Dar as Salaam, Tanzania:

A cool atmosphere swirled through the investing community yesterday after India’s multinational issued a detailed response to allegations by a US firm.

In its 413-page response, Adani Group said allegations of fraud and market manipulation by US-based short sellers at Hindenburg Research were nothing but a lie, likening them to a “calculated attack” on India, its institutions and growth story.

“This is not merely an unwarranted attack on any specific company but a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India,” Adan Group, which is owned by the richest Indian, Mr Gautama Adani, said in its response as published by the Economic Times of India.

The relevance of Adan Group to Tanzania stems from the fact that the company, through its Adani Ports and Special Economic Zone Limited (APSEZ), has been contracted to serve as a service provider for container handling at the side of the Dar as Salaam port that was previously managed by Tanzania International Container Terminal Services (Ticts).

Port officials insisted yesterday that Adan Group was only working as a service provider who gets paid by TPA at the end of the month.

It was TPA that was collecting all the port charges and the service provider was only being paid – at reasonable charges – by the ports’ body as a short-term measure in the process to get the right investor who has enough experience in port issues and who will convince the government.

And, in what sounds like a vote of confidence after Adan Group’s detailed explanation, the Abu Dhabi-based conglomerate, the International Holding Company (IHC), announced yesterday that it would be investing AED 1.4 billion (about $400 million) in the Adani Enterprises Further Public Offering (FPO), the Indian multinational publicly listed holding company and a part of Adani Group, through its subsidiary Green Transmission Investment Holding RSC Limited.

“Our interest in Adani Group is driven by our confidence and belief in the fundamentals of Adani Enterprises Ltd. We see a strong potential for growth from a long-term perspective and added value to our shareholders,” said Syed Basra Shoe, the Chief Executive Officer of IHC.

This is the second investment deal International Holding Company has completed with India’s

Adani Group after last year’s Dh7.3 billion ($2 billion) investment in three green-focused companies of the Adani Group, including Adani Green Energy, Adani Transmission and Adani

Enterprises, which are all listed on the Bombay Stock Exchange and National Stock Exchange of India.

“The advantage of the FPO is the historical reference for the company’s earnings report, company’s management, business practices and much data to bank on before making any investment decision,” Mr Shoe explained.

In its 413-page response as quoted by the Economic Times of India, Adani Group stated that Hindenburg Research’s January 24 report was “nothing but a lie”, adding that the document was “a malicious combination of selective misinformation and concealed facts relating to baseless and discredited allegations to drive an ulterior motive.”

“This is rife with conflict of interest and intended only to create a false market insecurities to enable Hindenburg, an admitted short seller, to book massive financial gain through wrongful means at the cost of countless investors,” it said.

According to the Economic Times of India, Adani Group’s response also questioned the credibility and ethics of Hindenburg, and said the mala fide intention underlying the report was apparent given its timing when Adani Enterprises Limited is undertaking one of the largest ever further public offering.

“Hindenburg has not published this report for any altruistic reasons but purely out of selfish motives and in flagrant breach of applicable securities and foreign exchange laws,” it said. “The report is neither ‘independent’ nor ‘objective’ nor ‘well researched’.” The response says as quoted by the Economic Times of India.

Share this news

This Year’s Most Read News Stories

Zanzibar Airport Authority to audit ground handlers

Unguja. The Zanzibar Airports Authority (ZAA) is set to conduct an audit on ground handling companies that currently operate at the Abeid Amani Karume Airport with effect from Monday. The week-long audit is set to include Transworld, ZAT and the newcomer Dnata Zanzibar who were licensed in June plus exclusive rights to manage Terminal 3 building by ZAA.Continue Reading

Muslims in Pemba conduct special prayer against ZAA decision

ZANZIBAR: More than 200 Muslims in Vitongoji Village, South Pemba Region over the weekend conducted a special prayer to condemn the Zanzibar Airports Authority (ZAA) move to appoint DNATA as the sole ground handler in Terminal III of the International Airport of Zanzibar. Abeid Amani Karume.Continue Reading

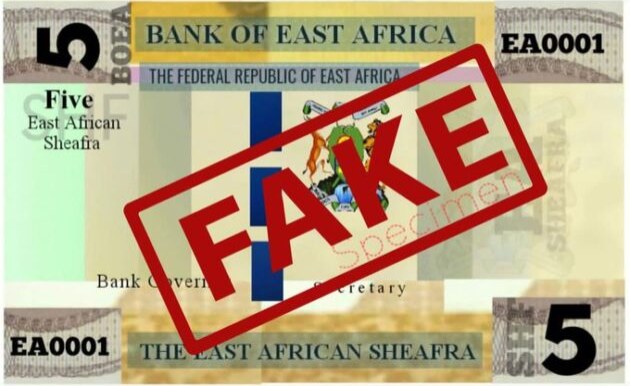

East African Community Bloc Dismisses Fake Common Currency

The secretariat of the East African Community (EAC) regional bloc has dismissed a post on X, formerly Twitter, which claimed that the bloc’s member countries have launched a common regional currency.Continue Reading