Unguja. The opposition party ACT-Wazalendo in Zanzibar is urging the complete withdrawal of the newly introduced mandatory travel insurance policy, set to take effect in three weeks.

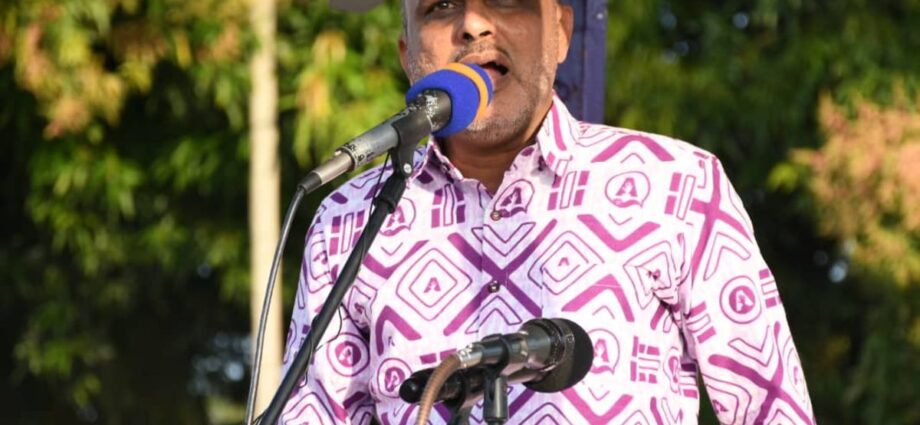

In an interview with The Citizen, ACT-Wazalendo’s Vice Chairman, Ismail Jussa Ladhu, criticised the policy for lacking adequate stakeholder engagement and for potentially harming Zanzibar’s tourism industry.

“In my view, which reflects ACT-Wazalendo’s stance, this travel policy should be withdrawn due to its likely negative impact on the tourism sector,” Mr Jussa stated. “The policy, as it stands, will make Zanzibar a very expensive destination and has already received negative coverage in international media.”

Mr Jussa expressed concern that the policy would deter tourists, who often choose destinations based on recommendations and current perceptions.

He noted that there has already been backlash from tourism stakeholders dissatisfied with how the policy was implemented.

He added that Zanzibar’s tourism sector, which has been a crucial part of the island’s economy for the past 30 years, remains sensitive, as evidenced by the downturn during the pandemic.

He also pointed out that Zanzibar is not the only East African or Indian Ocean destination vying for visitors.

Mr Jussa criticised the authorities’ comparisons of Zanzibar’s situation to that of other markets, arguing that the local services and infrastructure do not match those of competing destinations.

He said, “You cannot compare the services in Zanzibar to those in Qatar, especially when our services are monopolistic and more expensive. The government seems focused on revenue collection without considering the broader implications.”

He further stated that reconsidering the policy in light of its negative reviews would demonstrate the government’s willingness to listen to diverse opinions.

He emphasized that Zanzibar is already an expensive destination, and many visitors come with their own travel insurance from their home countries.

“It’s as if we’re asking visitors to pay for the same thing twice,” Mr Jussa added. “Our local health services, both private and public, face similar challenges, often requiring people to seek treatment in Dar es Salaam.”

Mr Jussa also highlighted concerns for the Zanzibar and Tanzanian diaspora, whose remittances are vital to many families on the island. Unlike tourists, diaspora members usually stay with relatives, contributing to the local economy. He noted that discussions about supporting the diaspora have been insufficient.

Additionally, there are reports that Western countries may retaliate by increasing visa fees for Tanzanians traveling to the EU, Britain, and the US.

Starting October 1, all visitors to Zanzibar will be required to purchase a mandatory travel insurance policy costing $44 at the point of entry, regardless of existing coverage from their home country.

In July, Zanzibar Finance Minister, Dr Saada Mkuya Salum told The Citizen that the new policy aims to improve visitor services by covering health, baggage loss, accidents, emergency evacuation, passport loss, and repatriation in case of death.

The insurance will be provided by the government-owned Zanzibar Insurance Corporation and will not consider any existing travel insurance policies. Prior to this, travel insurance was not mandatory in Tanzania or other East African countries.