The African Court on Human and Peoples’ Rights has reiterated its longstanding order to Tanzania to revoke the death penalty in line with the continental charter on the right to life.

Delivering judgment on two separate cases, the court sitting in Arusha emphasised again that mandatory capital punishment was a violation of the African Charter and gave the country six months to remove it from its legal statutes.

Nzigiyimana Zabron, a Burundi national, and Tanzanian Dominick Damian are convicted murderers who have been languishing on death row at Mwanza’s Butimba Central Prison for the last 12 years awaiting execution.

While the continental court has issued several similar orders for Tanzania to scrap the death penalty in recent years, the punishment has remained enshrined in the country’s Penal Code despite growing opposition against it as a colonial era legacy.

This puts it among several African countries that continue to retain it despite a 1999 resolution by the African Commission for Human and People’s Rights calling on African Union member states to observe a moratorium on capital punishment.

Only eight countries have abolished it in law and practice in the past 10 years, since 2014. Others are eyeing formal abolition while continuing to mete out the sentence for major offences.

Many, including Tanzania and Kenya, have not carried out any executions for years. Tanzania’s last execution was in 1995 and Kenya, which also still sentences people to death, in 1987.

In a July 2023 report, a Tanzanian government commission overseeing judicial reforms proposed that death sentences should be commuted to life imprisonment as a more “humane” option.

The commission, which was chaired by the former chief justice Mohamed Chande Othman, said public opinion in the country was sharply divided on the merits and demerits of capital punishment as the best way to deal with serious crimes.

Two offences carry the death penalty in Tanzania — murder and treason.

The report recommended that the Penal Code be amended to allow alternative punishments for murder in line with the circumstances behind each case and the sentence be converted to life imprisonment in cases where execution is delayed for at least three years.

Official statistics show that by May 2023, there were 691 prisoners in Tanzanian prisons awaiting execution of their death sentences meted out by domestic courts.

In the cases of Zabron and Damian, the African court rejected their appeals for their convictions to be quashed outright, saying their guilt had been established beyond reasonable doubt in the respective trial proceedings with no evidence of “miscarriage of justice.”

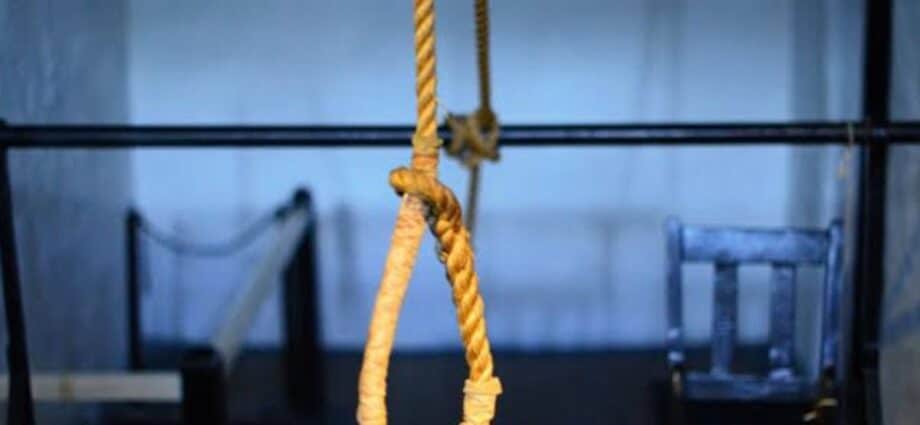

But it ruled that their sentences to die by hanging should be revoked immediately and resentencing hearings be held within a year “through a procedure that does not allow the mandatory imposition of the death sentence and upholds the discretion of the judicial officer (judge).”

It said the imposition of the mandatory death sentence under Section 197 of Tanzania’s Penal Code “constitutes an arbitrary deprivation of the right to life” and breached Article 4 of the African Charter by depriving the judicial officer of the “discretion to hand out any other penalty once the offence of murder is established.”

The court also deplored hanging as a method of implementing the death penalty, stating that it was “a form of torture and cruel, inhuman and degrading treatment which is in violation of Article 5 of the Charter.”

It said the violations against the right to life established by both applicants “extended beyond their cases” and required the respondent State to publish the two judgments on the websites of its judiciary and legal affairs ministry within three months and then continuously for one full year.