On Wednesday 26 October 2022, the African Development Bank, rated Aaa/AAA/AAA/AAA (Moody’s / S&P / Fitch / Japan Credit Rating, all stable), launched and priced a new USD 2 billion 5-year Global Benchmark due 3 November 2027. This transaction marks the Bank’s second USD Global Benchmark in 2022 following the 3-year USD 1 billion benchmark issued in June, and its first 5-year benchmark issuance since July 2021. The bond pays a coupon of 4.375% with a re-offer yield of 4.458%.

A combination of high inflation and rising rates has changed the landscape for bond issuance over the past few weeks, causing considerable and persistent volatility. While Supranational Sovereign and Agency (SSA) transactions in weeks prior to this trade had shown investor support in the 3-year part of the curve, the 5-year part of the curve remained untested. As the lead arrangers were highlighting potential investor fatigue in the 3-year tenor, the decision was made to announce a 5-year USD benchmark before year-end, and before conditions potentially worsened.

The mandate for a new 5-year USD Global Benchmark was announced on Tuesday 25 October at 12.21pm London time, with Initial Pricing Thoughts released simultaneously at SOFR Mid-swaps plus 51 basis points (bps) area. The deal enjoyed robust investor demand from the outset as Indication of Interest from AfDB’s high quality investor base accumulated at a rapid pace, exceeding USD 1.6 billion overnight (including USD 150 million of Joint Lead-Managers’ (JLM) interest).

The books officially opened the following morning, Wednesday 26 October at 8.26 am London time, with price guidance unchanged at Mid-swaps + 51bps area. The order book continued to grow through the European morning, with investor demand approaching USD 2.3 billion (including USD 225 million JLM interest) by 9.45am London time, which allowed the Bank to set the spread 1bp tighter at Mid-swaps + 50bps.

With stable market conditions and a robust appetite from high-quality investors for the Bank’s credit, the order book closed in excess of USD 3.3 billion (including USD 225 million JLM interest). The transaction was launched with a size of USD 2 billion and priced at 4.43pm London time priced at Mid-swaps + 50bps, equivalent to a reoffer yield of 4.458% and a spread of 27.31bps vs the on-the-run 5-year US Treasury.

The new issue brings an on-the-run reference point in the 5-year part of the Bank’s USD curve, extending its outstanding curve, and demonstrating its commitment to maintain liquid lines at key benchmark maturities. With the final order book closing in excess of USD 3.3 billion (including USD 225 million JLM interest), and with 83 investors participating, the success of this 5-year transaction is a clear vote of confidence from investors in the Bank’s credit, even amidst the more recent volatile market backdrop.

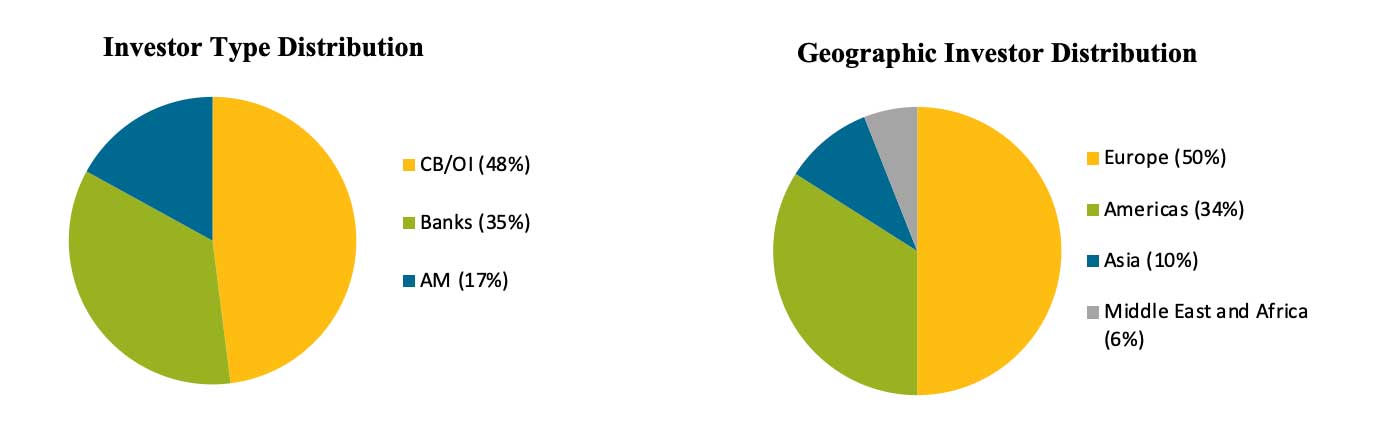

Investor distribution statistics:

Transaction details:

| Issuer: | African Development Bank (“AfDB”) |

| Issuer rating: | Aaa / AAA / AAA (Moody’s / S&P / Fitch, all stable) |

| Amount: | USD 2 billion |

| Pricing date: | 26 October 2022 |

| Settlement date: | 03 November 2022 (T+6) |

| Coupon: | 4.375 %, Fixed, semi-annual 30/360 |

| Maturity date: | 03 November 2027 |

| Re-offer price: | 99.632% |

| Re-offer yield: | 4.458% annual |

| Re-offer spread: | SOFR Mid-swaps + 50bps / UST 4.125% 09/27 + 27.31bps |

| Joint-Lead Managers: | BNP Paribas, BofA Securities, Goldman Sachs, HSBC, Nomura |

| Senior Co-Leads: | Standard Chartered and CastleOak Securities |

| ISIN: | US00828EEP07 |

Source: afdb.org

Share this news

This Year’s Most Read News Stories

Zanzibar land lease controversy with British Developer

Zanzibar investment lease controversy rumbles on after President Hussein Mwinyi claims the land lease was terminated following a court case which the developer lost Contradictory details come to light.Continue Reading

‘Sovereignty alone won’t solve Zanzibar economic woes’

The ruling party in Zanzibar on Monday , March 13, responded to growing demands for full autonomy in the Islands, saying sovereignty doesn’t guarantee economic strength.Continue Reading

Shock waves hit Zanzibar’s Real Estate industry

The revocation of British developer Pennyroyal’s leasehold for the construction of Blue Amber Resort by the Revolutionary Government of Zanzibar has sent shock waves in the nascent property market on the Isles.Continue Reading