African leaders on Wednesday laid out the continent’s vast potential and invited global investors to seize investment opportunities.

Speaking during the 2022 Africa Investment Forum Market Days being held in Abidjan, Cote d’Ivoire’s economic capital, the leaders vowed to continue working to strengthen the economic resilience of their countries against external shocks.

The three-day forum has drawn project sponsors, investors, and heads of state from around the world to participate in boardroom sessions that could lead to transactions worth billions of dollars.

President of Cote d’Ivoire Alassane Ouattara expressed the hope that Market Days 2022 would break the $100 billion threshold in investment interest. Vice President Tiemoko Meyliet Koné delivered his remarks.

Ouattara acknowledged the wave of threats African countries continue to face, including the Covid-19 pandemic, the war in Ukraine and the impacts of climate change. The Market Days 2022 theme, Building Economic Resilience Through Sustainable Investments, reflects these realities.

‘Immediately following the challenges of the pandemic, African countries are once again facing external shocks because of the war in Ukraine, with heavy economic, financial and social consequences,’ Ouattara said.

The current crisis makes us even more vulnerable to food insecurity, Ouattara said. ‘This is paradoxical for a continent that has 60% of the world’s arable land and abundant and youthful manpower.’

African Development Bank Group President Dr. Akinwumi Adesina gave a preview of the three-day event, saying, ‘You are in the right place: Africa! In the next 72 hours, we will have curated several investment-ready projects for you as investors. These range from renewable energy hydropower, gas infrastructure, railways, road, and water transport.’

Other priority investment sectors for 2022 include agriculture, health, mining, fertilizer manufacturing, port infrastructure, and urban green transport. The Africa Investment Forum is an initiative of the African Development Bank and seven partners.

The African leaders present had the opportunity to pitch their countries as investment destinations. They included Ethiopia’s President Sahle-Work Zewde; Ghanaian President Nana Akufo-Addo; President Emmerson Mnangagwa of Zimbabwe; Vice President of Liberia Jewel Howard Taylor; Tanzania’s Vice President Philip Mpango; José Ulisses Correia e Silva, Prime Minister of Cabo Verde; and Prime Minister Patrick Achi of Cote d’Ivoire.

A common thread in their remarks was the existence of a gap between perception and reality in terms of Africa’s investment risk.

President Mnangagwa spoke about what he termed Zimbabwe’s peculiar circumstances. ‘There are a lot of misperceptions about Zimbabwe just because we have chosen to be ourselves.’ He assured investors, saying: ‘For those who want to make money, Zimbabwe is open to business.’

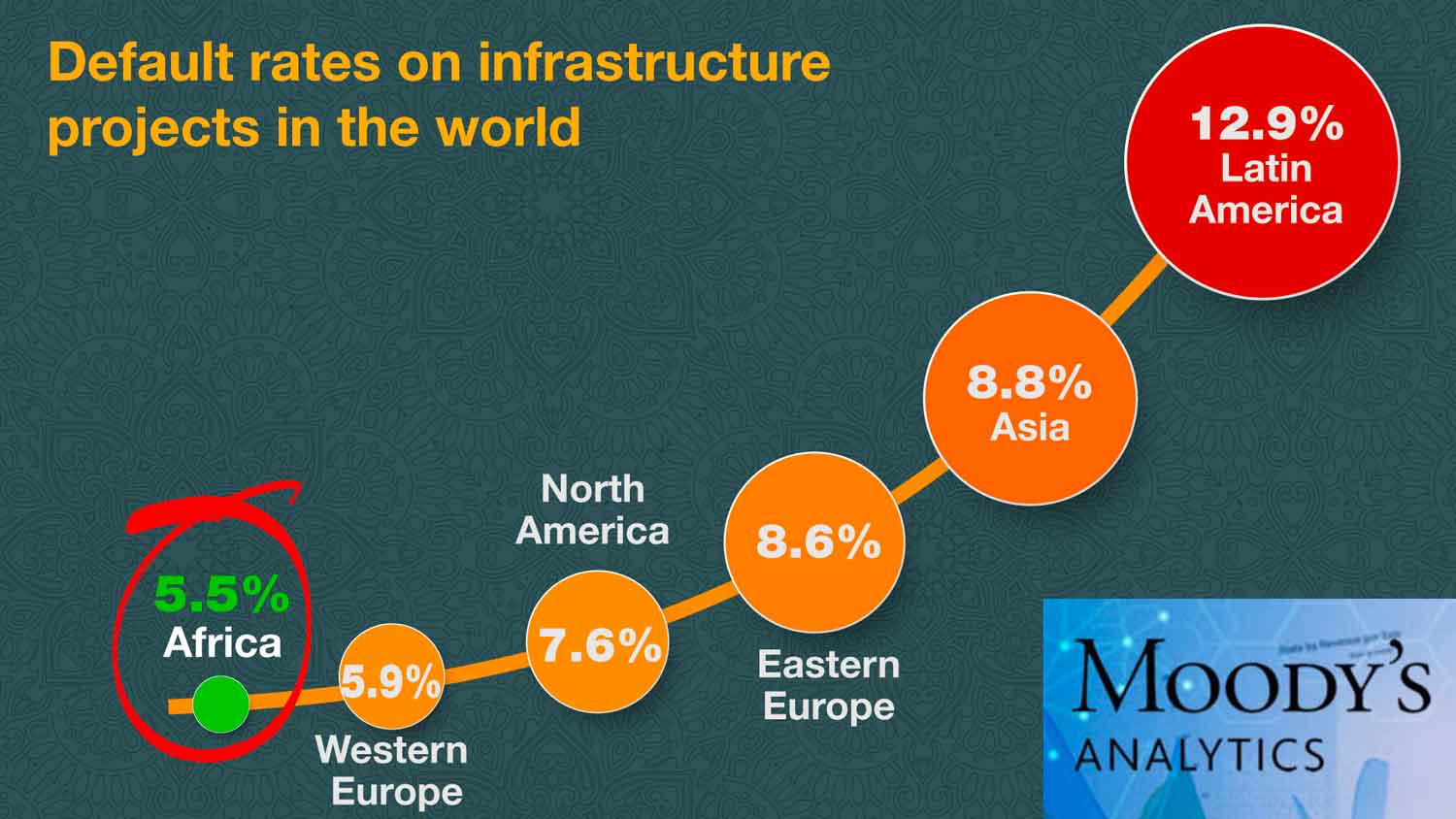

For Adesina, the perception gap is not borne out by data. He pointed out that Moody’s Analytics research indicates Africa has the lowest default rate on infrastructure projects among the world’s regions – 5.5% – compared to 12.9% in Latin America, 8.8% in Asia, and 5.9% in Western Europe. ‘Africa is not as risky as you think,’ Adesina said. ‘Perception is not the same as reality.’

President Akufo-Addo said that Africa’s promising future should make it very hard to overlook its opportunities. ‘There are problems but look beyond the challenges to what the future holds,’ he urged. He pointed to the continent’s demographic dividend and abundant arable land as causes for optimism.

One of the key themes of the Africa Investment Forum is women as investment champions, a topic that President Sahle-Work Zewde addressed at length. ‘We must accelerate women’s digital literacy as a matter of urgency given the enormous potential of e-commerce and digital finance. Otherwise we risk deepening yet another gap in the gender digital divide,’ she said.

Africa Investment Forum Market Days 2022 will feature boardroom sessions that also promote sectors where Africa has a comparative advantage, such as music, film, fashion, textiles, and sports.

The event will also cover potential investment and development in areas such as food security, environmental, social, and governance (ESG) investing, and emerging technologies including the internet of things and blockchain. Click here for the full agenda.

Since its inception in 2018, the Africa Investment Forum platform has mobilized investment interests in excess of $100 billion. It is an initiative of the African Development Bank; Africa 50; the Africa Finance Corporation; the African Export-Import Bank; the Development Bank of Southern Africa; the Trade and Development Bank; the European Investment Bank; and the Islamic Development Bank.

Source: afdb.org

Share this news

This Year’s Most Read News Stories

Zanzibar introduces $44 insurance fee for visitors

Visitors travelling to Zanzibar will now have to pay an insurance fee of $44 (about Sh118,360) with effect from September 1.Continue Reading

Tanzania PS Wants Greater Public Awareness in Health Insurance

Dodoma — PERMANENT Secretary (PS) for Health Ministry, Prof Abel Makubi, said accomplishing universal health insurance requires greater awareness to members of the public before the programme kicks off on July 1, 2023.Continue Reading

ZSSF money not for projects, says Ali Karume

Unguja. Veteran politician and diplomat Ali Karume has called on authorities of the Zanzibar Revolutionary Government (SMZ) to refrain from using the Zanzibar Social Security Fund money for establishing commercial projects.Continue Reading