Dar es Salaam.

Africa is home to some 138,000 dollar millionaires a latest wealth by research firm New World Wealth and Henley & Partners report released on March 28, 2023, shows.

The report indicates that the number of tycoons in African countries varies annually depending not only on the local and global economic conditions but also due to the migration of the super-rich to other countries.

It shows about 18,500 HNWIs have left Africa over the past decade in search of greener pastures elsewhere outside the continent.

About 1,200 HNWIs have moved between African countries over the past 10 years, with most relocating to Mauritius and South Africa.

“Most have relocated to the UK, the USA, and the UAE. Significant numbers have also moved to Australia, Canada, France, Israel, Monaco, New Zealand, Portugal, and Switzerland,” said the report.

To underline this movement, the report shows that, while some 50 dollar billionaires were born in Africa, just 23 of them still live on the continent, raising concerns that the tycoons are exporting business away from their home countries.

“Billionaires rarely move for tax reasons. They usually relocate to expand their businesses or due to safety concerns,” it says.

Africa is home to some of the world’s fastest-growing markets, including Rwanda, Mauritius, and Seychelles, which have seen wealth growth of 72 per cent, 69 per cent, and 54 per cent respectively over the past decade.

The report projects Mauritius to experience the highest private wealth growth rate at 75 per cent over the next decade, making it the fourth fastest-growing country globally in millionaire growth percentage terms after Vietnam, India, and New Zealand.

Share this news

This Year’s Most Read News Stories

CCM ready to task state organs on Zanzibar Airport deal

Ruling party Chama Cha Mapinduzi-Zanzibar has said it is ready to task state organs to investigate some of the claims against its government that have been raised by opposition politicians on the Abeid Amani Karume International Airport (AAKIA).Continue Reading

Zanzibar, Tanzania: Inflation hits five-year high

With Covid-19 and the war in Ukraine being blamed after inflation in Tanzania and Zanzibar rose to 4.5 this year and is climbing – the highest rate since November 2017Continue Reading

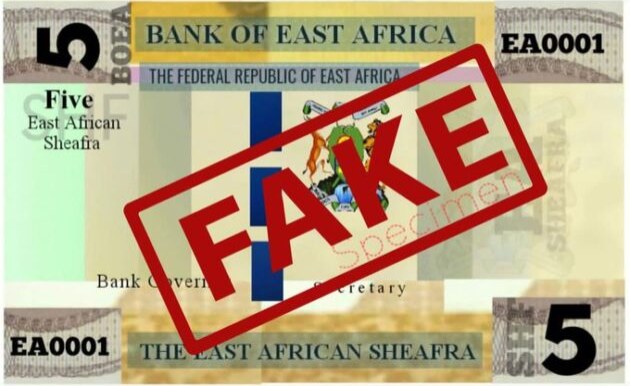

East African Community Bloc Dismisses Fake Common Currency

The secretariat of the East African Community (EAC) regional bloc has dismissed a post on X, formerly Twitter, which claimed that the bloc’s member countries have launched a common regional currency.Continue Reading