Cement facility.

Bamburi Cement boasts an annual production capacity of 3.2 million tonnes.

The acquisition will significantly enhance Amsons Group’s regional production capacity and market presence.

Information posted on the Amsons Group’s website shows that the group’s assets and infrastructure include the Camel Oil Depot with a storage capacity of 60 million litres of fuel, Camel Flour, which has a storage capacity of 24,000 tonnes and a production capacity of 15,000 tonnes and a transport fleet of 800 lorries.

Amsons Group has also created 1,700 and 2,000 direct and indirect jobs, respectively, in Tanzania alone.

With businesses spread across the EAC region, Amsons Group continues to strengthen its footprint in the manufacturing sector.

Amsons Group’s corporate strategy has evolved as its businesses have grown, matured and diversified into new sectors and regions over the last decade.

The company is behind the Camel Cement and Tembo Cement retail brands and has been among the major importers of bulk oil and petroleum products in Tanzania.

The company has also diversified into other ventures such as lubricants, liquefied petroleum gas (LPG), transportation, cement and concrete, inland container depots (ICDS), Camel Flour, Tanzania Clou Electronics Company Limited and Amsons Real estate.