Nairobi. Africa’s development bank is proposing a new ‘gold standard’ style currency arrangement backed by critical minerals such as cobalt, copper, lithium, manganese and some of the ‘rare earths’ key to the world’s energy transition and electric vehicles.

The 54-nation region, which has about 30 percent of the world’s critical minerals reserves, attracts only 3 percent of global energy investments each year and only 2 percent or $40 billion, of worldwide green investments last year, the African Development Bank said.

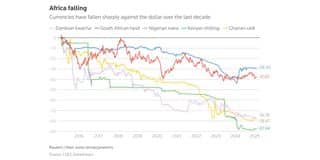

This is partly as a result of the continent’s volatile currency markets, said the AfDB, which is proposing a new “non circulating” currency called African Units of Account (AUA) which would be underpinned by critical mineral reserves.

Africa itself needs to double its clean energy investments to an average of $200 billion a year to both cut carbon emissions and boost vital electricity production.

Under the AfDB plan, countries would pool a pre-agreed amount of their proven critical mineral reserves and local currencies could then be converted at an agreed rate.

“The idea borrows from the Gold Standard that anchored global currency stability,” the AfDB said in a new report, without giving a timeline for introducing the currency.

The Abidjan-based development bank first floated the idea last year, but this is the first time it has laid out details.

“It further builds on the CFA-Euro peg in Francophone countries, which is backed by a pledge of external reserves,” the AfDB said, adding that a basket of critical commodities would hold its value “better than any African currency”.

There have been moves by emerging market countries to find ways of navigating the risks posed by their dependence on the dollar for trade and other transactions.

US President Donald Trump threatened on Thursday to impose 100 percent tariffs against BRICS nations if they moved to replace the dollar as their reserve currency.

The AfDB argued that the proposed new currency could help African governments attract international money into green energy projects as it would “mitigate the currency and convertibility risks”.

Revenues generated by the sale of electricity in local currencies would be paid to a designated settlement agent, which will then sell the equivalent amount of minerals to generate dollars to pay off any lenders into energy development projects.